The EURUSD exchange rate continued its descent after a surprise rate hike by the European Central Bank was met by a surprise inflation beat in the US.

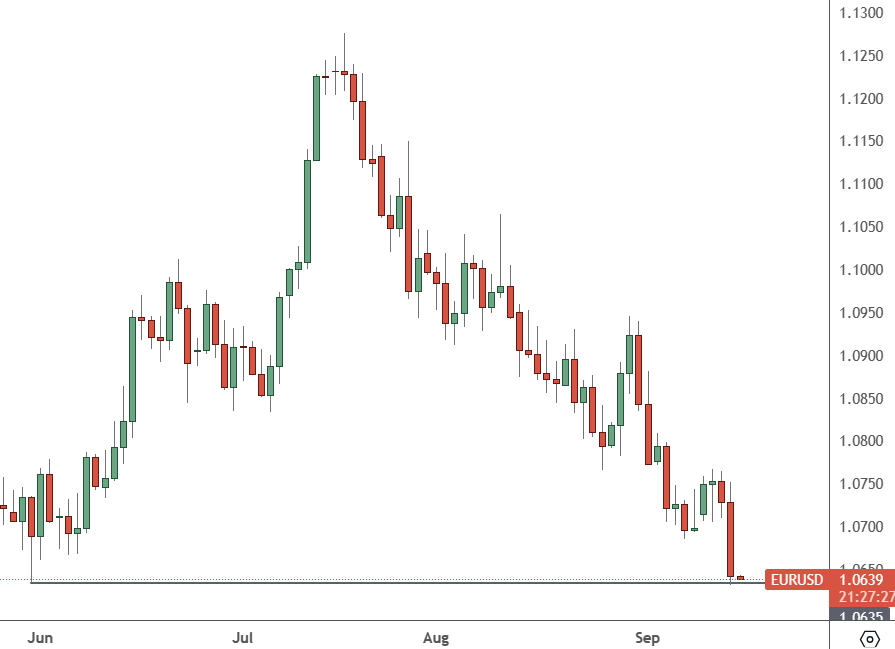

EURUSD: Daily Chart

The EURUSD showed signs of strength around the 1.080 level but has since crumbled back to test the 1.064 level from June. The euro bulls will be feeling the pressure at this level.

Despite some inflationary pressures, analysts had expected a pause from the ECB due to a recent downgrade of the economy. The central bank noted the recession in Germany, the eurozone’s largest economy, as a factor in the downgrade.

But policymakers made their fourteenth hike in 14 months and avoided fears of stagflation and worries about recession. However, the ECB signalled that the most recent hike was likely to be the last.

On the same day, the US PPI rose higher than expected. The producer price index is a measure of the input prices going into businesses, and that means the Federal Reserve may not be done with rate hikes.

Traders jumped on that and pushed the US dollar aggressively higher as inflation has been higher than the Fed’s 2% target for more than a year, with markets fearing further rate hikes.

The US PPI in August was up by 0.7%, with 80% of the gain due to a 2% spike in final demand goods, which was driven by a 20% surge in oil prices. That will be a problem in the coming months as oil prices continue to push higher, moving above $90 on Thursday.

Nathan Casey at Evelyn Partners in the UK said:

“August’s inflation report in the US saw the headline rate up 0.6%, its highest rate since June 2022. Much of this upward pricing pressure came from energy, with the monthly inflation rate for the sector accelerating to 5.6 percent.

“A significant driving factor in this was the recent surge in crude oil, which prompted gasoline prices at the pump to rise during August.”

US stocks were able to mount a rally, but the US dollar also crushed its rival major currencies as traders realised the data was not helpful to the Fed’s inflation rate.