Investment bank Goldman Sachs said it does not believe the Fed will change its policy on higher oil prices.

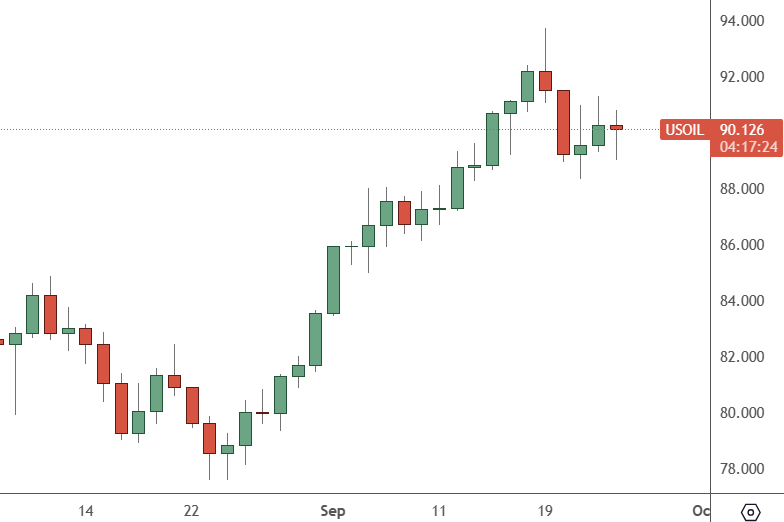

USOIL: Daily Chart

Oil prices dipped last week but remain elevated above the $90 level.

The jump in prices at the pump, which could worsen a recession threat, may take half a percentage point off consumption growth during the next two quarters but is a manageable headwind, according to Goldman Sachs.

Although consumption is expected to slow into the year-end, Goldman analyst Spencer Hill sees three reasons why higher oil prices are unlikely to cause consumer spending or growth to decline.

He added that the last of the three reasons would be key for the Federal Reserve. “Chair Powell reminded us at the September press conference that the Fed tends not to react to energy price shocks,” he said in a research note.

During the conference, Powell said higher energy prices were “significant” and that “it comes down to how sustained high energy prices are.” He added that “energy prices don’t have that much of a signal about where the economy is going.”

“We do not expect the recent oil move to de-anchor inflation expectations and, in turn, force a policy response.”

The size of the price increase is small; the effects on growth should be partially offset by higher energy-sector CAPEX in addition to lower electricity prices, and higher prices would not lead to further tightening from the Fed, according to the analyst.

Energy accounts for only 4.0% of consumption as of July, and gasoline is 2.3% of that. Despite a $20 jump in crude prices since June, it is less than half the increases in the first six months of 2008 and 2022. The investment bank also thinks most of the gains in gasoline prices have already occurred.

The economy will grow further due to a smaller-than-usual one-tenth percentage point increase in CAPEX over the next year, and a 1% drop in seasonally adjusted electricity prices should also boost consumers in that period.

Jack Janasiewicz, portfolio strategist at Natixis, thinks oil is more of a headwind.

The rapid rise to $100 per barrel could spell trouble for risky assets, he said in comments, stating that oil is one of the key economic risks demanding close attention.