U.S. technology stocks continue to push higher as retail buyers chase winners and earnings season gets underway.

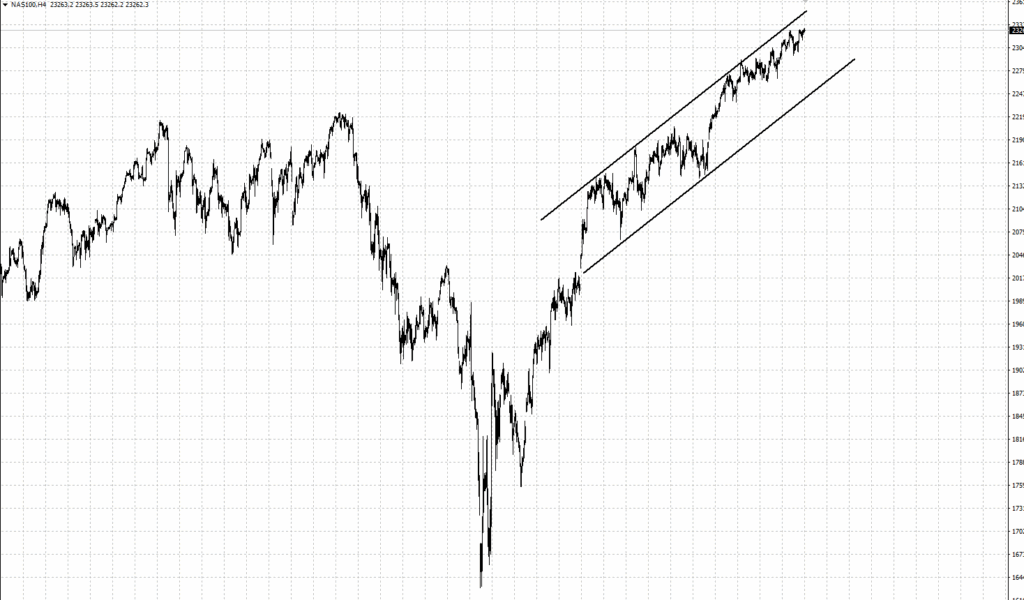

NAS 100 – 4H Chart

The NAS 100 has been following the uptrend line from May and continues to attract buyers. There is potential for another leg higher, but a correction could see price retreat toward the 22,000 level.

Retail investor activity has been surging in the U.S. and was a key driver of the rebound from the April lows. That interest is now sparking another bout ‘meme stock’ mania with penny stocks seeing sharp gains.

Social media platforms drove investor interest into Opendoor Technologies Inc. but has now grown to discounted names like Kohl’s, GoPro, and Krispy Kreme Inc.

“A lot of times with meme stocks in general, what the business does is much less important than who’s backing the stock,” said Max Gokhman at Franklin Templeton. “Influencers are commanding these followings. You may have this one person posting on TikTok about a stock they like, and then there’s 100,000 or more investors who are putting money behind it”.

According to Citadel, retail traders have been net buyers of cash equities for the past 19 straight trading sessions, which marks the longest streak since the 2021 meme stock craze that drove up the price of stocks like GameStop and AMC.

Similar to those plays, investors are seeking out heavily-shorted stocks in the hope that sellers will cash out.

Tech earnings got off to a mixed start with Google impressing investors, but IBM and Tesla stumbling.

Google was able to show strength in its search business after analysts had been concerned about AI competition. Revenue growth for the Search arm beat analysts’ expectations at 11.7%. Paid click growth was also higher from 2% in Q1 to 4% in Q2. Alphabet still trades at the lowest earnings metric of all ‘Magnificent Seven’ companies, and investors are looking for this to improve over the coming quarters.

It was a tough day for Tesla, with the stock down around 8% during the U.S. session. The earnings came in near expectations, but analysts weren’t happy with the earnings call, where Elon Musk once again gave a vague long-term plan for the company.

The EV company’s founder also said that U.S. government cuts to subsidies could mean a “few rough quarters” ahead before its self-driving software and services increase next year.

The Nasdaq 100 is continuing to climb higher and will do so unless there are negative news headlines that could spark a correction.