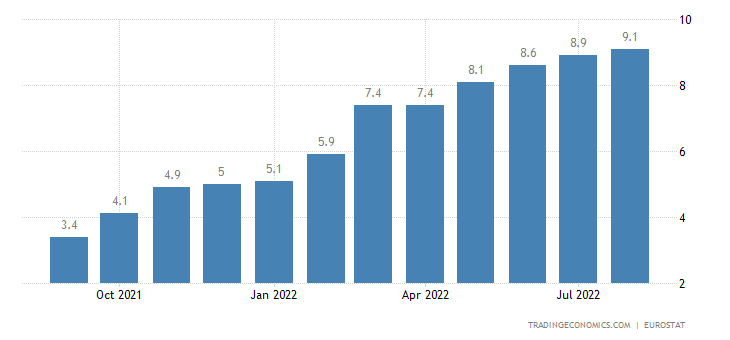

On August 31, the initial value of the euro zone’s CPI annual rate was released, which was much anticipated by the market. The previous value of the data was 8.9%, and the latest value was 9.1%, which was higher than the expected print of 9%. The previous core CPI value was 0.1%, and the announced value was 0.5%, which was also higher than market expectations. Inflation data in the eurozone continued to rise in August, but it is still uncertain whether eurozone inflation has peaked. With the advent of winter in Europe, the surge in energy and electricity costs may persist, and inflation in the euro area is at risk of hitting a new record high.

In August, inflation in the eurozone remained at a high level, which may also increase market bets on aggressive interest rate hikes by the European Central Bank next month. ECB official Martins Kazaks recently told the media that the authorities should discuss raising interest rates by 50 basis points on September 8, 2022, or 75 basis points and consider 50 basis points as the lower limit. A handful of ECB Governing Council members are willing to consider raising interest rates by 75 basis points.

Higher interest rates may benefit the euro, but the euro’s gains may be limited by concerns about an economic downturn and the risk of a recession. Since the beginning of August, the euro’s performance has been relatively sluggish, and many market analysts are not optimistic about the economic prospects of the euro area because of the winter season. In addition, Europe may face severe natural gas supply cuts, which may affect economic activity in the euro area, which could be a significant blow to the euro.

From a macroeconomic perspective, the eurozone economy is already challenging. The initial value of the euro zone’s composite PMI in August was 49.2, higher than the expected 49 but lower than the previous 49.9, marking a new 18-month low. Among them, the manufacturing industry and the initial value of the service PMIs both hit fresh record lows. There are signs of a slowdown in the overall eurozone economy, but it’s unclear whether such a contraction will be more profound. Coupled with the dependence of European countries on Gazprom, the panic associated with a “gas failure” may continue to permeate the European market throughout the winter season. Even if interest rates are raised sharply, the euro’s direction remains unclear.

Furthermore, EURUSD trends are closely related. Still, it can be seen that the euro’s rebound against the dollar was very short-lived and tiny in the past, indicating that the bears still have the upper hand in the tug of war between the bears and the bulls. From the hawkish stance of Powell’s speech at the Fed’s annual economic symposium, many expect the Fed to continue raising interest rates. However, Powell mentioned that if inflation shows signs of easing further, the Fed could slow rate hikes later in the year, a moment that may be far from today.

It is foreseeable that the US dollar will continue to trade at a high level amid the hope that the Fed will keep raising interest rates, which may put additional pressure on the euro, depending on the European Central Bank’s interest rate decision. If the ECB’s rate hike exceeds that of the Federal Reserve in September, it may give a short-term boost to the euro, but the magnitude of the move is expected to be relatively minimal. However, if the rising energy costs in Europe remain unresolved, the euro’s decline against the dollar may continue in the future.

European countries are also actively looking for ways to deal with the energy crisis. Norway recently said it plans to maintain natural gas production at its current high output levels up to 2030. The country accounts for 25% of Europe’s natural gas supply, while some European officials are preparing to significantly reform electricity pricing on the continent. To provide some relief to consumers ahead of the winter season, Canada and Germany are discussing the feasibility of sending LNG from Canada to Germany.

The market expects Europeans to start heating in the fall, and time is running out for Europe to stockpile energy reserves.