Key Takeaways on 2026 Market Outlook

|

As we step into 2026, global markets emerge from a challenging but pivotal 2025. Central banks across major economies adopted increasingly divergent strategies in response to easing inflation pressures, geopolitical tensions, and uneven economic growth trends. With these uncertainties, 2026 could prove turbulent, with markets moving in increasingly polarized directions.

2025 Recap: Major Central Banks and FX Markets

- The Federal Reserve (Fed) ended its long tightening cycle by cautiously cutting rates to 3.5%–3.75% in December amid notable uncertainty about future policy, reflected in a rare 9–3 split vote among policymakers.

- The European Central Bank (ECB) paused further rate hikes once inflation settled near its 2.0% target, prioritizing economic stability with a data-driven approach.

- Facing persistent inflation and weak growth, the Bank of England (BoE) held rates steady at 3.75% entering 2026, maintaining a balanced outlook amid uncertainty.

- In contrast, the Bank of Japan (BoJ) raised rates to 0.75% in December, continuing gradual normalization and adding complexity to global interest rate and currency markets.

- These divergent paths widened yield differentials, contributing to a softer US dollar, supporting the euro, and making the yen sensitive to carry trade dynamics and risk sentiment shifts.

With 2025 behind us, the focus shifts from rate hikes ending to the growing divergence in central bank policies globally.

How These Major Central Banks Enter 2026 on Diverging Paths

Federal Reserve: Transitioning to Easing

December 2025 marked a key turning point, with the Fed moving away from its highest interest rates. Official projections show rates falling slightly from 3.6% at the end of 2025 to 3.4% by the end of 2026, implying only one quarter-point cut during 2026. This measured approach aims to avoid reigniting inflation while supporting a gradual economic slowdown.

A critical 2026 factor is the Federal Reserve leadership transition, as Jerome Powell’s term expires in May. Markets closely watch for signals about his successor, since any perceived change in the Fed’s independence could trigger sudden spikes in bond yields and dollar volatility. The table below highlights the minimal projected rate changes end-2025 through 2027 and into the longer run.

| Time Period | Fed Interest Rate Projection |

| End of 2025 | Projection: 3.6% Actual effective rate: 3.64% |

| End of 2026 | 3.4% |

| End of 2027 | 3.1% |

| Longer Run | 3.0% |

Source: Extracted from Federal Reserve Board, Summary of Economic Projections (SEP), December 10, 2025 (https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20251210.htm)

ECB and BoE: Divergent Responses to Inflation Stabilisation

The ECB’s steady stance reflects growing confidence that inflation pressures are easing, enabling prioritization of economic stability over further tightening. The BoE’s outlook remains more cautious, with any easing contingent on incoming inflation and growth data.

Bank of Japan: Continuing Gradual Normalisation

Japan remains on a distinct policy path, with gradual adjustments aimed at restoring policy flexibility without disrupting financial conditions. This divergence keeps the yen closely linked to global yield movements and risk sentiment.

FX Market Implications

Diverging monetary policies will keep yield spreads a key driver of currency performance. The US dollar may soften as easing expectations build, while the yen remains sensitive to carry trade strategies. In stable, low-volatility environments, yield-seeking strategies could regain popularity, especially against low-yield currencies.

The Macro Reset – Growth, Inflation, and Sentiment in 2026

Despite persistent downside risks, 2026 starts not as a downturn, but as a macro reset toward slower yet resilient global growth.

- Global Growth Outlook: Expansion moderates across major economies but remains broadly intact. Downside risks persist but are generally manageable rather than systemic.

- Inflation Trends: Disinflation continues unevenly, with services inflation and wage-driven components proving more persistent, reinforcing cautious policy calibration.

- Regional Growth Dynamics: Growth increasingly driven by a mix of mature and emerging markets. China transitions structurally toward domestic demand, while India leads with projected 7.3% growth as forecast by the Reserve Bank of India. This balance shapes the emerging market landscape for 2026.

- Fiscal Pressures: Elevated fiscal deficits and political uncertainty in several large economies continue to influence bond markets, risk premiums, and overall investor sentiment.

Cross-Asset Trading Outlook for 2026

FX

- The US dollar may face periodic pressure as global interest rate differentials narrow, potentially softening against the euro and British pound.

- Yield spreads remain the dominant driver of currency moves, favouring selective positioning rather than broad trends.

- Carry trades may regain appeal under stable volatility, particularly involving low-yield currencies like the Japanese yen.

Gold

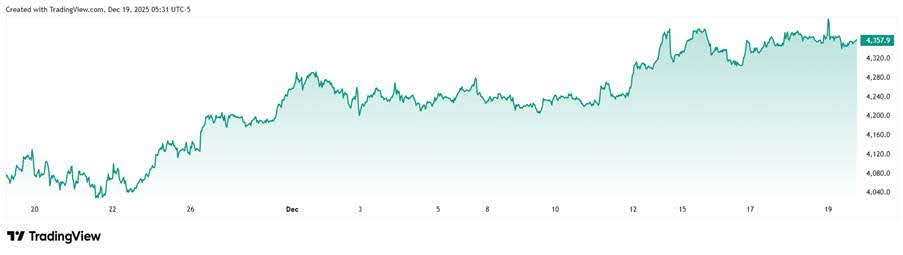

Gold prices rose noticeably in late 2025, as shown in the chart, with higher values in December compared to November. This strength is mainly driven by strong buying from central banks and ongoing global political uncertainty. In a world that’s becoming more unpredictable, gold remains an important safe investment that helps protect and balance portfolios, with market expectations also seeing scope for further support into 2026 amid expectations of policy easing and continued central bank demand.

Source: TradingView.com – November 2025 to December 2025

Oil

Despite ongoing geopolitical risks, crude oil markets face a supply-heavy environment. Expanding production and shifting demand patterns may continue to cap upside momentum.

Cryptocurrencies

Regulatory developments and growing institutional participation remain key themes into 2026. Traders should remain mindful of the sector’s heightened volatility and distinct risk profile.

Indices

Global equity sentiment remains broadly constructive, supported by resilient earnings expectations in sectors such as artificial intelligence and defence. That said, performance is likely to remain selective, with sector rotation and regional divergence playing a larger role.

Key Drivers & Must-Watch Events for 2026

To navigate the polarized markets, traders should focus on key drivers and scheduled watchpoints that often dictate short-term volatility.

Structural & Overlooked Drivers

These underlying themes are often underestimated but can cause significant market distortions, particularly in the year’s early months:

- Portfolio Rebalancing Flows: Large-scale institutional rebalancing early in the year can create temporary but powerful distortions across yields, FX, and equity indices.

- Volatility and Risk Appetite: Persistently low volatility may encourage yield-seeking behaviours such as carry trades, increasing sensitivity to sudden data or policy shifts, raising the chance of sharp and unexpected price swings.

- Liquidity Traps: Early-year thinner liquidity amplifies market reactions to geopolitical headlines and economic releases, potentially causing sharper price moves than later in the year.

Key Calendar Watchpoints

These scheduled events will serve as direct tests of the 2026 narratives:

- Economic Data: U.S. labour and inflation reports, Eurozone inflation updates, and China’s Purchasing Managers’ Index remain critical for defining expectations around growth resilience and policy direction.

- The Fed Chair Succession: Developments around the May 2026 Fed Chair term expiration are perhaps the most important policy event to watch, potentially influencing dollar and bond market stability.

- Earnings Season: Early earnings from technology, biotech, and defence sectors will test 2026 growth narratives.

- Geopolitical Developments: Trade tensions (specifically U.S.-China relations) and disruptions in key trade routes remain significant sources of potential volatility.

For detailed economic events and high-impact data releases, you can check it out here on the ATFX Economic Calendar webpage – Live Forex Economic Calendar | Live Forex Event & Signals | ATFX

Navigating 2026

2026 is shaping up as a year of divergence and strategic realignment rather than a uniform downturn. Market outcomes will increasingly be driven by relative policy paths, capital flows, and positioning. Staying attentive to central bank signals, key economic data, and geopolitical developments will be essential for identifying opportunities and managing risk.

What’s Next

Given the high level of uncertainty surrounding the 2026 market outlook, staying informed and managing risk is vital. You can keep updated via ATFX’s Market News for timely analysis, and enhance your trading strategy by exploring comprehensive trading education resources (e-books, webinars). Ensure you manage risk effectively using practical tools like personalised watchlists to monitor key markets and advanced charting tools available on the ATFX mobile app.