The Bank of England decided to announce the latest policy direction, and many market participants had been betting that the Bank of England would raise interest rates again at this meeting. In fact, on December 16, the Bank of England’s interest rate meeting announced that it would raise the benchmark interest rate from 0.1% to 0.25%, becoming the first major central bank to raise interest rates since the outbreak of the new crown pneumonia epidemic. Since the outbreak of the Russian-Ukrainian war, soaring energy prices have also caused inflation in the United Kingdom to exceed market expectations, increasing the possibility of another rate hike by the Bank of England.

Inflation skyrocketing

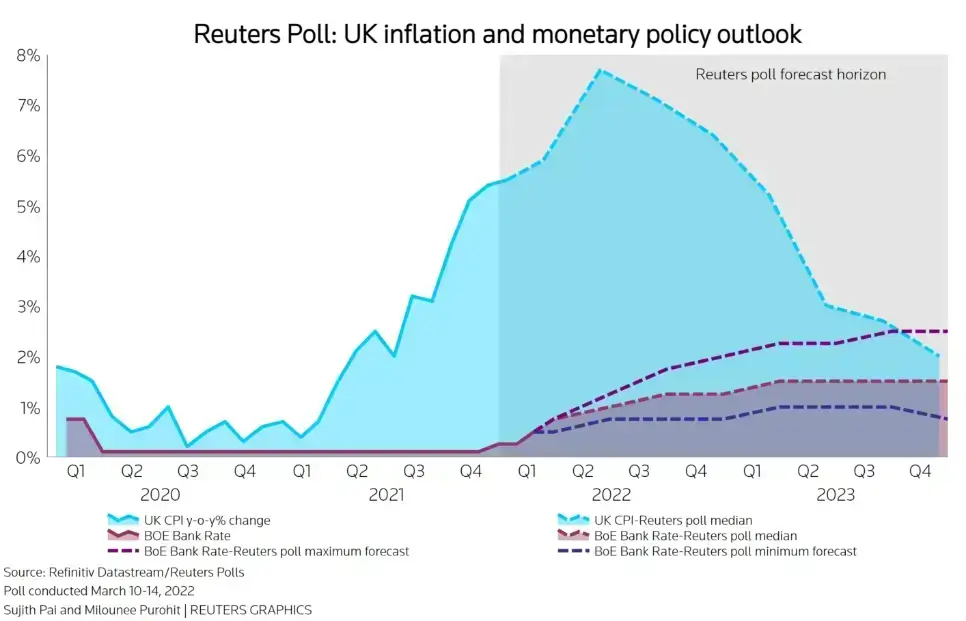

At a time when market news is focusing on the rising inflation rate in the United States, the inflation rate in the United Kingdom has also shown a straight upward trend. With the lifting of epidemic prevention restrictions, the UK economy is recovering rapidly. The UK’s consumer price index (CPI) rose to 5.5% year-on-year in January, hitting a 30-year high. up, well ahead of market expectations and the target’s 2% level. However, the market believes that the current inflation rate in the UK has not peaked.

In order to curb the soaring inflation rate, the Bank of England has raised interest rates by another 25 basis points to 0.5% on February 3. Will there be a third rate hike in tonight’s meeting? Nearly two-thirds of respondents in a Reuters poll from Feb. 7-11 expected the Bank of England to raise rates by 25 basis points to 0.75% at its meeting tonight. If the forecast comes true, it would be the first time since 1997 that the Bank of England has raised interest rates three times in a row.

At its February meeting, four members of the Bank of England’s monetary policy committee favored raising the bank rate by 0.5 percentage points, directly to 0.75%. Therefore, there are also traders who expect a 50% chance that the meeting will decide to raise interest rates by 50 basis points, but this is a policy that the Bank of England has never implemented.

With the rate hike comes more tightening, with the Bank of England already planning to scale back its 895 billion pounds bond-buying program when it first raised rates, although it kept the size of bond purchases unchanged at the time. The market is already bracing for a reversal of the Bank of England’s bond-purchasing program and expects the Bank of England to start shrinking its balance sheet as early as March, so the pace and timing of the reduction will also be another focus of tonight’s meeting.

Increased probability of another rate hike

After the outbreak of the Russian-Ukrainian war, energy prices in the UK rose sharply, adding to the current level of inflation. Consumer price inflation will hit a high level of around 7.25% in April, according to the Bank of England think tank, which predicts that household energy tariffs will more than halve from the pre-crisis period in Ukraine. Therefore, it is expected that the pace of interest rate hikes by the Bank of England will not stop. Some market participants expect the Bank of England to raise interest rates by a total of 75 basis points at the March and May meetings and raise interest rates 2 to 4 times in 2022.

(Source: Reuters forecasts for UK inflation and monetary policy)

From the perspective of economic growth, the UK’s economic recovery is better than market expectations. The UK’s GDP in January increased by 0.8% month-on-month, significantly exceeding market expectations of 0.1% and the previous value of -0.2%; GDP increased by 10% year-on-year, higher than the expected 9.3% and the previous value of 6%. The market demand in the UK may be further released, promoting a comprehensive recovery of various industries.

In the three months to January, the UK unemployment rate fell to 3.9%, the lowest level since the start of 2020. A shortage of labor means exacerbating shortages of goods, adding to upside risks to inflation, which could also accelerate the Bank of England’s rate hike to 2% this year. Therefore, the UK unemployment rate data has also become an important data for the recent market attention.

The Sterling has maintained a bullish trend since the Bank of England raised interest rates, which is conducive to supporting the GBP/EUR and other currencies pair, but with the Federal Reserve also starting to raise interest rates, the gains against the dollar may be limited.