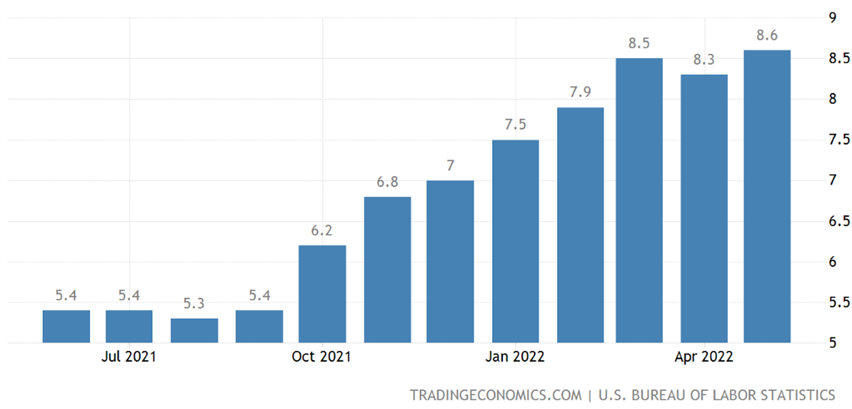

Critical economic data from the United States about its June unseasonal CPI will be revealed soon. The previous figure was 8.60%, and the June data is expected to rise to 8.8%. White House press secretary Ka Jean-Pierre had warned that the June US Consumer Price Index (CPI) would “rise sharply” as gasoline and food prices skyrocketed.

Inflation is expected to continue soaring, supporting the Fed’s decision to keep raising interest rates. If the Fed becomes more hawkish, the possibility of a 75 basis point rate hike at the Fed meeting scheduled for later this month is likely, allowing the dollar to strengthen afterwards.

The possibility of an aggressive interest rate hike by the Federal Reserve this month is pretty significant, which will continue to support the US dollar’s upward momentum in the short term. As a result, the price of gold is under pressure. According to the CME FedWatch, the probability of a 50 basis point hike this July is 17.4%, and the likelihood of a 75 basis point hike is 82.6%.

Earlier, Fed Governor Michelle Bowman, Chicago Fed President Evans Charles Evans, Fed Governor Christopher Waller, Minneapolis Fed President Neel Kashkari, and San Francisco Fed President Mary Daly all expressed support for another 75 basis point rate hike in July to curb inflation. And the Fed’s “dot plot” released last month showed that by the end of the year, the Fed’s benchmark interest rate would rise from the current target range of 1.5% to 1.75% to 3.4%.

Market participants believe that US CPI will remain above the 8% level for four consecutive months from June to September, so the impact of high inflation on the US economy will continue. In addition, the US retail sales in May were 0.30% lower than the expected growth of 0.2%, mainly due to the sharp decline in auto sales and the impact of high auto prices. The unexpected drop in retail sales worried the market about the impact of high inflation combined with high-interest rates leading to increased financing costs that could further drag down retail sales.

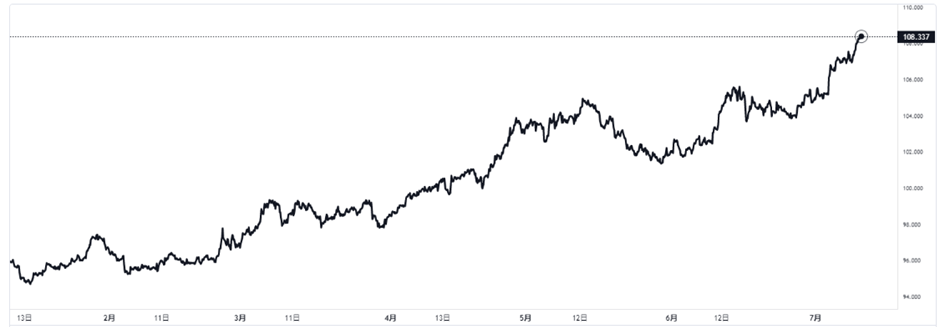

On the other hand, the US dollar has entered an upward channel. The dollar index broke through the 108 mark with a high of 108.2, an increase of over 1.2%, hitting a new high last seen in June 2002, and is still rising. The dollar is expected to maintain its upward trend before the Fed meeting, or there will be increased volatility. The bulls will have an advantage in the short term.

Over the medium and long term, the follow-up trend of the US dollar also depends on the Fed’s final decision to raise interest rates and its guidance on the subsequent interest rate hike arrangements. If the Fed continues to express its determination to curb inflation, it is expected that the situation of the rising dollar will fluctuate until inflation starts to fall steadily. But, of course, it also depends on when the inflation data turns lower and whether the decline is pronounced. If there is a significant turning point, the dollar may reverse its bullish trend.

Furthermore, it is essential to note the possible negative impact of economic data on the US dollar, as the US non-farm payrolls increased by 372,000 in June, which was better than market expectations. The data temporarily eased the market’s fears that the US economy would fall into recession and increased the forecast of aggressive interest rate hikes from the Fed. However, Goldman Sachs argues that the labour market is undoubtedly still slowing down and that more data needs to be released to reflect the actual performance of the job market.

The United States is set to release the June retail sales data this week. Investors must also pay close attention to the high inflation, sharp interest rate hikes, and future consumer confidence changes. If the downward trend continues, I am afraid retail sector stocks will bear the biggest impact.