| Key Takeaways on December Fed Meeting ● The Fed faces uncertainty over another rate cut amid slowing growth, cooling labour market, and persistent inflation. ● A prolonged government shutdown delayed key economic data, complicating decisions and market outlook. ● Market odds favour a 25 bps cut, but traders should prepare for volatility and watch key indicators closely. |

The Federal Reserve (Fed) will convene for its last policy meeting of the year on December 9–10, 2025, and traders worldwide are watching closely. After two rate cuts earlier in 2025 (including one in September and another on October 29 that lowered the target range to 3.75%–4.00%), the big question is whether the Fed will deliver another cut or pause to wait for clearer signals.

As highlighted in our November CPI analysis, the inflation data released in September played a critical role in shaping market expectations ahead of this final Federal Reserve meeting. The macro backdrop has shifted meaningfully since mid-year: economic growth is losing momentum, the labour market is cooling, and services inflation remains sticky. Layer onto that the recent prolonged U.S. government shutdown, which only began to ease in mid-November, disrupting many key data releases, and the Fed now faces the challenge of making a major policy call with limited visibility.

With all this uncertainty as the year draws to a close, markets are focused on how the Fed will steer the economy into 2026.

What Has Changed Since October’s FOMC Meeting?

At the October 28–29 meeting, the Fed cut rates by 25 basis points (bps), bringing the target range to 3.75%–4.00%. In a major shift, the Fed also announced that quantitative tightening (QT) would end on December 1, halting reductions in its Treasury and mortgage-backed securities holdings.

Since then, several developments have shaped expectations for December:

1. Growth Is Slowing

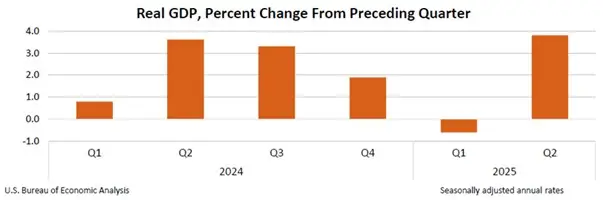

Real GDP grew at an annualized rate of 3.8% in Q2 2025, revised upward from earlier estimates, driven primarily by stronger consumer spending and a surge in business investment, particularly related to AI technologies. However, this robust growth followed a 0.6% contraction in Q1 2025, signalling uneven momentum across the year.

Looking ahead, forecasts indicate a slowdown through Q3 and Q4, as weakening consumer spending and cautious business investment weigh on growth. The recent government shutdown has also delayed key economic data releases for the latter half of the year, increasing uncertainty about the current state of the economy.

The chart below shows recent quarterly changes in real GDP, indicating a dip in Q1 2025 followed by a sharp rebound in Q2, reflecting the uneven momentum in the economy:

Source: U.S. Bureau of Economic Analysis (BEA)

Fed Chair Jerome Powell acknowledged this slowdown during the October 29, 2025, press conference, noting that “the economy is growing at a slower rate than it was—2.4 percent last year, we think around 1.6 percent this year.” He added that growth could have been “a couple of tenths higher if not for the shutdown,” highlighting how both underlying economic softness and data disruptions have complicated the outlook (Federal Reserve Press Conference Transcript, Oct 29, 2025).

2. Labour Market: Cooling, Not Crashing

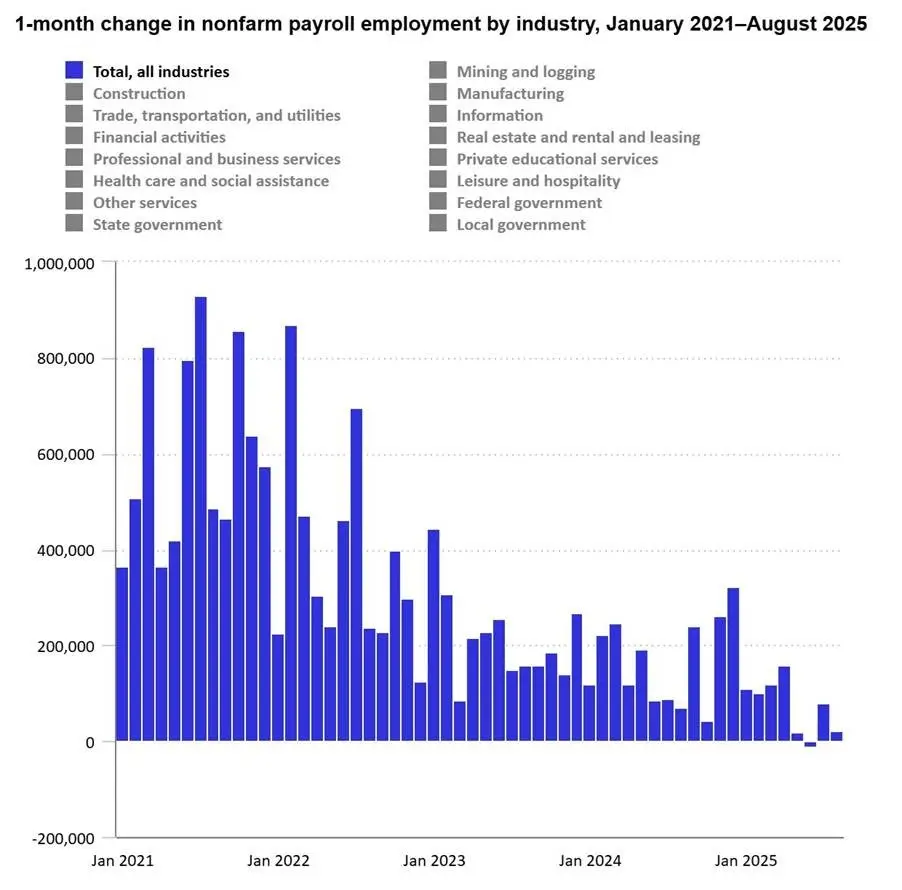

Job gains have slowed, hiring has eased, and some sectors are showing strain. But recession indicators remain mixed, suggesting the labour market is softening rather than collapsing.

This trend is reflected in the decline in monthly nonfarm payroll gains shown in the chart:

Source: U.S. Bureau of Labor Statistics, January 2021 – August 2025

In August 2025, healthcare jobs grew by 31,000, which was below the 12-month average, while employment declined in the federal government, manufacturing, mining, and wholesale trade. Despite these sector shifts, the unemployment rate held steady at 4.3%, and labour force participation remained stable at 62.3%. However, recent data show rising unemployment claims and subdued home-builder sentiment, hinting at some weakening momentum in hiring.

Fed Chair Jerome Powell highlighted the labour market’s unusual stability, noting that “economic activity may be on a somewhat firmer trajectory than expected,” and that “available evidence suggests that both layoffs and hiring remain low.” (Federal Reserve Press Conference Transcript, Oct 29, 2025)

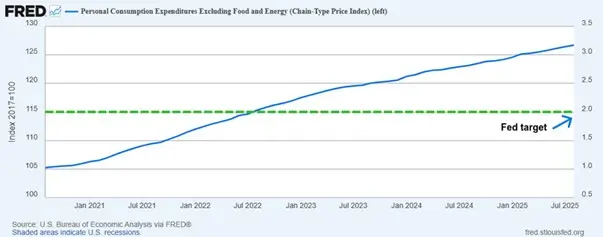

3. Inflation: Price Levels Remain Elevated Despite Some Progress

Headline inflation has eased from its peak, showing some progress. However, the core PCE price index, which excludes volatile food and energy prices, remains elevated, reflecting persistent inflationary pressures in sectors such as housing and healthcare.

The chart below shows the core PCE price index steadily increasing since early 2021 and remaining above the level consistent with the Fed’s 2% inflation target, marked by the green dashed line. Although the pace of increase has slowed, this sustained higher price level limits the Fed’s ability to reduce inflation quickly without risking the economy.

Source: U.S. Bureau of Labor Statistics via FRED

This persistence of elevated price levels is likely to influence the Fed’s policy decisions in the near future.

4. Missing Data: The Government Shutdown Problem

The biggest complication is the lack of official data. The shutdown has been delayed:

- Nonfarm payrolls

- CPI and PCE inflation updates

- GDP revisions

- Retail and production reports

With so many key releases on hold, the Federal Reserve is operating with an incomplete picture of the economy. Fed Governor Stephen Miran emphasized the importance of a forward-looking approach in a recent CNBC interview, stating that “if you’re making policy for what the data are now, you are backward looking.” Since monetary policy effects typically take 12 to 18 months to impact the economy, he stressed the importance of basing decisions on forecasts of where the economy will be a year or more ahead, rather than relying solely on current data.

This uncertainty has also filtered into markets. Traders have become more cautious in forecasting the December decision; some expect a rate cut based on softer private-sector indicators, while others point to the economy’s underlying resilience. The data blackout raises the risk of misreading trends at a critical moment for policy.

Market Expectations: One More Cut or a Pause?

Market pricing has swung sharply as new data and Fed commentary unfold:

- Market-implied odds (CME FedWatch) are roughly 69% for a 25-bp cut in December, ahead of Fed Beige Book release on Nov 27 (this is date-sensitive and moves daily).

- Current pricing leans slightly in favour of a 25 bps cut, but recent signals have also supported the possibility of a pause.

- Missing inflation and employment data due to the government shutdown have raised risks on both sides, complicating forecasting.

- Market sensitivity remains high:

- The USD has been range-bound but reacts sharply to Fed remarks.

- Gold holds near recent highs as safe-haven demand persists amid uncertainty.

- Equities show steadiness, buoyed by hopes for easier financial conditions.

- Yields continue drifting lower on expectations of easing in early 2026.

Fed Governor Stephen Miran cautions in a recent New York Times interview about the risks of prolonged restrictive policy, warning that “The longer you keep policy restrictive, the more you run the risk that monetary policy itself is inducing a recession.” This view highlights growing concerns among some policymakers that delaying rate cuts could inadvertently put the economy into a downturn.

Meanwhile, others continue to point to sticky inflation pressures and resilient services sectors as reasons for restraint in cutting rates too quickly.

Global Market Implications

The Fed’s December decision will ripple globally, influencing currencies, commodities, and risk sentiment:

If the Fed cuts:

- The USD could weaken, supporting emerging market currencies such as the South African rand (ZAR) and Singapore dollar (SGD), alongside the Australian dollar (AUD).

- Gold could benefit from a softer dollar and looser monetary conditions.

- Global bond yields may decline, bolstering risk assets worldwide.

If the Fed pauses:

- The USD may strengthen amid expectations of tighter policy.

- Commodities could face increased volatility as market positioning adjusts.

- Risk assets might experience short-term pressure.

- Markets may recalibrate rate expectations for early 2026 higher.

- For traders worldwide, these shifts are crucial, affecting FX pairs like USD/JPY, EUR/USD, and commodity-linked currencies, as well as precious metals.

Trading Insight: Preparing for Policy Uncertainty

Given the prolonged mix of missing data and divided Fed policymakers, traders should:

- Monitor alternative economic indicators such as private payroll surveys, purchasing managers’ indices (PMIs), and online price trackers.

- Watch critical currency pairs and safe havens — USD/JPY, EUR/USD, XAU/USD.

- Hedge directional exposure ahead of the announcement to manage whipsaw risk.

- Utilize economic calendars, sentiment gauges, and probability trackers to stay nimble.

- Prepare for heightened volatility during the announcement and Powell’s press conference.

This meeting could significantly shape market direction well into Q1 2026, making preparedness essential.

The Fed’s Delicate Balancing Act

The December FOMC meeting is one of the most uncertain of 2025. Cutting rates too soon risks reversing the progress of inflation, while waiting too long may weaken the labour market and economic growth.

With quantitative tightening ending and growth slowing, the Fed’s path is less clear than before. Fed Chair Powell’s focus on data and flexibility reflects this challenge.

Traders should stay alert, monitor key data, and prepare for volatility whether the Fed cuts or pauses. December’s decision will shape monetary policy and markets into 2026.

Next Step

With such uncertainty surrounding the Fed’s decision, it also indicates an opportunity to trade, but caution is key. As such, we suggest staying informed with ATFX’s Market News to keep updated on the latest market insights. If you are new to trading or or looking to sharpen your strategies, explore our comprehensive Trading Education & Tools and manage your risk effectively using our tools. Whether you’re monitoring volatile markets or planning your next move, ATFX is here to support your trading journey.

Trading involves risk. Trade responsibly.