US stocks continue to be hurt by a surge in treasury, which is at levels not seen since 2007.

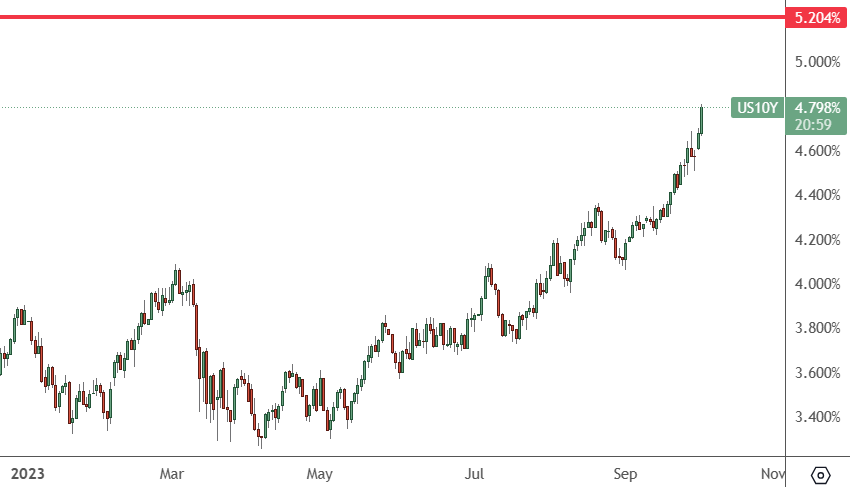

US 10 Year Daily Chart

Today, yields surged again to 4.798%, and the target could be as high as 5.204% in the near term.

The S&P 500 index fell 1.40%, while the tech-heavy Nasdaq fell 1.81%.

Traders have been hoping since the turn of the year that a recession would force the Federal Reserve to reverse its rate hike strategy, but they continue to hold them elevated, with inflation falling and the economy still strong.

Mark Spiegel of Spanhill Capital has said that 3-4% could be a new floor for the interest rate.

“There’s no way an “everything bubble” built on over a decade of 0% interest rates and trillions of dollars of worldwide “quantitative easing” cannot implode when confronted with 5%+ rates and $95 billion/month in US quantitative tightening plus tighter money from the ECB, BOJ, and other central banks.”

“Contrary to the belief of equity bulls, bubbles don’t unwind gently, and once they burst and the economy takes a dive, it takes a long time before lower inflation and lower rates help stock prices. When the 2000 bubble burst, the Nasdaq was down 83% through its 2002 low and the S&P 500 was down 50%. The rates of CPI inflation were just 3.4% in 2000, 2.8% in 2001, and 1.6% in 2002, and the Fed was cutting rates almost the entire time”.

Tomorrow will see the release of the important PMI number in the US, which underpins the country’s consumer economy activity. Manufacturing PMI already came in stronger this week, touching the expansionary 50 mark. The ten-year Treasury may run out of steam soon, but we also have to consider the damage to businesses or banks.

The regional bank crisis in March was an early problem for unprepared companies. As we climb higher from here, we may see further fallout.