Table of contents:

- Top 10 Warren Buffett Stocks Portfolio List 2026

- What is Berkshire Hathaway?

- Who is Warren Buffett?

- History of Berkshire Hathaway

- Class A (BRK.A) & B Share (BRK.B)

- Berkshire Hathaway Portfolio Companies List 2026

- Is Berkshire Hathaway a Good Stock to Buy in 2026?

- Steps to Trade Warren Buffett’s Top Shares

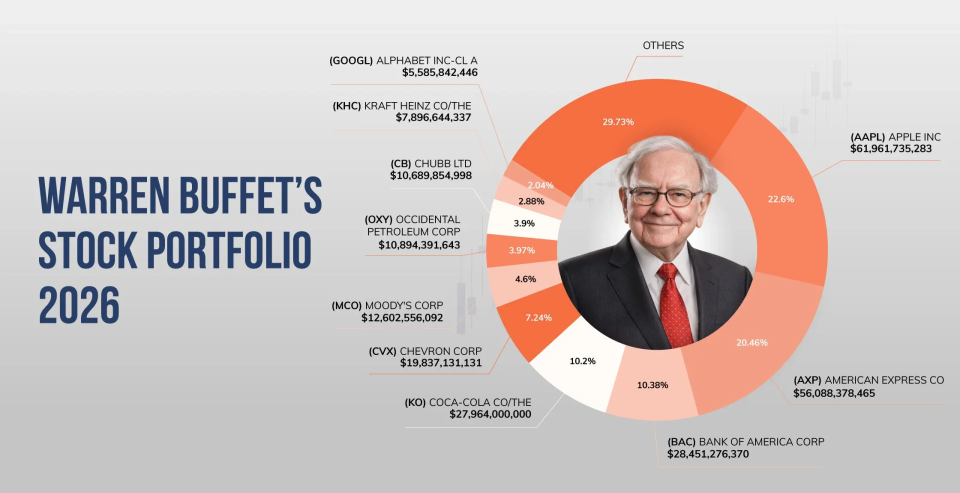

Top 10 Warren Buffett Stocks Portfolio List 2026

- Apple Inc. (AAPL)

- American Express Co. (AXP)

- Bank of America Corp. (BAC)

- Coca-Cola Co. (KO)

- Chevron Corp. (CVX)

- Moody’s Corporation (MCO)

- Occidental Petroleum Corp. (OXY)

- Chubb Ltd. (CB)

- Kraft Heinz Co. (KHC)

- Alphabet Inc CL-A (GOOGL)

What is Berkshire Hathaway?

Berkshire Hathaway is a multinational conglomerate led by Warren Buffett. It invests in various industries, including insurance, utilities, railroads, and manufacturing. Berkshire Hathaway’s market value is estimated to be $1.05 trillion in 2025, making it one of the world’s most valuable firms.

In 2025, Warren Buffett focused Berkshire Hathaway’s strategy on integrating artificial intelligence and advanced manufacturing technologies for long-term growth and efficiency. While specific AI investments aren’t detailed, the emphasis reflects a proactive approach to emerging trends. For example, Berkshire Hathaway Energy is investing $3.9 billion in the Wind PRIME project in Iowa and exploring battery storage solutions, such as the Glacier Battery System, in Montana. This move demonstrates that Berkshire is adapting to both technological advancements and sustainability to ensure future growth.

Who is Warren Buffett?

Warren Buffett, known as the “Oracle of Omaha,” is one of the most successful investors in history. He became CEO of Berkshire Hathaway in 1965, and the company has since developed into a global powerhouse. Buffett is well-known for his value investing strategies and long-term market view.

When people talk about Warren Buffett’s share portfolio, they usually mean the publicly traded stocks in Berkshire Hathaway’s investment portfolio, which is chosen and managed by Buffett and his team. However, this may not include Berkshire Hathaway’s other investments, including privately held companies and significant minority stakes in publicly traded companies.

History of Berkshire Hathaway:

Berkshire Hathaway began as a textile company in the 19th century. Warren Buffett acquired it in the 1960s and transformed it into a holding company with stakes in diverse industries, including Geico, BNSF Railway, and Dairy Queen.

As of 2025, Warren Buffett and large institutional investors like Vanguard, BlackRock, and State Street Corporation hold most of Berkshire’s shares. The Bill & Melinda Gates Foundation also holds notable shares due to Buffett’s contributions. The ownership is rounded out by individual investors, from small shareholders to high-net-worth individuals.

Charlie Munger, Buffett’s longtime partner, passed away in 2023. His estate or trust may still hold his shares, which are managed according to his estate plan. This plan could involve distributing the shares to his heirs, transferring them to trusts, or making charitable donations.

Class A (BRK.A) & B Share (BRK.B)

Berkshire Hathaway offers two categories of shares: Class A (BRK.A) and Class B (BRK.B), designed to accommodate different types of investors and provide greater flexibility in stock ownership. They not only serve large institutional investors and smaller retail investors, but also strike a balance between accessibility and maintaining a stable, long-term investment base.

Class A Shares (BRK.A): These initial shares constitute a greater investment in the corporation. They are expensive and primarily intended for institutional investors and high-net-worth individuals. In early 2025, each Class A share was valued at more than $700,000.

Class B Shares (BRK.B): These were introduced in 1996 to make Berkshire Hathaway more accessible to small investors. Each Class B share is 1/1,500th of a Class A share and substantially cheaper. Class B shares were worth more than $400 in early 2025.

Key Differences Between A and B Shares:

- Price: Class A shares are far more costly than Class B shares.

- Voting Rights: Class A shares have stronger voting power (1 vote per share vs 1/10,000th of a vote per B share).

Berkshire Hathaway Portfolio Companies List 2026:

Warren Buffett has carefully curated a diversified portfolio of publicly traded stocks and wholly-owned businesses. Refer to Warren Buffett’s current portfolio as below.

1. Apple Inc. (AAPL)

- Stake Value: ~$62.0 billion

- Percentage of Portfolio: ~22.6%

- Shares Owned: ~227.9 million

- Industry: Technology

Apple remains Berkshire Hathaway’s largest public stock holding by a wide margin. Buffett and his team often describe Apple not just as a tech stock but as a consumer products company, because of its powerful brand, recurring revenue from services, and ecosystem lock‑in. Although Berkshire trimmed its position slightly in late 2025, Apple still drives a huge portion of the portfolio’s total value and contributes significant dividends and buybacks.

2. American Express Co. (AXP)

- Stake Value: ~$56.1 billion

- Percentage of Portfolio: ~20.5%

- Shares Owned: ~151.6 million

- Industry: Financial Services

American Express remains one of Buffett’s longest‑held positions, dating back decades to times of crisis. Its strong brand, affluent cardholder base, and premium network economics deliver steady profits and dividends, making it core to Berkshire’s financial sector exposure.

3. Bank of America Corp. (BAC)

- Stake Value: ~$28.5 billion

- Percentage of Portfolio: ~10.4%

- Shares Owned: ~517.3 million

- Industry: Financial Services

Bank of America continues as one of Berkshire’s largest banking bets. Acquired initially during the 2011 financial stress period, the stake has been a major dividend generator and remains a central piece of the conglomerate’s financial holdings, even after modest reductions.

4. Coca‑Cola Co. (KO)

- Stake Value: ~$28.0 billion

- Percentage of Portfolio: ~10.2%

- Shares Owned: 400 million

- Industry: Consumer Staples

Coca‑Cola stands as one of Berkshire’s longest continuingly held equities, reflecting Buffett’s admiration for brands with enduring global demand. Its stable, growing dividend and pricing power have helped deliver consistent returns through decades of changing macroeconomic conditions.

5. Chevron Corp. (CVX)

- Stake Value: ~$19.8 billion

- Percentage of Portfolio: ~7.2%

- Shares Owned: ~130.2 million

- Industry: Energy

Chevron is Berkshire’s top‑tier energy position, boosted in recent years as oil and gas valuations rose. Buffett’s team views energy companies like Chevron as dependable cash generators with strong dividends, offsetting some cyclicality in other sectors.

6. Moody’s Corporation (MCO)

- Stake Value: ~$12.6 billion

- Percentage of Portfolio: ~4.6%

- Shares Owned: ~24.7 million

- Industry: Financial Services

Moody’s, a leading credit ratings provider, continues to be a core financial holding due to its high margins, recurring income, and role in capital markets. Buffett has praised its durable competitive position and consistent earnings growth.

7. Occidental Petroleum Corp. (OXY)

- Stake Value: ~$10.9 billion

- Percentage of Portfolio: ~4.0%

- Shares Owned: ~264.9 million

- Industry: Energy

Occidental Petroleum remains a major energy holding. Berkshire’s stake — above 20% ownership — reflects confidence in Occidental’s low‑cost production base and disciplined capital allocation, although broader oil price volatility still affects returns.

8. Chubb Ltd. (CB)

- Stake Value: ~$10.7 billion

- Percentage of Portfolio: ~3.9%

- Shares Owned: ~34.2 million

- Industry: Insurance

Chubb is one of Berkshire’s most significant insurance sector equity positions. Buffett values insurers for their ability to generate “float” (premiums held before claims), and Chubb’s underwriting discipline, dividends, and buyback activity align with Berkshire’s long‑term investment philosophy.

9. Kraft Heinz Co. (KHC)

- Stake Value: ~$7.9 billion

- Percentage of Portfolio: ~2.9%

- Shares Owned: ~325.6 million

- Industry: Consumer Staples

Kraft Heinz remains a familiar yet challenging holding in Berkshire’s portfolio. While performance has lagged at times due to shifting consumer tastes, Buffett’s commitment stems from the company’s strong brand portfolio and eventual value creation potential.

10. Alphabet Inc. Class A (GOOGL)

- Stake Value: ~$5.6 billion

- Percentage of Portfolio: ~2.0%

- Shares Owned: ~17.8 million

- Industry: Technology

Alphabet rounds out the top ten, representing Berkshire’s relatively newer foray into big‑tech search/AI exposure. The position reflects more recent portfolio diversification and a belief in Alphabet’s dominant digital advertising, cloud, and AI‑driven growth opportunities.

11. Other notable holdings:

Taiwan Semiconductor Manufacturing Company (TSMC) – (TSM)

- Stake Value: ~$4.3 billion

- Percentage of Portfolio: ~1.5%

- Shares Owned: ~60.3 million

- Industry: Semiconductor Manufacturing

In 2025, Warren Buffett’s Berkshire Hathaway made a notable investment in Taiwan Semiconductor Manufacturing Company (TSMC), reflecting Buffett’s increasing focus on the semiconductor industry. TSMC is a critical player in global chip production and has become a key beneficiary of the technological demand for advanced semiconductors. Although Buffett has expressed reservations about the risks of investing in foreign companies, the TSMC position stands out due to its strategic importance in the tech ecosystem. With rising demand for semiconductors driven by AI, automotive, and computing needs, TSMC’s long-term growth potential is significant.

Is Berkshire Hathaway a Good Stock to Buy in 2026?

Due to Warren Buffett’s proven track record, Berkshire Hathaway is often regarded as a reliable long-term investment. However, consider the following before investing in top Berkshire Hathaway portfolio companies:

Reasons to Buy:

- Diversified Portfolio: Gain exposure to various sectors through one stock.

- Strong Management: Buffett’s value investing approach has historically generated impressive returns.

- Financial Stability: The company holds significant cash reserves for acquisitions.

Reasons to Reconsider:

- Lower Growth Potential: As a mature company, Berkshire may offer slower growth than smaller companies.

- Dependence on Warren Buffett: At 93, Buffett remains a central figure in the company, raising concerns about future leadership.

Steps to Trade Warren Buffett’s Top Shares

- Research and Analyze: Familiarize yourself with the businesses, financial health, market position, and future prospects of Buffett’s top holdings. This comprehensive understanding aids in making informed investment decisions.

- Select a Brokerage Account: Choose a reputable brokerage platform that offers access to U.S. stock markets and provides robust research tools. A good brokerage should have a user-friendly interface, low fees, and reliable customer support. See also shares CFDs on ATFX, including Hong Kong stock trading and global stock trading.

- Portfolio Diversification: Ensure your portfolio is diversified across different sectors and asset classes, even while focusing on Buffett’s top picks. Diversification helps manage risk and reduces the impact of poor performance in any investment.

- Investment Strategy: Follow Buffett’s strategy of holding stocks long-term to benefit from potential growth and compounding returns. This approach reduces the impact of short-term market volatility.

- Regular Monitoring and Adjustment: Regularly review the performance of your investments and make necessary adjustments. Stay informed about any company or market changes to ensure your portfolio remains aligned with your investment goals.