All eyes are on the Federal Reserve (Fed) as it approaches its pivotal Federal Open Market Committee (FOMC) meeting on 16 – 17 September 2025. After months of speculation and debate, markets are waiting to see whether the Fed will finally deliver the long-anticipated first rate cut of the year.

This decision goes far beyond a domestic policy call for the United States. It carries global consequences, shaping the direction of currencies, equities and commodities. For traders, it is critical to understand the implications, as the outcome will impact trading strategies through asset prices, market sentiment and the strength of the US dollar. With so much at stake, this meeting is set to be one of the most closely watched events on every trader’s calendar.

What to Expect in September 2025 FOMC Meeting

Market Expectations Tilt Toward a Rate Cut

Expectations are leaning toward a potential rate cut, driven by two key factors:

1. Cooling Labour Market:

The July Nonfarm Payrolls (NFP) report indicated a notable slowdown, with only 73,000 new jobs created, well below the forecast of 110,000. More significantly, May and June figures were revised sharply lower, from 144,000 and 147,000 to just 19,000 and 14,000, respectively, a combined downward revision of 258,000. The unemployment rate also ticked up to 4.2%, raising concerns about waning economic momentum.

2. Moderating Inflation:

The July CPI report showed a modest 0.2% monthly increase in headline inflation, while the annual rate eased to 2.7%, moving closer to the Fed’s 2% target. This progress provides policymakers with greater room to consider rate cuts without undermining their inflation mandate.

As of 26 August 2025, the CME FedWatch Tool indicates an 87.3% probability of a 25-basis-point rate cut, with a 12.7% chance that the Fed will maintain the current rate. These expectations, however, remain subject to change as new data emerges.

Cut vs. Hold: Potential Market Implications for Forex, Commodities,and Stock

The Fed’s decision will have immediate and pronounced effects across major asset classes. Here’s what traders should watch for:

1. Forex Markets

If Cut: The US dollar could weaken as yield differentials shift, providing support for major currencies such as the EUR, GBP, and JPY.

If Hold: The US dollar may rebound, as investors reassess the timeline for Fed policy easing.

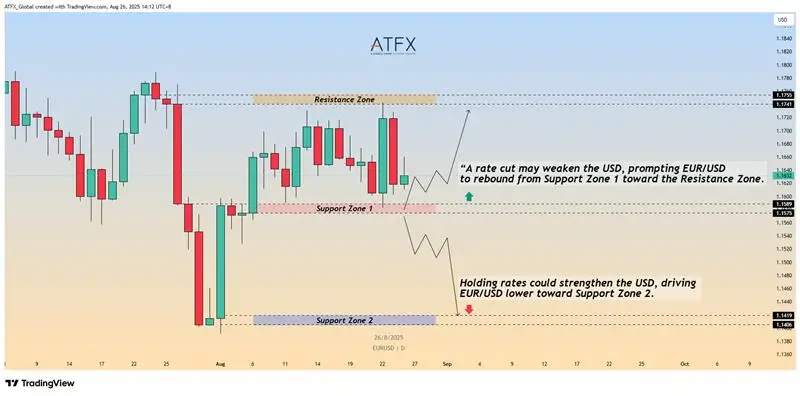

Potential EUR/USD Paths Under Fed Decisions:

2. Commodities Markets

If Cut: A softer US dollar could support dollar-denominated assets like gold and silver; growth-sensitive commodities such as oil and copper may also benefit from improved demand expectations.

If Hold: Gold may come under pressure from a stronger dollar, while industrial metals could lose momentum as growth optimism fades. However, oil is more influenced by supply-side dynamics such as OPEC+ decisions and geopolitical factors, so Fed policy may have a more limited impact.

Potential XAU/USD Paths Under Fed Decisions:

3. Stock Markets

If Cut: Lower borrowing costs could spark a relief rally, boost corporate earnings outlooks, and support risk sentiment.

If Hold: A pullback is likely, as markets unwind bets built on easing expectations.

Potential NAS100 Paths Under Fed Decisions:

How Traders Can Stay Steady Amid Market Moves

While Fed decisions can be unpredictable, traders can stay prepared by anticipating and managing the volatility that follows. Key approaches include:

1. Stay Informed

Stay on top of the Fed’s announcements, speeches, and key data releases such as jobs, inflation, and growth. Focus on the context, whether the Fed is signalling a hawkish or dovish stance, and how that aligns with market expectations.

2. Manage Risk Wisely

Periods around major announcements are characterized by elevated volatility and potential for rapid price movements. Prudent position sizing and the use of stop-loss orders are advisable.

3. Spot Opportunities

Shifts in monetary policy often create trends across correlated assets. A dovish tilt may weaken the US dollar while supporting gold and equities, whereas a hawkish hold could lift the dollar and weigh on risk assets. Recognizing these correlations helps traders to act with greater confidence.

How ATFX Empowers Traders

ATFX equips clients with the tools, insights, and support needed to navigate fast-evolving markets with confidence.

1. Expert Market Analysis

Access regular updates and timely insights from ATFX seasoned experts and dedicated analytical team.

2. Advanced Trading Platforms

Trade on user-friendly platforms equipped with professional charting tools, real-time news feeds, and fast execution speeds.

3. Risk Management Features

Utilize stop-loss orders, negative balance protection, and educational resources to help traders make informed trading decisions.

Markets move quickly, and the Fed’s decision remains uncertain. Whether it is a cut or a hold, staying well-prepared and attuned to market dynamics is key. Stay calm and trade confidently with ATFX.