Asian stocks rose for a fourth session on Monday as investors bet on early rate cuts in the United States and Europe after a benign US payrolls report and upbeat productivity numbers suggested the labour market was cooling enough to obviate the need for further rate hikes from the Federal Reserve.

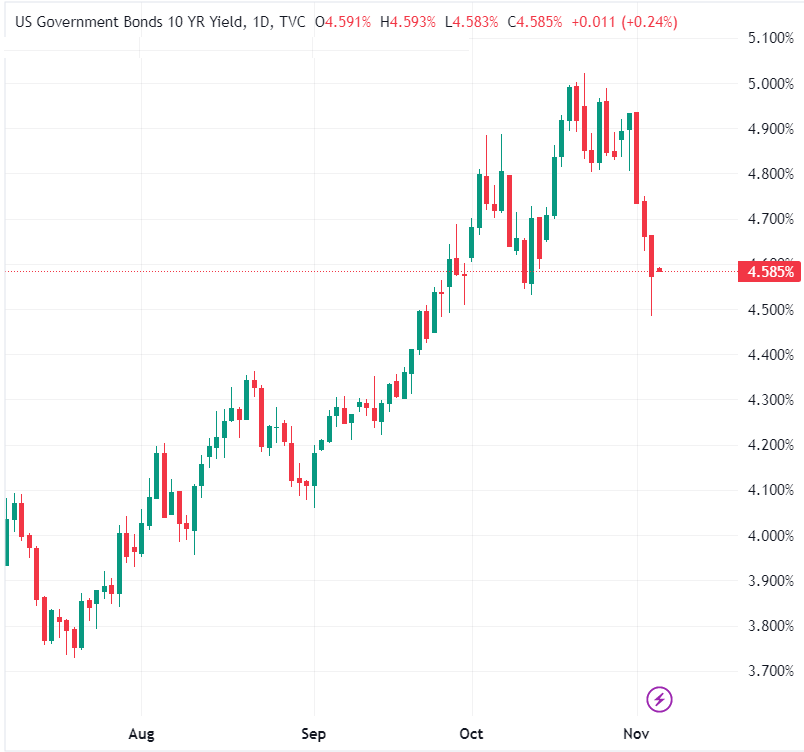

Bond markets swung to imply a 90% chance the Fed was done hiking and an 86% chance the first policy easing would come as soon as June. Markets also indicate around an 80% probability that the European Central Bank will be cutting rates by April, while the Bank of England is seen easing in August.

Central bankers can weigh in on this dovish outlook, with at least nine Fed members speaking this week, including Chair Jerome Powell. Also on the docket are speakers from the Bank of Japan, BoE and ECB.

An odd man out is Australia’s central bank, which is considered likely to resume hiking rates at a policy meeting on Tuesday as inflation stays stubbornly high.

Elsewhere, hopes for lower borrowing costs helped MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.5%, having already rallied 2.8% last week and away from one-year lows. Japan’s Nikkei rose 1.8% after jumping 3.1% last week. S&P 500 futures and Nasdaq futures were both flat.

The retreat in Treasury yields pulled the rug out from under the dollar, pinned at 105.110, having slid 1.3% last week to the lowest since late September. EURUSD was firm at $1.0728, surging 1% on Friday to its highest in two months. The dollar even lost ground to the ailing yen as USDJPY stands at 149.46 and some way from its recent top of 151.74.

The drop in the dollar and yields helped underpin gold at $1,990, within striking distance of the recent five-month peak of $2,009. Oil prices increased after shedding 6% last week, drawing support from confirmation that Saudi Arabia and Russia would continue their additional voluntary oil output cuts.

In the Middle East, Israel on Sunday rejected growing calls for a ceasefire in Gaza, with military specialists saying that forces are set to intensify their operations against Palestinian Islamist group Hamas. Brent added 32 cents to $85.21 a barrel, while US crude climbed 46 cents to $80.97 per barrel.