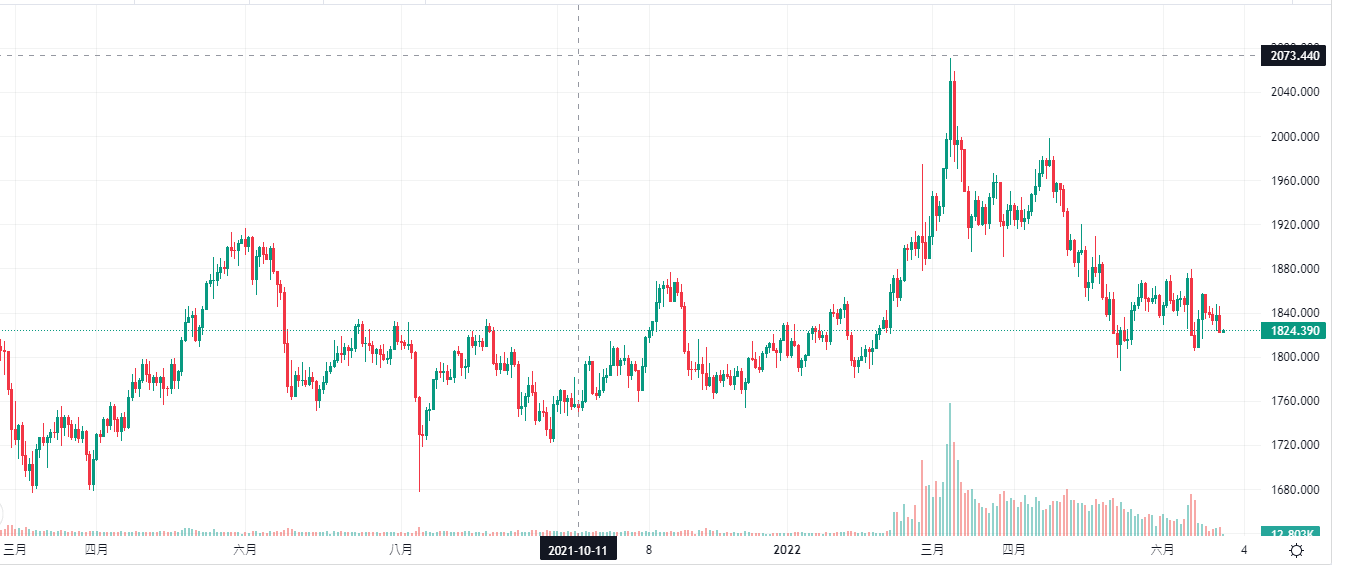

XAUUSD – Gold prices have been volatile over the past two weeks, plummeting below $1820 due to market expectations for interest rate hikes. However, the prices rebounded after the Fed announced a 75 basis point rate hike, which Fed Chairman Jerome Powell said was uncommon. Recently, gold prices have come under pressure as the market weighs the Fed’s hawkish remarks. However, Fed Chairman Powell’s testimony before the Senate yesterday made the market adjust its expectations, and gold prices rebounded slightly after the shock.

Yesterday evening, Powell testified before the House Financial Services Committee. The focus was on the semi-annual monetary policy report, which the market expects to provide further guidance on the Fed’s future monetary policies in addition to Powell’s speech. His remarks are particularly critical of the dollar and gold prices.

From Powell’s speech last night, it is clear that he believes the Fed’s interest rate hike strategy to combat inflation may lead to a recession. However, he added that we would never want to see such an outcome, but it was a possibility. This shows that the Fed’s current expectation of a soft landing for the US economy could face multiple challenges.

The pace of future rate hikes is of great concern to the market. Powell also stressed that the Fed plans to raise interest rates until inflation starts sliding to 2%. The Fed chairman also emphasised that they would try to find convincing evidence that inflation is falling in the coming months.

The Fed has shown its willingness to raise interest rates, coupled with the expectations of some Fed officials to continue to raise interest rates, giving gold bears multiple opportunities as Fed policies continue to put downward pressure on gold prices. Fed Governor Waller recently said that inflation should be fought at all costs and that if the economic data is in line with his expectations, he will support the same 75 bps rate hike at the Fed’s July meeting.

Minneapolis Fed President Neal Kashkari is also hawkish, saying he supports a 75 basis point rate hike by the Fed in June and may support another move in July to raise rates by 75 basis points.

Their hawkish rhetoric also diverted earlier speculation that the market expects a slowdown in interest rate hikes, returning gold to a vulnerable situation, favouring another decline. As a result, the current bullish and bearish expectations of gold have constantly diverged in the market. They have also exacerbated the volatility of the gold price trends, making them fluctuate between $1,800 and $1,870.

Although the Fed has raised interest rates sharply by 75 basis points, the inflation situation in the United States is still grim. The market expects the CPI to fall back from 8.6% in May. However, it is likely to be at a high of 8.3%, while some market analysts believe inflation will keep rising from the previous value.

In addition, the market has not stopped discussing the sources of the record-high inflation. The latest research shows that only about one-third is driven by demand, and nearly half is due to supply chain problems. Suppose the supply side mainly brings about inflation. In that case, aggressive austerity policies could significantly reduce economic output while lowering prices, increasing the likelihood that the US economy will fall into recession. However, if interest rate hikes are slowed down or stopped in the future, waiting for supply to recover may take a long time. The current situation of high inflation is expected to continue.

Therefore, the trend in gold prices may remain volatile before next month’s Fed interest rate meeting. However, suppose more people in the market are worried about a recession than those expecting continued interest rate hikes. In that case, there may be positive prospects for a rebound in the momentum of gold prices. From Powell’s remarks, he also expressed a risk warning about a future recession, indicating that market concerns will significantly impact the number and magnitude of future interest rate hikes. At the same time, gold investors must pay attention to changes in US economic data to capture inflation signals in time.