EV giant Tesla (NAS100:TSLA) releases earnings on Wednesday after the U.S. market closes and will likely be volatile into the weekend.

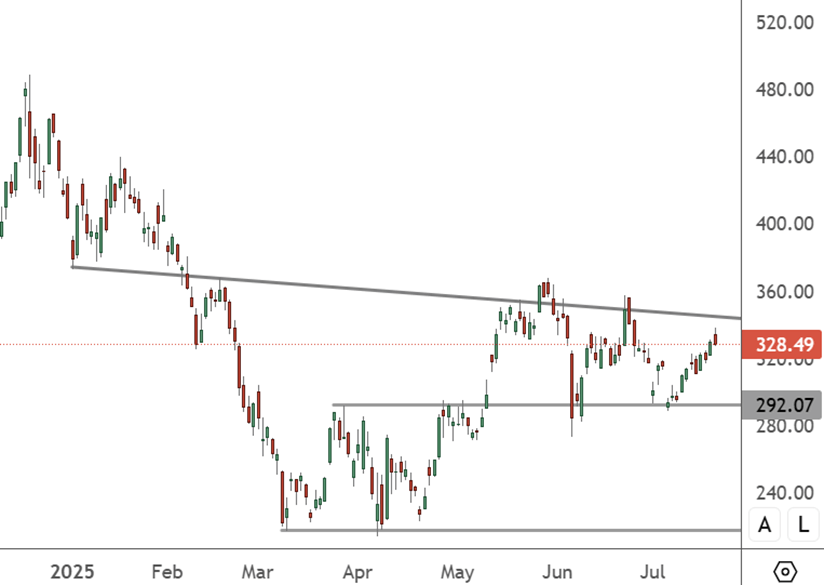

TSLA – Daily Chart

The price of TSLA is still above the $292 support, and now the price needs a catalyst to vault the resistance around the $350 level.

Elon Musk has said he is back to working a seven-day week at Tesla, in a move that will please his critics. Musk said on X that he had shifted his stance toward artificial intelligence. After “living in denial,” about the technology for too long, Elon Musk wrote: “I resisted AI for too long. Living in denial. Now it is game on”.

The statement could mean that Musk moves forward with his plans to create AI-related revenue streams. His plan to create robotic assistants for factories could also be an option.

While Tesla stock has struggled over recent months, fellow ‘Magnificent 7’ stocks are trading at record highs or seeing stronger gains in 2025. That could be an opportunity for Musk to leverage his reputation on this quarter’s earnings call.

Ahead of the earnings, Tesla has opened a Diner in Los Angeles, linked to a supercharger station. The restaurant is something that Musk said he would create years ago, and his Optimus robot is serving customers, while diners can order food from their Tesla touchscreen and watch drive-in movies, synced to the car’s sound system.

Ahead of the company’s Q2 earnings, analysts have been lowering quarterly profit expectations after global vehicle sales declined by more than 13% in Q2. European sales were particularly hard hit, and competition in China is affecting a significant market for the company.

On Monday, Bank of America raised its price target on TSLA to $341 from $305, but noted that Q2 earnings are “likely to be challenged due to tariffs” and “disappointing deliveries”.

However, there was the start of robotaxi ride-hailing services in Austin, Texas, which they said is promising for full self-driving by the end of 2025.

“It’s not as bad as you think,” said Piper Sandler’s Alex Potter this week. “We frequently receive questions about Tesla’s regulatory credits, and for good reason: the company received $3.5 billion in ‘free money’ last year, representing roughly 100% of the FY24 free cash flow,” Potter wrote.

The analyst said it is “fair to ask” how regulatory changes could “threaten” Tesla’s earnings outlook in the coming quarters.