The EURUSD has European and U.S. economic data ahead in the form of the PMI for manufacturing and services.

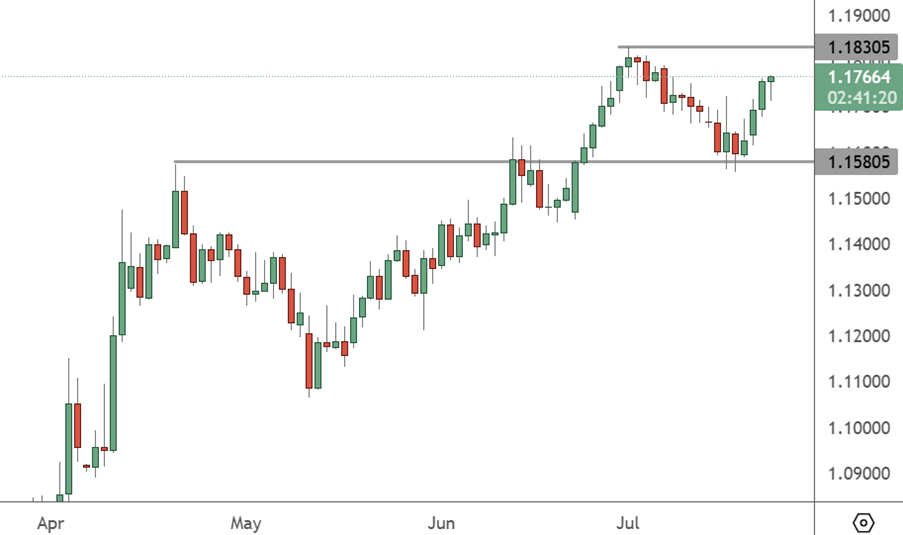

EURUSD – Daily Chart

The EUR/USD live chart indicates that it is currently testing the overhead resistance after finding support at the 1.15805 level. The 1.18305 barrier will be key to the next trend in the pair.

The widely watched PMI data is released at 3:30 pm HKT for the German economy and at 16:00 for the European data. The HCOB PMI for manufacturing has the German economy looking to hit 49.4 after last month’s 49.0. Any upside surprise could boost the euro.

The number is expected to reach 50, which marks the threshold between expansion and contraction. A move above 50 would be positive. Europe’s version is predicted to be 49.8 for manufacturing and 50.8 for the services figure.

The data comes at a key time for the euro as the European Central Bank is on course to hold interest rates steady for the first time in almost a year this week. The 26 members of the ECB’s governing council will meet a week ahead of an August 1 tariff deadline set by U.S. President Donald Trump.

Trump has threatened to raise the basic tariff on imports from the EU to 30% from 10% if policymakers in Brussels fail to sign a deal by the end of the month.

Ahead of the talks, the U.S. and Japan have agreed on a deal that may speed up the European efforts. Under the terms of the agreement, Japanese goods will face a 15% tariff, instead of the previously proposed 24%.

The U.S. has its own PMI data released overnight, and that comes an hour after the ECB’s press conference at the later than normal time of 8:45 pm HKT.

The EUR vs USD will likely have a clear trend from Friday into the weekend, and that will set the pair up for the August 1 deadline for tariffs.