The Australian stock market has been boosted by the recent news that China is building a huge energy project.

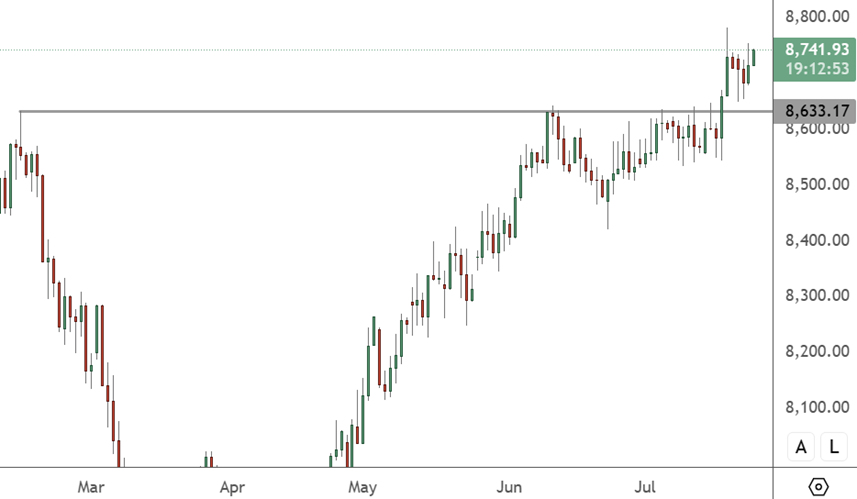

AUS200 – Daily Chart

The AUS200 index has found support above the February highs and is using that as a base to move higher.

China’s leaders are building the world’s largest hydroelectric dam, hoping it will create a massive stimulus for the struggling economy and boost clean power. Chinese Premier Li Qiang announced on Monday that building has now started on the 1.2 trillion yuan ($256 billion) dam on the Tibetan Plateau.

“From an investment perspective, mature hydropower projects offer bond-like dividends,” said Wang Zhuo, partner of Shanghai Zhuozhu Investment Management.

The new project is expected to drive demand for construction and building materials, including cement and civil explosives, according to Huatai Securities. Domestic stocks have already seen gains on the news.

Shares of Hunan Wuxin Tunnel Intelligent Equipment jumped 30%, alongside those of Geokang Technologies, which manufactures intelligent monitoring terminals. Cement maker Xizang Tianlu and Tibet GaoZheng Explosive Co. also added 10%.

The development also boosted demand for Australian mining stocks as iron ore prices had already been rising on expectations for further China stimulus.

“Assuming 10 years of construction, the investment/GDP boost could reach 120 billion yuan ($16.7 billion) for a single year,” said Citigroup. “The actual economic benefits could go beyond that”.

That adds a long-term demand structure for Australian commodity producers and is seen as a sign that the Chinese Government is starting a new phase of economic stimulus.

A $10 per ton increase in the most commonly traded form of iron ore to $100/t has added 23% to the stock price of Australian mining stock Fortescue in recent weeks.

The latest China development and hopes for continued stimulus could continue to see investment flows into Australian mining stocks and the broader market.