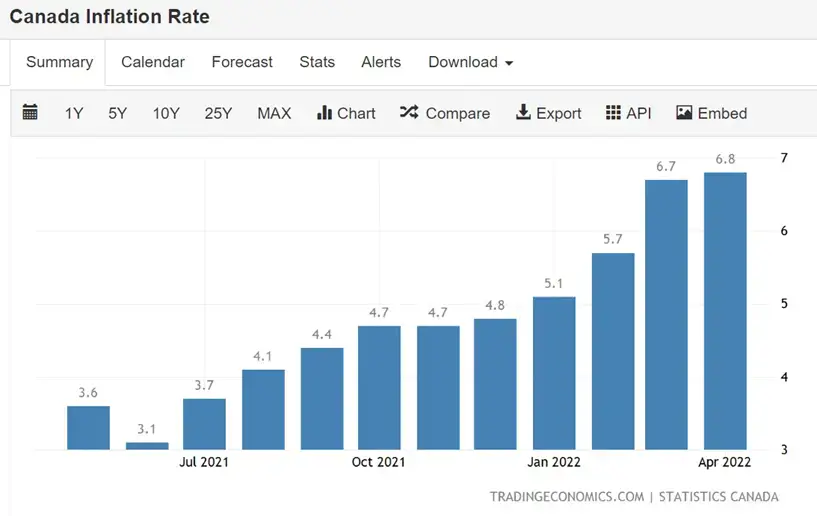

除了美国通胀居高不下之外,在本月各国公布的CPI数据中,加拿大4月的通胀指数高达6.8%受到市场关注,这是该国自 1991 年 1 月以来的通胀最高水平,超过了市场 6.7% 的中值估计。

今晚,加拿大央行利率决议即将出炉,市场预计加拿大央行在下周可能考虑进一步收紧货币政策,将基准利率加息50个基点,从1%上调到1.5%,也有预计会更加激进的加息75个基点。连续的加息政策会对加元走向产生什么影响?

加拿大物价一路飙升

和美国一样,加拿大正在忍受着有史以来最严重的通货膨胀,加央行在西方国家中率先开始加息,从3月至4月连续两次升息,将基准利率从0.25%上调至1%,但是仍然难挡该国CPI指数的一路飙升。

从5月公布的分项数据看,食物价格和住房成本是 4 月份加拿大CPI物价指数上涨的主要推动力。由于受到俄乌战争对于农产品和化肥产品出口的冲击,食品生产成本快速上升,如果战争持续,食品和原材料的供应短缺还会令企业将更多的成本转嫁给消费者。数据显示表示,加拿大人从超市购买的食品价格比一年前上涨了 9.7%,这是自 1981 年以来的最快涨幅。

相较去年同期,住房成本上涨 7.4%,由于天然气等能源价格的上升,较长时间需要供暖的加拿大家庭不得不增加支出。另一方面,加拿大就业市场强劲复苏,4月份的失业率降至历史最低点,这推升了工资的上行压力,增加了企业的生产成本,加剧了通胀的持续攀升。目前加拿大国内生活成本的增长速度已经超出了该国平均工资增长的两倍多。

正是由于这些因素,大大提升了市场对于此次会议中加央行再度升息的预期,有市场预测认为当前的通胀水平还没有到顶,有望冲破7%,因此预计加央行还不会停下加息的步伐。

加息对加元有何影响?

持续的加息会给加拿大的房地产行业带来较大的冲击,借贷成本会随之升高,减少居民对于房地产的投资意欲,这对房地产行业依赖程度较高的加拿大经济将产生负面影响。

不过,由于加拿大是世界重要的粮食和能源出口国,大宗商品价格的普遍上升其实利好其出口贸易,在一定程度可以抵消一部分加息对经济带来的负面影响。而未来如果大宗商品价格普遍回落,对于加拿大的经济和货币价值的影响将是不利的。

加拿大目前2年期和10年期的债息率均高于美国,反映投资者预期加央行未来为应对通胀将会持续加息,有利于加元走强,但是从昨日公布的第一季度加拿大GDP数据看该国经济出现放缓,不及市场预期,若经济无法改善也会制约加息对于加元形成的提振作用。

后续市场需要关注美国方面的加息政策,预计在6-7月议息会议之后,随着美国通胀连续回落,其加息的步伐有望放缓。如果美联储的政策符合市场预期,逐渐放缓加息或令美元表现走软将有利于加元兑美元汇率的进一步上行。

另外,受惠于油价和食品等大宗商品价格在高位持续,加拿大进出口贸易均在近期呈现大幅增长,如果在第二季度该国经济数据得到改善,相信会为加元带来新的上升动力。但投资者也需要留意未来油价、粮食价格可能出现的震荡对于加元汇率造成的波动行情。