GBPUSD has retreated from last week’s rally to trade around the 1.277 level.

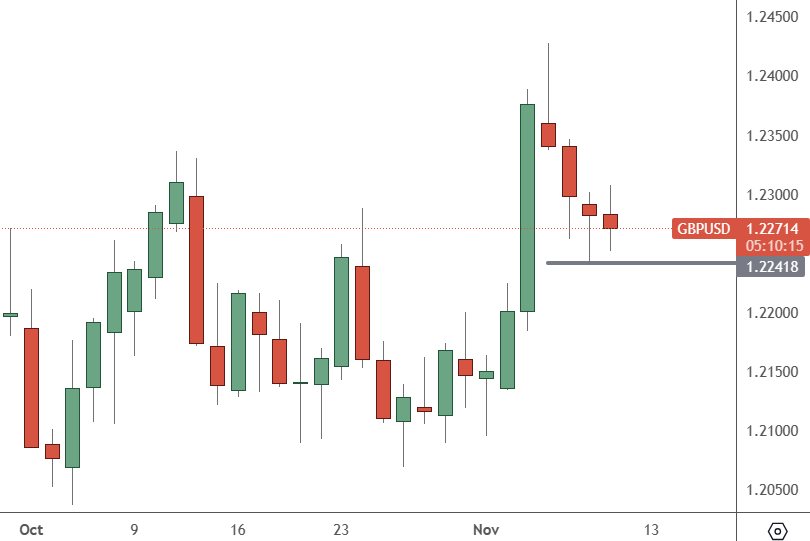

GBPUSD – Daily Chart

GBPUSD – Daily Chart

The low of Wednesday looks like it will be support for a further advance or the door to further lows.

Bank of England governor Andrew Bailey said this week he is “optimistic” inflation will return to normal levels but warned that the cost of borrowing will remain high. Bank of England forecasts last week said inflation should be at 2% by 2025.

This week, he also said it was “too early” to talk about cutting interest rates.

“I think it is common when you look at the Fed minutes, you look at ECB, you look at us, it’s really too early to be talking about cutting rates. The market of course will reach a view, it has to reach a view on the future path of interest rates. But we are very clear. We’re not talking about that. What we’re saying is that policy is going to have to be restrictive for an extended period.”

“I’m optimistic. I think it will happen, but I’m afraid we’ve got to continue doing the work to make it happen,” he added. Huw Pill, Chief economist at the BoE, said rates will unlikely return to the zero level seen before the year-long inflationary fight.

New figures for UK GDP are released on Friday with an expectation for a slight contraction of 0.1%, down from a gain of 0.3% in the previous three months. If the economy outperforms that contraction, then a rally in the British pound is likely as it would reduce fears over a recession.

The US dollar has struggled this week after a fall in treasury yields, but they are still near Friday’s close after a Wednesday rally. The UK GDP number will be released at 3pm HKT.