EURAUD has seen recent weakness, which could continue due to fears of a European recession.

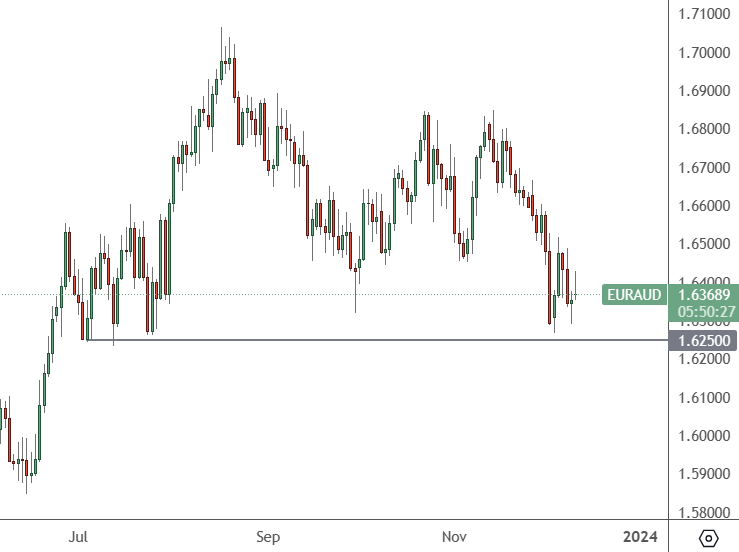

EURAUD – Daily Chart

EURAUD trades at 1.6370 after a recent slump and can test support near the 1.6250 level.

Economic data starts on Tuesday at 6pm HKT with Germany and Europe’s ZEW economic sentiment index. Last month’s European number was 13.8 and may slow again. Germany is expected to see a dip from 9.8 to 8.8. However, the index was 28 in February as economists are gloomy about the outlook.

The next release will be Australian GDP figures on Thursday at 8:30 HKT. The unemployment rate is expected to tick higher to 3.8%, with only 11k new jobs added. The Aussie jobs market has been slowing, and that was confirmed again with a 4.6% drop in new job advertisements for November.

Data from the employment website Indeed said the drop was the fastest since August 2021. Ads were down 16.8% from a year before but remained 36.7% higher than pre-Covid levels.

“The decline in job opportunities highlights that the labour market is cooling, and points to a further lift in the unemployment rate,” said ANZ economist Madeline Dunk.

“We expect the number of job ads to moderate as the impacts of this tightening cycle continue to show up in the labour market.”

In Europe, the region is expected to see its first recession since the pandemic. According to Bloomberg, the economy will likely shrink for a second straight quarter in the year’s final months.

The 0.1% contraction predicted between September and December compares with the previous survey’s projection for output to remain unchanged. A mild recovery is seen at the start of 2024.

“We doubt that we’re at the start of an upswing,” said Joerg Angele, an economist at Bantleon. “Headwinds remain strong, especially the ones stemming from the massive increase of interest rates.”

Germany is leading the decline as it struggles to see a rebound in its manufacturing industry. With a budget crisis and weak global demand, the country is expected to experience a 0.2% decline in the fourth quarter — more than the 0.1% initial projection.

Those trends should keep pressure on the EURAUD pair this week.