Market Highlight 27/10/2025

U.S. September consumer prices rose slightly less than expected, as a surge in gasoline costs was partly offset by a sharp decline in rents, supporting expectations for a Fed rate cut this week. U.S. equities closed at record highs on Friday, driven by the softer inflation data and strong corporate earnings. The S&P 500 and Nasdaq posted their largest weekly gains since August, while the Dow recorded its strongest week since June. The dollar ended Friday marginally lower, though it still posted a slight weekly advance.

Gold pared losses after the softer-than-expected inflation report but still logged its first weekly decline in 10 weeks. Spot gold settled at $4,111.52 per ounce, down 0.3%, after falling nearly 2% earlier in the session. For the week, gold fell more than 3%. International oil prices turned lower on Friday, as markets questioned whether the Trump administration would strictly enforce sanctions against Russia’s two major oil companies.

Key Outlook 27/10/2025

This week marks the final trading week of October, with global markets bracing for a “super week” of central bank decisions. The Federal Reserve’s policy decision will be the clear highlight, while the Bank of Canada, Bank of Japan, and European Central Bank will also announce their rate decisions. In addition, a series of critical economic releases is due, including eurozone and German GDP, U.S. GDP, and the core PCE price index. These events are expected to impact global financial markets significantly, warranting close investor attention.

Key Data and Events Today

16;15 RBA Governor Bullock Speech ***

- 17:00 EU GERMANY Ifo Business Climate OCT **

- 22:30 US Dallas Fed Manufacturing Index OCT **

- 22:30 US Durable Goods Orders MoM SEP **

Tomorrow:

- 15:00 EU GERMANY GfK Consumer Confidence NOV **

- 22:00 US CB Consumer Confidence OCT **

- 22:00 US Richmond Fed Manufacturing Index OCT **

Markets Analysis 27/10/2025

EURUSD

- Resistance: 1.1670/1.1688

- Support: 1.1593/1.1575

EUR/USD edged up to 1.163 as Eurozone October business activity outperformed forecasts, reinforcing optimism on regional resilience. Softer U.S. CPI data further fueled bets on Fed rate cuts, pressuring the dollar. Technically, the pair is testing resistance near 1.1670; a breakout could open the path toward 1.1750, while failure to hold 1.1593 risks lower.

GBPUSD

- Resistance: 1.3392/1.3426

- Support: 1.3281/1.3248

GBP/USD slipped 0.15% to 1.333 as stronger UK retail sales failed to counter weak inflation, reinforcing expectations for BoE rate cuts. Technically, the pair is capped by the downtrend line near 1.3392; rejection here could send it back toward 1.3281. A break above 1.3426, however, would lead to further gains.

USDJPY

- Resistance: 153.73/154.19

- Support: 152.25/151.79

USD/JPY climbed to 152.85, marking a two-week high, as U.S. sanctions on Russian oil drove up Japan’s import costs while new PM Sanae Takaichi considered a sizeable fiscal stimulus package. Technically, the pair holds above 152.25 support, with upside momentum aiming for 153.73 resistance, suggesting buyers remain in control unless a sharp reversal emerges.

US Crude Oil Futures (DEC)

- Resistance: 62.92/63.73

- Support: 60.27/59.45

WTI crude hovered near $62, posting a weekly gain of over 7%, its most substantial rally since June, after U.S. sanctions on Russian oil firms sparked supply concerns. However, doubts about enforcement kept prices from rising further. Technically, support lies at $60.27, with resistance at $62.92, and a break above could open the way toward $65.

Spot Gold

- Resistance: 4162/4214

- Support: 4008/3944

Spot Silver

- Resistance: 49.52/50.00

- Support: 47.52/47.06

Spot gold traded near $4,083 per ounce, marking its first weekly loss in 10 weeks (-3%) amid easing trade tensions, which curbed safe-haven demand. Technically, prices are consolidating between key support at $4,008 and resistance at $4,162, with the breakout direction likely to shape the next trend.

Dow Futures

- Resistance: 47426/47666

- Support: 47050/46813

The Dow Futures surged 1.01% to 47,207, logging its best weekly gain since June, supported by robust earnings and Fed rate cut bets. On the chart, price holds above 47,050 and targets 47,426, with momentum favoring a bullish continuation toward $4,7426 or even 47,666 if support remains intact.

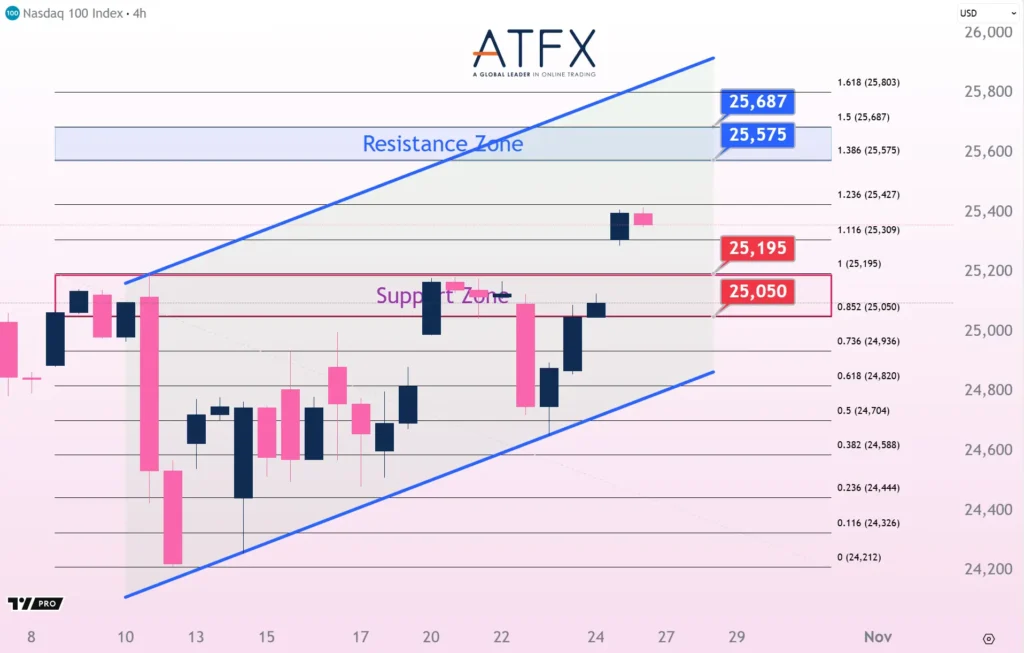

NAS100

- Resistance: 25575/25687

- Support: 25195/25050

NAS100 gained 1.15% to 23,204, its best week since August, supported by strong tech earnings and AI momentum. Technically, the index is holding above the 25,195 support zone, with an ascending trendline offering additional strength. A sustained push above 25,400 could open the way toward 25,575, while failure to hold above the support zone and breakout of the ascending trendline risks a deeper pullback.

BTC

- Resistance: 117482/118978

- Support: 111271/109800

Bitcoin climbed to around $111K, posting a 2% weekly gain as easing U.S.-China trade tensions and softer inflation boosted risk appetite. The confirmation of a Trump–Xi meeting at the APEC summit lifted sentiment across equities and crypto. Technically, BTC holds support near $111,271, while resistance at $117,482 remains the key upside barrier, with potential to test $119K if momentum extends.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.