Chinese EV shares dropped this week after BYD, a leading EV manufacturer, increased fears of a tough price war. The company’s aggressive price cuts have been rattling the sector, adding to fears over profitability and competition.

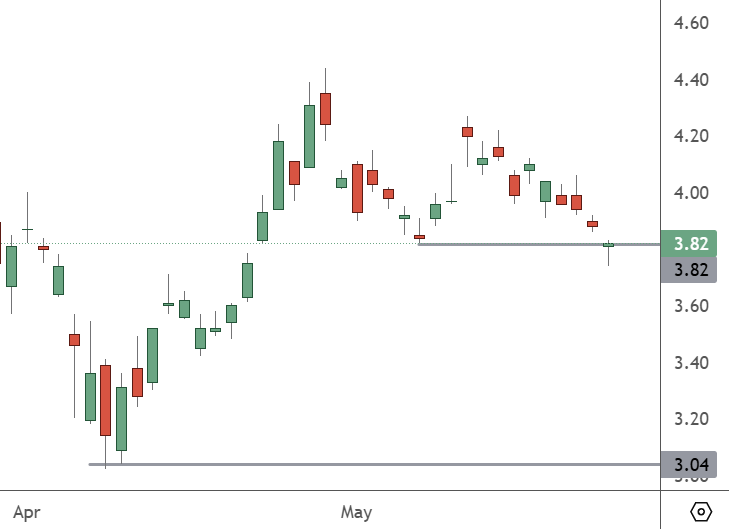

NIO (NYSE:NIO) shares were lower on the news with a move from the $4 level to prices under $3.80. This is a key level for the stock as a failure could move further down toward the $3 lows of April.

Shares of Geely, Li Auto, and Xpeng saw declines of 7%, 5%, and 4% respectively, after BYD announced significant price reductions on 22 models, including the entry-level Seagull EV.

“The price cuts are a strategic move by BYD to maintain its market leadership,” said analysts at Financial Times. “However, this aggressive pricing strategy could lead to a prolonged price war, affecting the entire industry”.

“This is a clear indication that the price war in the Chinese EV market is heating up,” said an analyst from South China Morning Post. “BYD’s move is likely to force other manufacturers to follow suit, leading to a potential race to the bottom”.

The price war raises concerns about the profitability of rival Chinese EV manufacturers, especially those that are targeted at higher-end consumers, such as NIO. BYD’s latest profit forecast fell short of analyst’s expectations, highlighting the challenges created by the intense competition in electric vehicles.

Despite the recent setback, BYD was optimistic about its long-term prospects. In a statement released after the earnings, the company emphasized its commitment to innovation and market leadership. The latest price cuts by BYD may also be an effort to hit Tesla while it has already been struggling.

“The price war could lead to a shakeout in the Chinese EV market,” said an analyst from NBC Los Angeles. “Only the most competitive and innovative companies will be able to withstand the pressure”.