Canadian dollar market outlook

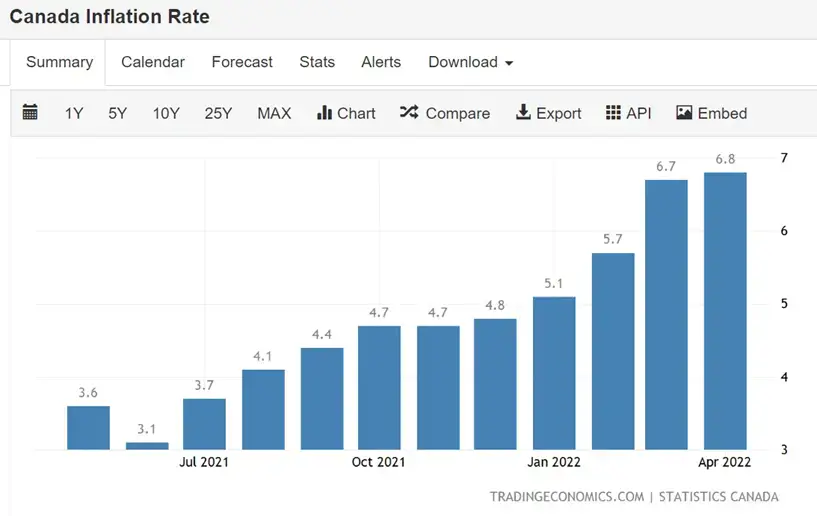

In addition to the high inflation in the United States, and from the CPI data released by various countries this month, Canada’s inflation index in April was at a record-high of 6.8%, which was the highest inflation since January 1991. The April inflation data exceeded the market’s median estimate of 6.7%.

The Bank of Canada will release its interest rate decision tonight. The market expects the BoC to consider further tightening monetary policy next week by raising the benchmark interest rate by 50 basis points from 1% to 1.5%. Some expect the Bank of Canada to raise interest rates more aggressively by 75 basis points. What impact will the continuous interest rate hike policy have on the Canadian dollar?

Canadian prices are soaring

Like the United States, Canada is enduring the most severe inflation spike. As a result, the Bank of Canada is one of the Western countries that have raised interest rates twice in a row in March and April, raising the benchmark interest rate from 0.25% to 1%. However, the bank has found it still difficult to stop Canada’s CPI index from soaring.

Judging from the itemised inflation data released in May, food prices and housing costs were the main drivers behind the rise in Canada’s CPI in April. Due to the impact of the Russia-Ukraine war on the export of agricultural products and fertiliser products, the cost of food production has risen rapidly worldwide. If the war continues, the food and raw materials shortage will cause companies to pass on more costs to consumers. As a result, the April data showed that the price of food Canadians bought from supermarkets rose 9.7% from a year ago, the fastest increase since 1981.

Housing costs rose 7.4% compared to the same period last year. In addition, Canadian households that need heating for extended periods have spent more due to rising energy prices, leading to higher natural gas and electricity costs. On the other hand, the Canadian job market has recovered strongly, with the unemployment rate falling to an all-time low in April, placing significant upward pressure on wages, increasing production costs for businesses, and contributing to the rising inflation. Therefore, Canada’s cost of living has risen more than twice as fast as the country’s average wage.

Because of these factors, the market’s expectations for the Bank of Canada to raise interest rates again at today’s meeting have significantly increased. Furthermore, some market analysts believe that the current inflation level has not peaked yet, and expect it to break through 7%. Therefore, it is likely that the Bank of Canada will not stop hiking interest rates until inflation starts cooling off.

How will the rate hike affect the Canadian dollar?

Continued interest rate hikes will significantly impact Canada’s real estate industry. Borrowing costs will increase accordingly, reducing residents’ desire to invest in real estate. This will harm the Canadian economy, which is highly dependent on the real estate industry.

However, since Canada is an important food and energy exporter globally, the general rise in commodity prices is excellent for its export trade. Hence, it can offset part of the negative impact of interest rate hikes on the economy to a certain extent. On the other hand, if commodity prices start falling, the effect on Canada’s economy and its currency value will be unfavourable.

Canada’s current 2-year and 10-year bond yields are higher than those of the United States, reflecting investors’ expectations that the Bank of Canada will continue to raise interest rates in response to inflation, strengthening the Canadian dollar. However, the latest data shows that the country’s economy has slowed down, which is lower than the market’s expectations. If the economy cannot improve, it will restrict the positive impact of interest rate hikes on the Canadian dollar.

The markets’ should pay close attention to the interest rate hikes policy in the United States. It is expected that after the June-July meeting on interest rates, the pace of interest rate hikes in the United States will reduce as US inflation continues to fall. If the Fed’s policy is in line with market expectations, gradually slowing interest rate hikes or weakening the US dollar will favour the Canadian dollar’s further gains against the US dollar.

In addition, thanks to the continued high prices of commodities such as oil and food, Canada’s import and export trade has shown substantial growth recently. Suppose the country’s economic data improves in the second quarter, which could trigger new upward momentum for the Canadian dollar. However, investors also need to pay attention to the Canadian dollar exchange rate fluctuations caused by possible future shocks in oil and food prices.