Microsoft will release earnings after the market closes on Thursday. The support levels are well-defined if earnings are slower than expected.

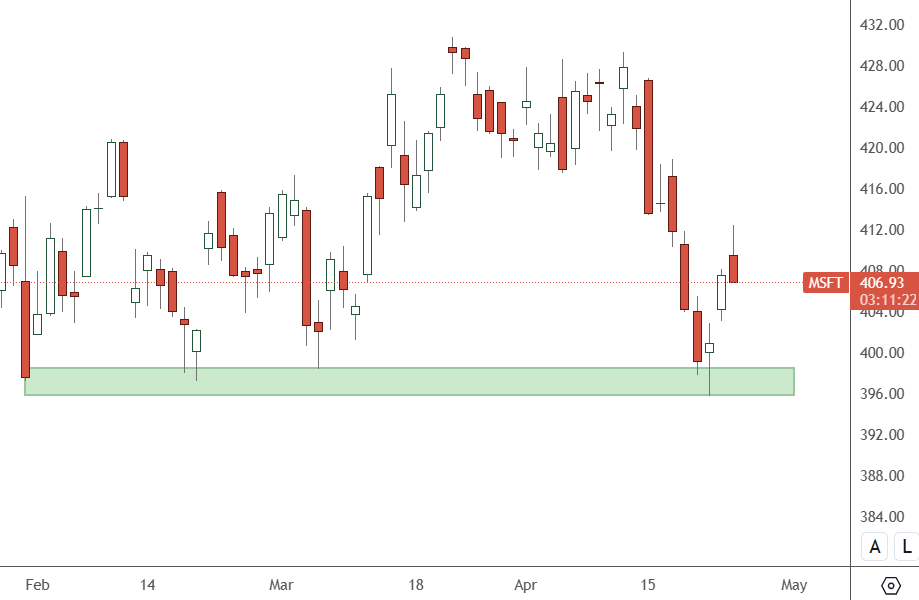

MSFT – Daily Chart

MSFT has support levels under $400 to around $396. The upside stalled on Wednesday at $412.

The big story will be Microsoft’s traction in gaining AI-related subscribers to its Copilot tool.

Analysts expect a year-over-year increase in the top and bottom lines, with earnings per share of $2.84 on revenues of $60.89 billion.

Wall Street will closely watch the tech giant’s AI adoption, with analysts at Wedbush calling it Microsoft’s (MSFT) “iPhone Moment”. Microsoft has poured billions of dollars into OpenAI and other tools.

Increased adoption of generative AI tools is expected to drive more dollars to the company’s Azure cloud business, which Wedbush expects will show 30% growth over the quarter. The analysts believe that more companies will utilise generative AI tools and Copilot, adding to Azure cloud deals. They said AI use cases will likely “explode across the enterprise landscape” over the next six months to a year.

That remains to be seen, and Microsoft’s earnings will be essential on Thursday. Analysts at Cit expect AI-related revenue to surprise the upside during the third-quarter earnings. Shares of the software giant are up more than 8% year-to-date, with the S&P 500 up 6%.

Over the last three months, the company has seen substantial revisions to its estimates. Its earnings per share estimates have been revised 27 times vs. one downward revision. In contrast, its revenue estimates have seen 15 upward moves compared to 18 downward revisions.

The earnings are more critical because Meta releases on Wednesday evening and Alphabet releases alongside Microsoft, so the AI growth expectations will be tested into the end of the week and will be vital for the path of stock markets.