Market Highlight 29/01/2026

The Federal Reserve kept interest rates unchanged, with Chair Jerome Powell noting that risks to both inflation and employment have eased. Following the decision, traders increased bets that the Fed could begin cutting rates in June. Interest rate futures suggest a 28% probability of a rate cut as early as April. The Dow Jones edged up 0.03%, the S&P 500 slipped slightly, while the Nasdaq rose 0.17%.

After several days of declines, the U.S. dollar rebounded following the Fed’s decision, gaining 0.5%, as the latest policy statement offered little guidance on when borrowing costs might start to fall again. The euro weakened to 1.1916 against the dollar, down 0.7%.

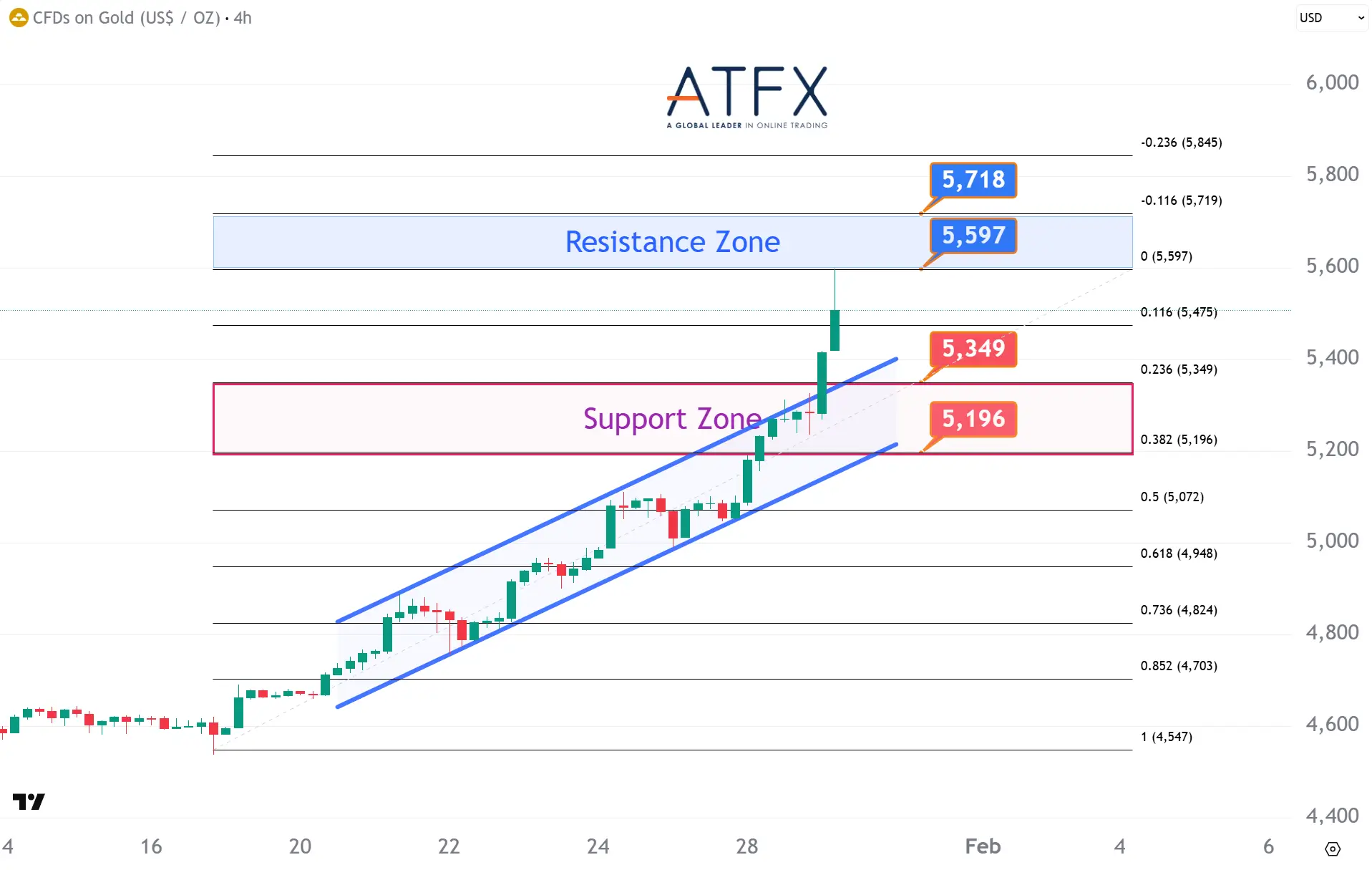

Gold prices surged sharply, breaking above $5,400 per ounce for the first time and extending gains above $5,600 early this morning. The strong rally seen so far this month shows no signs of slowing, driven by rising economic and geopolitical uncertainty that continues to fuel demand for safe-haven assets. Spot gold jumped more than 4% to settle at $5,399.29 per ounce.

International oil prices climbed to their highest levels since late September last year, supported by escalating concerns over the situation in Iran, while a weaker U.S. dollar also provided additional tailwinds.

Key Outlook 29/01/2026

Markets continue to digest the Federal Reserve’s policy decision alongside earnings reports from major technology companies. U.S. equities remain focused on Apple’s results, as the reporting quarter includes a seasonally strong consumption period, raising expectations that revenue could reach a record high. Services revenue is also expected to maintain double-digit growth. Apple’s performance is likely to remain a key driver of broader technology stocks. Investors will also watch U.S. initial jobless claims, expected to come in at 205,000 (previously 200,000). In addition, November factory orders are forecast to rebound with a monthly increase of 1.6%, reversing the prior decline of -1.3%.

Key Data and Events Today:

- 18:00 EU Economic Sentiment JAN **

- 21:30 US Initial Jobless Claims ***

- 21:30 US Balance of Trade NOV **

- 23:00 US Factory Orders NOV**

Tomorrow:

- 07:30 JP Unemployment Rate DEC **

- 08:30 AU Q4 PPI **

- 16:55 EU GERMANY Unemployment Rate DEC **

- 17:00 EU GERMANY GDP QoQ Flash Q4 ***

- 18:00 EU GDP Q4 YoY Prel ***

- 21:00 EU GERMANY CPI Prel JAN **

- 21:30 US PPI YoY DEC ***

- 21:30 CA GDP MoM NOV **

Markets Analysis 29/01/2026

- Resistance: 1.2058/1.2086

- Support: 1.1945/1.1918

EURUSD pulled back after briefly breaking above 1.20, as the Dollar rebounded following the Fed’s steady-rate decision and renewed “strong dollar” rhetoric from U.S. officials. Technically, the pair stalled near major resistance at 1.2058–1.2086, with upside momentum cooling. Near-term direction hinges on the ECB’s reaction to Euro strength and evolving U.S. policy risks.

- Resistance: 1.3879/1.3905

- Support: 1.3759/1.3733

GBPUSD eased from four-month highs, trading around 1.3750, as the dollar regained traction after the Fed held rates steady. With no fresh UK catalysts, Sterling remained externally driven. Technically, price is consolidating below the 1.3879–1.3905 resistance zone following a sharp breakout, suggesting a pause in momentum rather than a reversal.

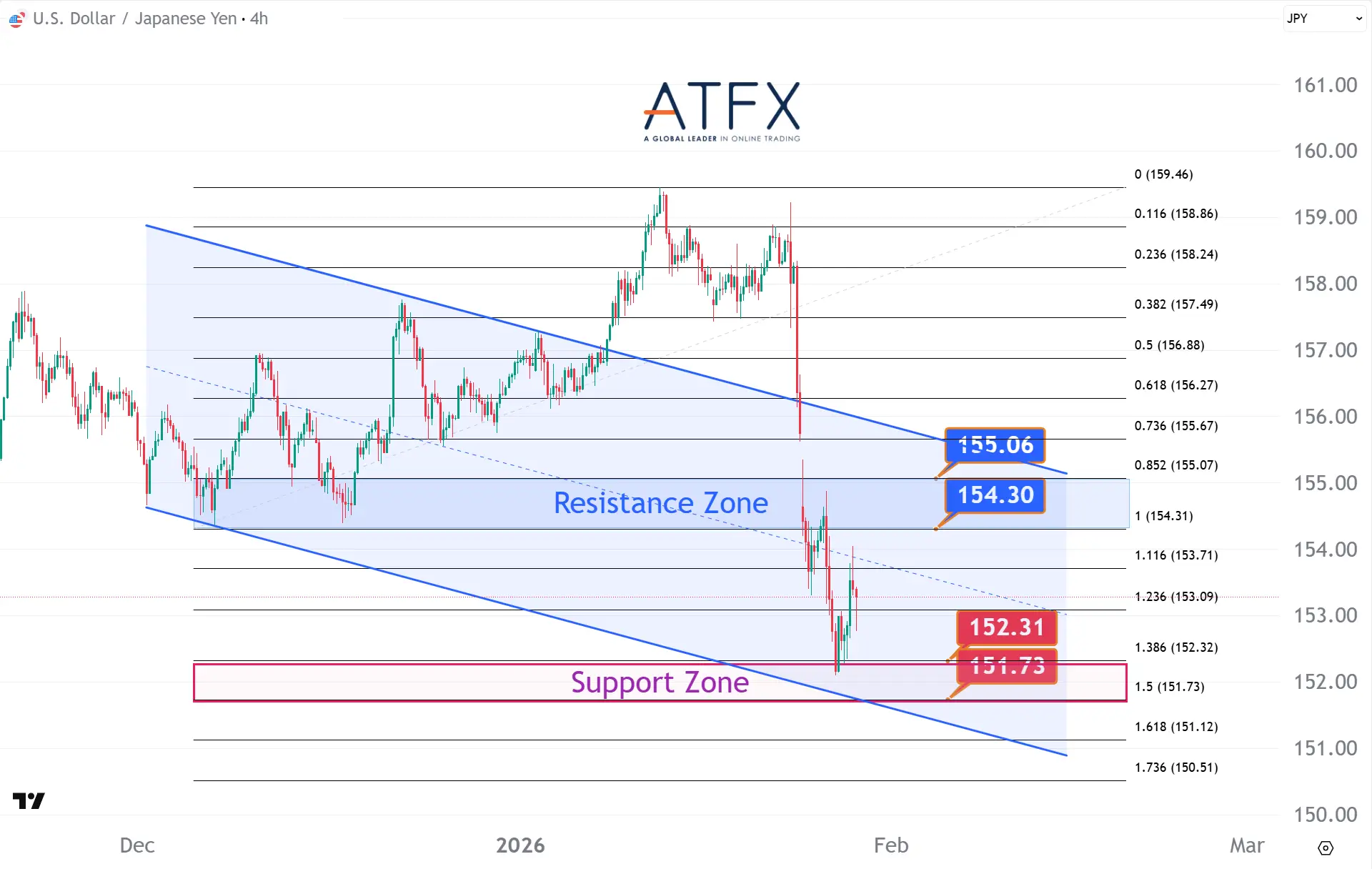

- Resistance: 154.30/155.06

- Support: 152.31/151.73

USDJPY rebounded towards 154.00 as renewed dollar strength offset lingering concerns about Japanese intervention. Firm U.S. policy signals eased immediate pressure for coordinated FX action. Technically, the pair bounced from the 151.73–152.31 support zone but remains capped below 155.06, keeping upside cautious and headline-driven.

- Resistance: 64.11/64.53

- Support: 63.15/62.72

WTI climbed towards $63.50, reaching four-month highs as Middle East tensions intensified and U.S. supply faced winter-storm disruptions. Falling inventories further strengthened bullish fundamentals. Technically, price remains supported above the rising channel near $62.72, with $64.11–64.53 marking the next key resistance zone.

- Resistance: 5597/5719

- Support: 5349/5196

- Resistance: 123.38/129.08

- Support: 112.35/106.64

Gold surged towards $5,500, extending a self-reinforcing rally as geopolitical risks and economic uncertainty fueled intense safe-haven demand. The Fed decision was largely ignored, underscoring momentum-driven buying. Technically, prices remain overbought but firmly supported above $5,196, with resistance near $5,597–5,719.

- Resistance: 49480/49789

- Support: 48436/48036

The Dow Futures hovered near 49,000, edging higher as the Fed’s steady policy stance underpinned risk sentiment, though mixed earnings capped gains. Technically, the index consolidates within an ascending channel, holding above the 48,036 support level. Upside remains selective, with resistance near 49,480 – 49,789.

- Resistance: 26269/26403

- Support: 25817/25644

The NAS100 traded near 25,800, modestly outperforming as chipmakers and selective AI optimism provided support. Gains were capped ahead of major tech earnings, keeping sentiment cautious. Technically, the index rebounded from support at 25,644 but remains below resistance at 26,269–26,403, pointing to a range-bound trade.

- Resistance: 91195/92789

- Support: 86439/84440

Bitcoin slipped back below $90,000, trading near $88,000, after the Fed held rates steady. The dollar stabilised while gold rallied. Near-term sentiment remains cautious despite longer-term hopes for rate cuts. Technically, BTC failed to hold above $90K, leaving downside risks towards $86,439–84,440 support.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.