Market Highlight 15/12/2025

U.S. stocks fell sharply on Friday, with the S&P 500 and Nasdaq both dropping over 1% as investors rotated out of tech amid renewed AI-bubble fears triggered by weak outlooks from Broadcom and Oracle. Rising Treasury yields added further pressure. For the week, the Nasdaq and S&P 500 declined 1.62% and 0.63%, while the Dow gained 1.05%. The U.S. dollar rebounded modestly after several sessions of losses, though the Dollar Index still posted its third straight weekly decline—up 0.1% on the day to 98.44 but down 0.6% for the week. Both the British pound and the euro strengthened for a third consecutive week.

Gold rose to a seven-week high on Friday, while silver retreated more than 2% after profit-taking following a fresh record peak. Spot silver fell 2.45% to $62.01 after hitting $64.65; spot gold gained 0.45% to $4,302.13 after touching its highest level since October 21. Oil prices also fell, with WTI down for the day and sliding 4% on the week, as oversupply concerns and potential Russia–Ukraine peace progress outweighed worries about a U.S. seizure of a Venezuelan oil tanker.

Key Outlook 15/12/2025

This week marks the final “super week” of the year, with markets watching major catalysts including U.S. nonfarm payrolls, inflation data, and rate decisions from the ECB, the Bank of England, and the Bank of Japan. These events will be pivotal in shaping policy expectations heading into 2026. Monday’s data is more dispersed, with Eurozone industrial production expected to show modest improvement. Canada’s November CPI is likely to stay above 2%, reinforcing expectations that the Bank of Canada will keep rates on hold. In the U.S., the December New York Fed manufacturing index—after two months of gains—is expected to weaken again.

Key Data and Events Today:

- 18:00 EU Industrial Production OCT **

- 21:30 CA CPI NOV **

- 21:30 US NY Empire State Manufacturing Index DEC **

Tomorrow:

- 06:00 AU Manufacturing & Services PMI Flash DEC **

- 08:30 JP Manufacturing & Services PMI Flash DEC **

- 15:00 GB Unemployment Rate OCT **

- 16:30 EU GERMANY Manufacturing & Services PMI Flash DEC **

- 17:00 EU Manufacturing & Services PMI Flash DEC **

- 17:30 GB Manufacturing & Services PMI Flash DEC **

- 18:00 EU Economic Sentiment DEC **

- 18:00 EU Balance of Trade OCT**

- 21:30 US Non-Farm Payrolls NOV ***

- 22:45 US Manufacturing & Services PMI Flash DEC **

Markets Analysis 15/12/2025

EURUSD

- Resistance: 1.1778/1.1797

- Support: 1.1695/1.1675

The Dollar stays soft as markets continue pricing further Fed easing in 2026, keeping EUR/USD supported. Technically, the pair is consolidating near the upper channel and holding above the 1.1695–1.1675 support zone keeps upside bias toward 1.1778–1.1797. Weak NFP or CPI this week could reinforce Euro momentum.

GBPUSD

- Resistance: 1.3455/1.3509

- Support: 1.3317/1.3275

Weak UK GDP has increased expectations for a BoE rate cut, pressuring the Pound, though a soft US Dollar helps cushion downside. Technically, GBP/USD remains within an ascending channel, with 1.3317–1.3275 acting as key support. Holding this zone keeps the door open for another push toward the 1.3455–1.3509 resistance area.

USDJPY

- Resistance: 156.54/156.97

- Support: 155.18/154.75

The Dollar stays soft while rising expectations of a BoJ hike to keep the Yen supported, though higher US yields are limiting downside momentum. Technically, USD/JPY continues to struggle beneath the channel’s upper boundary, with 156.54–156.97 acting as firm resistance. Failure to break higher may drag the pair back toward the 155.18–154.75 support zone.

US Crude Oil Futures (JAN)

- Resistance: 58.39/58.79

- Support: 57.09/56.69

WTI stays pressured as the IEA’s outlook points to a substantial 2026 supply surplus, while rising momentum in peace talks reduces the geopolitical premium. Price action hovers near the lower channel boundary, and a break below the 57.09–56.69 support zone could trigger further downside. Any stabilization requires reclaiming the 58.39–58.79 resistance band.

Spot Gold

- Resistance: 4369/4398

- Support: 4274/4245

Spot Silver

- Resistance: 63.18/64.21

- Support: 58.78/57.77

Gold surged after breaking out of its ascending channel, though momentum is easing slightly, suggesting a potential pullback toward the 4274–4245 support band. Holding this zone could reignite upside toward the 4369–4398 resistance area, while slipping back inside the channel would soften the bullish structure.

Dow Futures

- Resistance: 49068/49473

- Support: 48032/47719

The Dow pulled back after testing the resistance, slipping into a high-level consolidation as momentum cools. Holding above the 48,032–47,719 support zone keeps the door open for another push toward the 49,068–49,473 resistance area; losing this support would weaken the bullish structure and push prices lower.

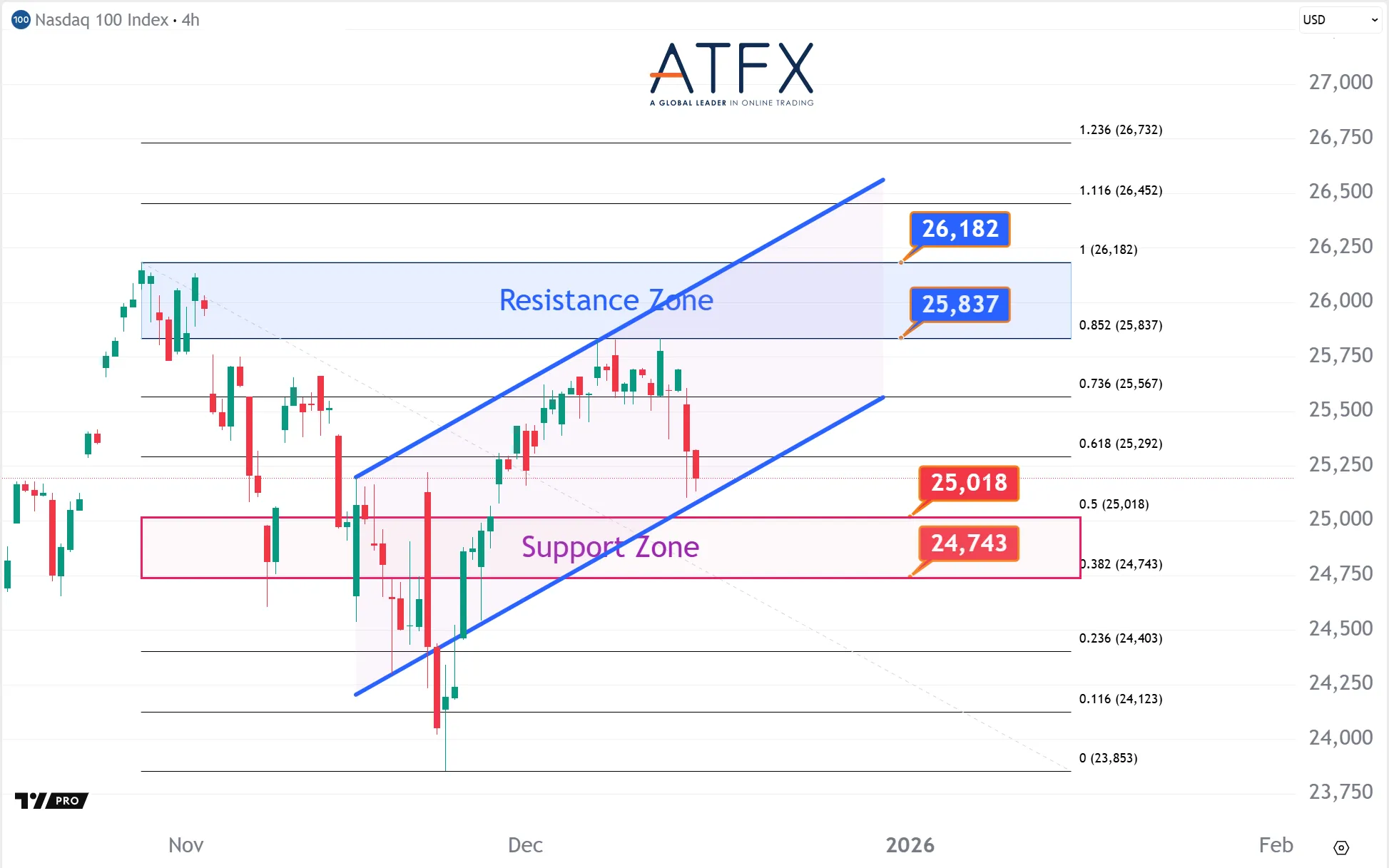

NAS100

- Resistance: 25837/26182

- Support: 25018/24743

The NAS100 slipped toward the lower support as tech weakness deepened, keeping short-term bias tilted downward. Holding the 25,018–24,743 support zone could trigger a corrective rebound, while a breakdown below this area may open the door to deeper Fibonacci retracements and a weaker structure overall.

BTC

- Resistance: 90507/92088

- Support: 86673/85417

Bitcoin remains bound as the Fed’s cautious tone limits appetite for risk, despite mild ETF inflows and fresh institutional accumulation. Technically, BTC is sliding within a descending channel, with 90,507–92,088 acting as key resistance. Failure to reclaim this zone could send price back toward the 86,673–85,417 support area.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.