Market Highlight 09/01/2026

U.S. initial jobless claims edged higher last week, but overall labor demand remains weak. U.S. equities closed mixed on Thursday, with technology stocks such as Nvidia declining, while defense-related shares advanced after President Donald Trump called for an expansion of the $1.5 trillion military budget. The Dow Jones Industrial Average rose 0.55%, the S&P 500 posted marginal gains, while the Nasdaq Composite fell 0.44%. The U.S. Dollar Index extended its rally for a third consecutive session, closing up 0.125% at 98.87.

Gold prices held steady on Thursday as investors waited for the U.S. nonfarm payrolls report for clues on the Federal Reserve’s policy outlook. However, short-term pressure from adjustments to the broader commodity index continued to cap gold’s gains. Oil prices rebounded more than 3% on Thursday after two days of declines, closing at a two-week high, as investors assessed the situation in Venezuela and remained concerned about potential supply disruptions from Russia, Iraq, and Iran.

Key Outlook 09/01/2026

The United States is set to release its December nonfarm payrolls report, with job growth expected at 55,000 (previous: 64,000), indicating a return to a more normalized pace of cooling, though growth remains moderate. The unemployment rate is forecast to edge lower to 4.5% from 4.6% (a four-year high). If payroll growth meets expectations and the unemployment rate ticks slightly lower, it would suggest that the U.S. labor market is gradually slowing but remains resilient, increasing the likelihood that the Federal Reserve will keep interest rates unchanged at its January meeting.

Key Data and Events Today:

- 09:30 CN CPI DEC **

- 15:00 EU GERMANY Industrial Production NOV **

- 18:00 EU Retail Sales NOV **

- 21:30 CA Unemployment Rate DEC **

- 21:30 US Non-Farm Payrolls DEC ***

- 21:30 US Building Permits OCT Prel **

- 21:30 US Housing Starts SEP **

- 23:00 US Michigan Consumer Sentiment Prel JAN ***

Key Data and Events Coming Week

- Monday: Japan Holiday, EU Sentix Investor Confidence JAN

- Tuesday: US CPI NOV, US New Home Sales OCT

- Wednesday: EIA Monthly Oil Market Report, API Crude Oil Stock Change, CN Balance of Trade DEC, US PPI NOV, US Retail Sales NOV, OPEC Monthly Oil Market Report, US Existing Home Sales DEC, EIA Crude Oil Stocks Change

- Thursday: JP PPI DEC, GB GDP NOV, GB Industrial Production NOV, GB Manufacturing Production NOV, EU Industrial Production NOV, EU Balance of Trade NOV, US Initial Jobless Claims, US NY Empire State Manufacturing Index JAN

- Friday: Germany CPI Final DEC, US Industrial & Manufacturing Production DEC, US CB Leading Index NOV

Markets Analysis 09/01/2026

EURUSD

- Resistance: 1.1712/1.1734

- Support: 1.1615/1.1593

EUR/USD edged lower within a descending channel, with rebounds capped by the 1.1710–1.1730 resistance zone, keeping the near-term bias tilted to the downside. The 1.1615–1.1593 support area is a key downside test. Fundamentally, a firmer dollar ahead of NFP, softer eurozone inflation, and geopolitical uncertainty continue to weigh on the euro.

GBPUSD

- Resistance: 1.3485/1.3505

- Support: 1.3402/1.3383

GBP/USD weakened after breaking below its short-term rising trendline, with rebounds capped by the 1.3485–1.3505 resistance zone. The 1.3402–1.3383 support area is a key near-term pivot, with a break likely opening further downside. Fundamentally, firm USD positioning ahead of NFP and a lack of UK data keep sterling driven by dollar dynamics.

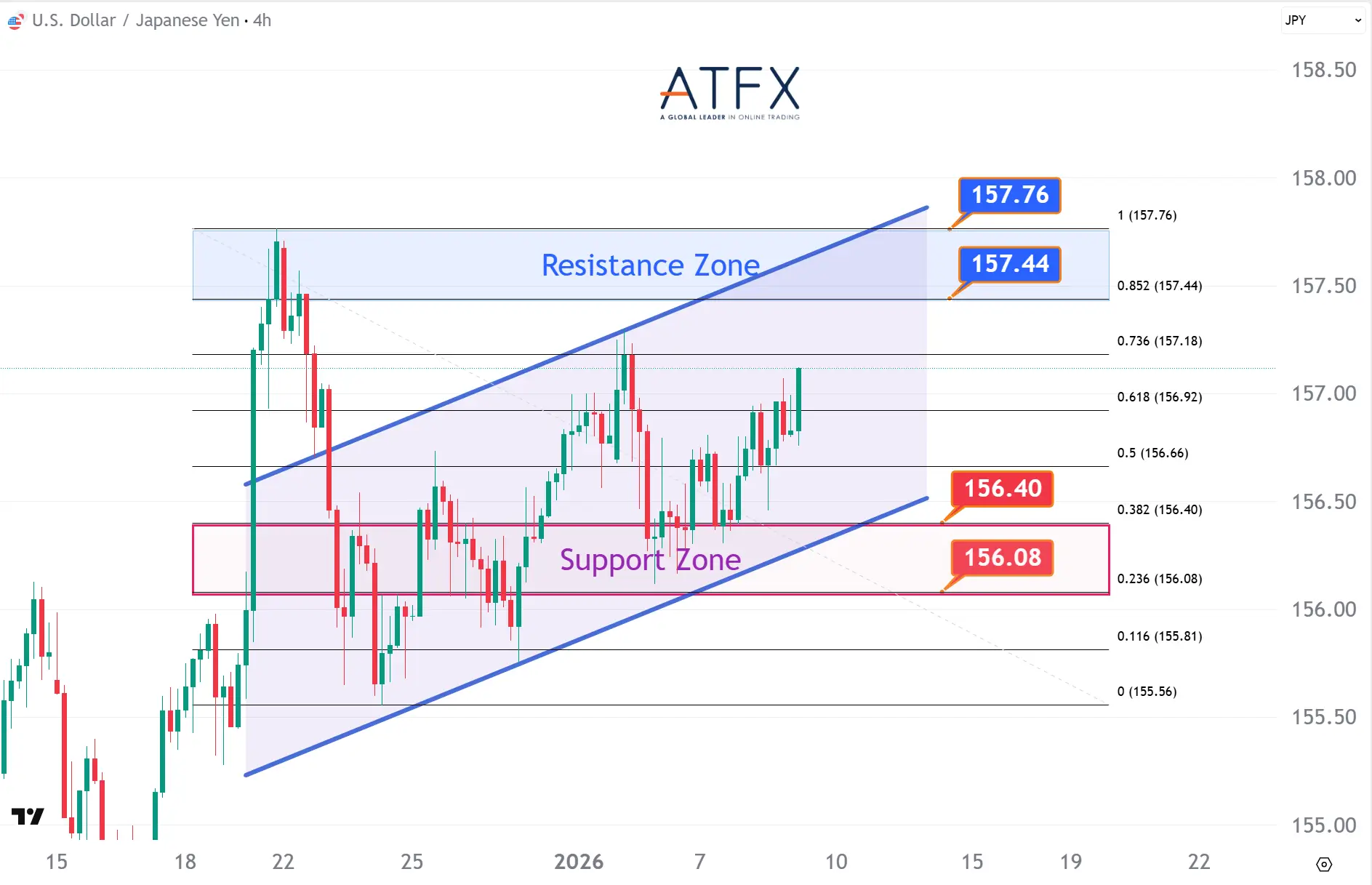

USDJPY

- Resistance: 157.44/157.76

- Support: 156.40/156.08

USD/JPY remains elevated within an ascending channel, holding above the 156.40–156.08 support zone, suggesting dip-buying interest persists. Upside momentum is capped near 157.44–157.76, keeping price action range-bound. Firm U.S. yields support the dollar, while contained risk sentiment limits safe-haven demand for the yen ahead of NFP.

US Crude Oil Futures (FEB)

- Resistance: 59.23/59.61

- Support: 57.31/56.95

WTI surged more than 3% as supply risks intensified, driven by developments in Venezuela, tanker seizures, and rising geopolitical tensions. Technically, the price rebounded strongly from the support zone and is pushing toward the upper resistance near $59.23–59.61. Short-term momentum has turned bullish, though gains may face selling pressure near the channel top.

Spot Gold

- Resistance: 4550/4582

- Support: 4411/4379

Spot Silver

- Resistance: 80.27/81.87

- Support: 71.71/70.11

Gold is consolidating above the $4,379–4,411 support zone, keeping the short-term uptrend intact, while upside is capped near $4,550–4,582 resistance. Direction hinges on U.S. NFP, as softer labor data supports Fed cut expectations, but Bloomberg index rebalancing and higher CME margins may limit near-term upside.

Dow Futures

- Resistance: 49772/50088

- Support: 48742/48431

The Dow Futures is consolidating after failing to extend above the 49,772–50,088 resistance zone, with momentum easing near record highs. Structurally, price remains supported above 48,742–48,431, preserving the broader uptrend. Defense stocks rebounded on Trump’s military budget proposal, though valuations and upcoming data cap risk appetite.

NAS100

- Resistance: 26179/26449

- Support: 25290/25016

The NAS100 pulled back after stalling below the 26,179–26,449 resistance zone, as profit-taking emerged in AI and mega-cap tech. Technically, the index remains supported above 25,290–25,016, keeping the rising channel intact. Long-term AI themes persist, but NFP uncertainty is lifting short-term volatility.

BTC

- Resistance: 92332/93571

- Support: 89605/88386

Bitcoin eased toward $90,000, pressured by geopolitical risks and cautious positioning ahead of U.S. payrolls. Technically, BTC remains capped below the $92,332–93,571 resistance zone, while $89,605–88,386 continues to cushion downside. MSCI’s decision on crypto treasury firms offered limited sentiment support, keeping BTC range-bound.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.