Silver’s price rally is at risk of being halted by the $80 barrier as inventory remains low.

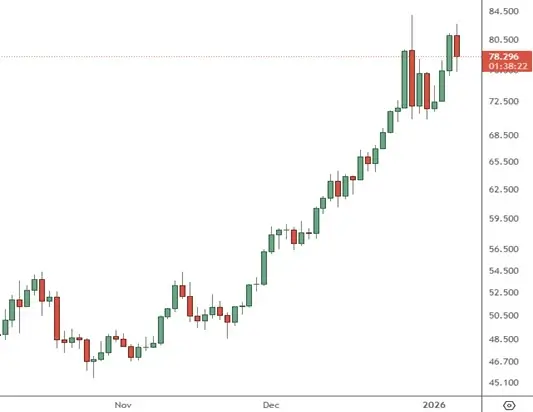

XAGUSD – Daily Chart

The XAGUSD price is testing the $80 level again, and this will be key to the near-term prospects for the metal. If the price fails here, $70 is critical support.

Silver has been surging at the tail-end of 2025 as the Federal Reserve moves to cut interest rates, and inventories remain under pressure. Silver inventories, particularly in London, have declined sharply, with London Bullion Market Association (LBMA) vaults reporting a 33% drop in stockpiles since mid-2021. Current estimates say there are only around 200 million ounces of “free float” silver, down from 850 million ounces in 2019.

Global supply and demand continue to exert upward pressure on prices, with the Silver Institute’s World Silver Survey 2025 reporting annual demand of 1.16 billion ounces. This has led to a cumulative deficit of nearly 800 million ounces since 2020.

Recycling and production in 2024 reached a 12-year high of 193.9 million ounces, but this cannot offset the current supply shortfall.

Silver is currently seeing resistance at the recent highs, but we cannot rule out a retail-driven surge toward $100 if support is strong here.