The US Dollar slid broadly after the Federal Reserve held rates steady but remained committed to three rate cuts this year.

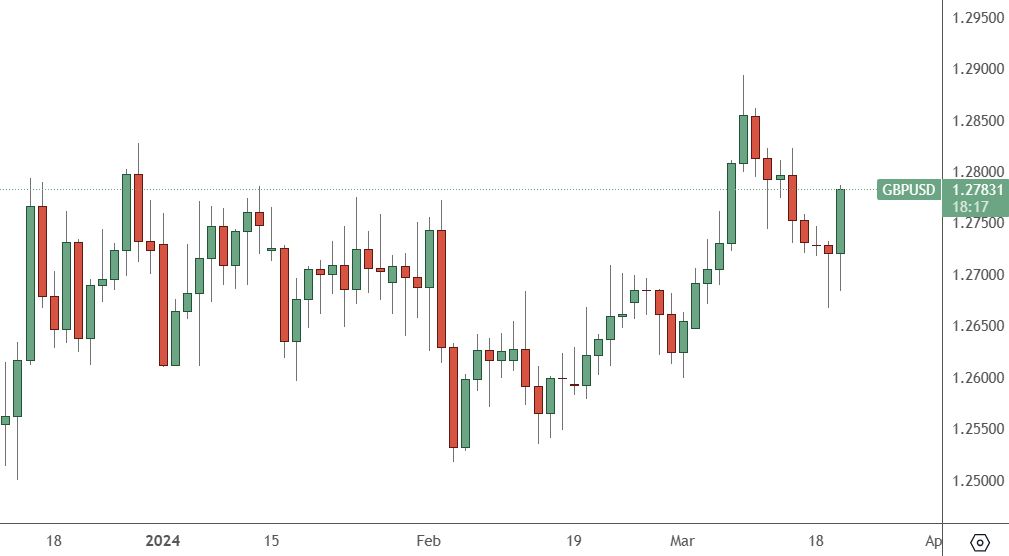

GBPUSD – Daily Chart

GBPUSD surged on the news and will now look to test the 2024 resistance at 1.29.

GBPUSD will remain active next week, with a Bank of England interest rate meeting ahead late Thursday. The event at 8pm HKT could extend the trend into next week.

The outlook for interest rate cuts has weakened the US dollar, but the pound could advance if the BoE projects a slower path to reductions.

Inflation data for the UK on Thursday showed that prices in February were lower again, with consumer prices rising 3.4% annually. A Reuters poll of economists and the bank’s forecasts last month had predicted an annual rate of 3.5%

“Today’s inflation numbers do not change our view … that the MPC is likely to convey the message that it has an eye on easing policy rates this year, but the hurdle to do so has not yet been overcome,” analysts at Investec said.

That could support the British pound against the US dollar in coming sessions, and a test of 1.29 could be in the cards.

Finance Minister Jeremy Hunt said the latest drop in inflation could help the government achieve its goal of abolishing social security taxes. However, a general election is being touted for later in the year. The Conservative Party may have to give way to the Labour Party as it trails in the polls.

In the Federal Reserve’s post-release press conference, Jerome Powell also discussed a reduction in the central bank’s balance sheet.

“It will be appropriate to slow the pace of run-off fairly soon,” Powell said. However, he did not give a specific time frame for the decision, saying that officials were only debating the issue.

Quantitative easing saw the Fed holdings balloon more than double, topping out at $9 trillion by the summer of 2022. The Fed began to shrink the size of its holdings later that year as it ramped up the country’s interest rates to tackle inflation.

However, the Fed Chair has expressed concern over government spending in the country in recent months, and the dollar could remain pressured into the election.