Tonight, the ECB is about to announce its interest rate decision. The market expects it to raise the key interest rate by 25 basis points for the first time in 11 years. Some market participants expect a 50 basis point hike or a signal that a 50 basis point hike could come in September. European policymakers are facing a dilemma in fighting inflation on the one hand while tackling the risk of a recession on the other. What impact will this rate hike have on the euro and European markets?

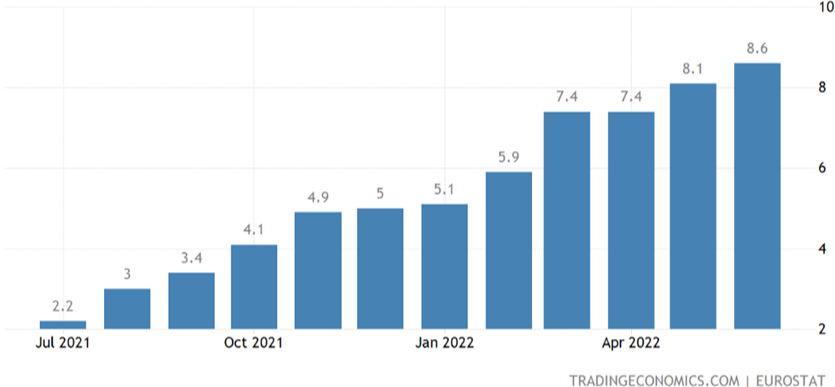

The reason behind raising interest rates is to tame the rising energy and food prices triggered by the Russo-Ukrainian war. Eurostat released data on Tuesday showing that the final value of the eurozone’s harmonised CPI in June rose to 8.6% year-on-year, to reach a record high of 8.1% in the previous month. The most significant contributor to the eurozone’s June inflation increase was energy prices, which rose 42% year-on-year, well above the 8.9% increase in food, alcohol, and tobacco prices.

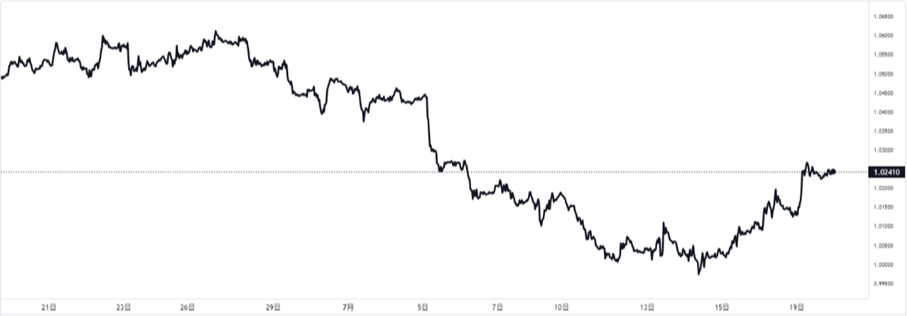

The continued surge in CPI data increased the market expectations of an interest rate hike from the ECB. The speculation pushed the euro to start rebounding against the dollar over the short term, causing some negative impact on the dollar index. However, the momentum of the euro’s recovery may continue before the ECB announces its interest rate decision.

On the opposite side of high inflation is the continued downturn in the eurozone economy, with many European countries dealing with a rapidly widening trade deficit. Germany experienced a trade deficit for the first time since 1991 this year. Exports rose 11.7% year-on-year to €125.8 billion, and imports were up 27.8% y-o-y to €126.7 billion, leading to a trade deficit of nearly €1 billion. In addition to Germany, trade deficits persisted in the United Kingdom, France, Italy, and other European countries. The Federal Reserve continues to raise interest rates pushing up the exchange rate of the US dollar against a basket of European currencies. The ECB has to raise interest rates to reverse the widening trade deficit, thereby boosting the Euro Area GDP performance.

The general concern is that successive interest rate hikes will increase Europe’s likelihood of a recession, limiting the extent of future ECB interest rate hikes. As a result, the EU expects eurozone GDP growth to be 2.6% this year and 1.4% next year, which is lower than the 2.7% and 2.3% forecasts in May.

As the Federal Reserve raises interest rates, the EURUSD exchange rate has continued to fall. The euro fell to parity with the US dollar at one point, repeatedly making new lows last seen 20 years ago. The market is also waiting to see how long the euro rebound will last. Judging from the current situation across European economies, the outlook for the euro remains uncertain. The sluggish economic data has left the euro in a bearish trend against other currencies. Citigroup analysts recently said that the risk of “disorderly fluctuations” in the euro ranging from $0.90 to $0.95 is increasing.

In the short term, the euro exchange rate will likely recover, driven by investors’ hope for a rate hike. The dollar has accumulated significant gains against the euro over the past few months. The market has gradually raised its expectations of an interest rate hike. The dollar’s exchange rate may pull back in future, especially after an ECB rate hike, thus benefiting the euro, which has been sluggish in the past. The upcoming tighter monetary policies in the euro area are expected to support the euro.

In the long run, the road to interest rate hikes in the euro area will not be smooth. When the market gradually factors in the expectations of interest rate hikes, investors need to pay close attention to the impact of interest rate hikes on various economic data. Suppose the adverse effects of interest rate hikes offset the euro’s rebound momentum, and the single currency may fall back into its previous downward channel.