Market Highlight 25/11/2025

Federal Reserve Governor Christopher Waller said a rate cut in December would be appropriate, though he noted that action in January is more uncertain. U.S. equities closed higher on Monday, extending last Friday’s gains, as the rising likelihood of a December Fed rate cut helped investors look past concerns about overvalued tech stocks. The Dow Jones rose 0.44%, the S&P 500 gained 1.5%, and the Nasdaq jumped 2.69%. The U.S. Dollar Index weakened as investors digested dovish remarks from Fed officials, which boosted expectations of a rate cut next month and limited the dollar’s upside against major currencies.

Gold prices climbed more than 1%, supported by strengthening expectations of a Fed rate cut in December, while investors await fresh U.S. economic data for additional clues on monetary policy. Spot gold settled at $4,139.19 per ounce. Oil prices rose about 1% as markets bet on a potential December rate cut, while doubts intensified over whether Russia could reach a peace agreement with Ukraine that would help restore its crude exports.

Key Outlook 25/11/2025

The primary focus tonight will be on U.S. data releases. September retail sales are expected to slow to 0.4% (previous: 0.6%), while September PPI year-on-year is projected to accelerate to 2.7% (previous: 2.6%). These indicators will continue to shape expectations for whether the Fed will cut rates in December. In the Eurozone, attention will shift to Germany’s final GDP reading, which is expected to remain at 0.3% year-on-year.

Key Data and Events Today:

- 15:00 EU GERMANY YoY Final Q3 **

- 21:30 US Retail Sales MoM SEP **

- 23:00 US CB Consumer Confidence NOV **

- 23:00 US Pending Home Sales MoM OCT **

- 23:00 US Richmond Fed Manufacturing Index NOV **

Tomorrow:

- 05:30 API Crude Oil Stock Change ***

- 08:30 AU CPI YoY OCT **

- 09:00 RBNZ Interest Rate Decision ***

- 21:30 US Durable Goods Orders MoM SEP **

- 21:30 US Initial Jobless Claims ***

- 23:30 EIA Crude Oil Stock Change **

Markets Analysis 25/11/2025

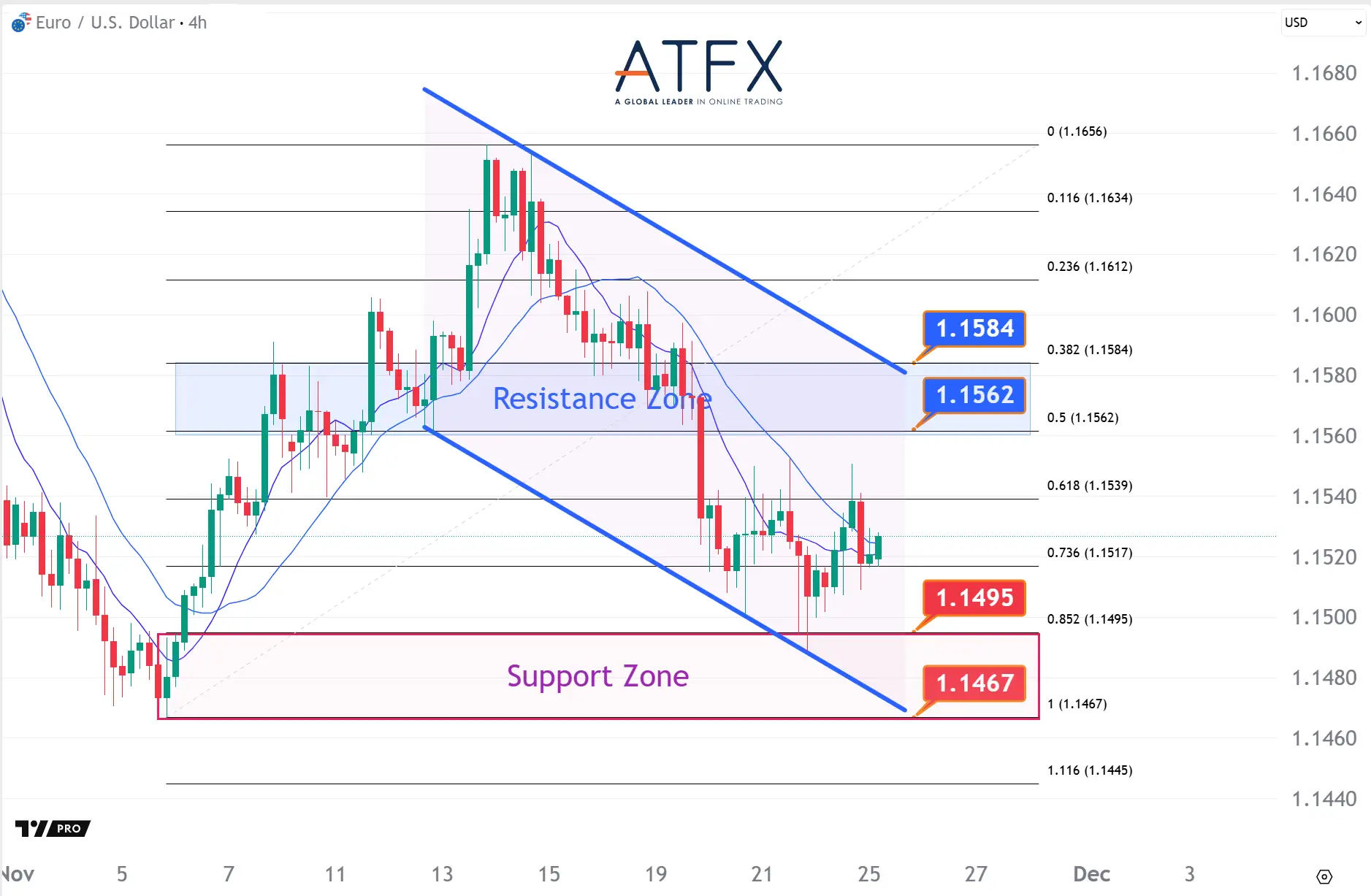

EURUSD

- Resistance: 1.1562/1.1584

- Support: 1.1495/1.1467

EUR/USD inched higher as the dollar softened on dovish Fed rhetoric, but persistent Eurozone weakness kept sentiment capped. The pair continues to struggle below the 1.1562–1.1584 resistance zone. Unless this ceiling is broken decisively, downside risks dominate, with price likely drifting back toward the 1.1495–1.1467 support region.

GBPUSD

- Resistance: 1.3168/1.3192

- Support: 1.3064/1.3040

GBP/USD inched higher ahead of the UK budget as softer USD tones offered brief support, but lingering UK growth worries kept upside limited. The pair continues to face resistance near 1.3168–1.3192, where repeated rejections have capped gains. Unless price breaks above this zone, the risk remains tilted lower toward 1.3064.

USDJPY

· Resistance 157.40/157.90

- Support: 156.26/155.76

USD/JPY rose even as the dollar softened, with traders staying alert for possible Japanese intervention around the 158–162 zone. Technically, the pair is consolidating above 156.25 support, and as long as this level holds, a retest of 157.40 resistance remains likely, though upside may struggle beyond there.

US Crude Oil Futures (JAN)

- Resistance: 59.52/59.85

- Support: 58.10/57.77

WTI climbed toward $59 as rising Fed cut expectations boosted risk sentiment, while doubts over whether a Russia-Ukraine peace deal can be smoothly reached kept supply risks on the radar and limited deeper losses. Technically, prices may retest to the 59.52–59.85 resistance band; if this zone continues to cap the upside, the pullback risk toward the $58.10 area remains.

Spot Gold

- Resistance: 4151/4180

- Support: 4093/4056

Spot Silver

- Resistance: 51.74/52.12

- Support: 50.54/50.17

Gold surged back above $4,100 as markets priced in an 85% probability of a December Fed rate cut, supported by softer U.S. labor data and dovish Fed remarks. Price is now testing the resistance near $4,151 level, and the chart structure shows a potential pullback before another attempt higher. A clean breakout could open the way toward $4,200, while $4,093 remains key support on the downside.

Dow Futures

- Resistance: 46946/47298

- Support: 46241/45894

The Dow futures rose 0.44% as stronger Fed rate-cut expectations boosted sentiment, though valuation worries persisted despite solid earnings. Price is still capped below the 46,946 resistance zone, and a failure to break higher may pull the index back toward the 45,894 support area.

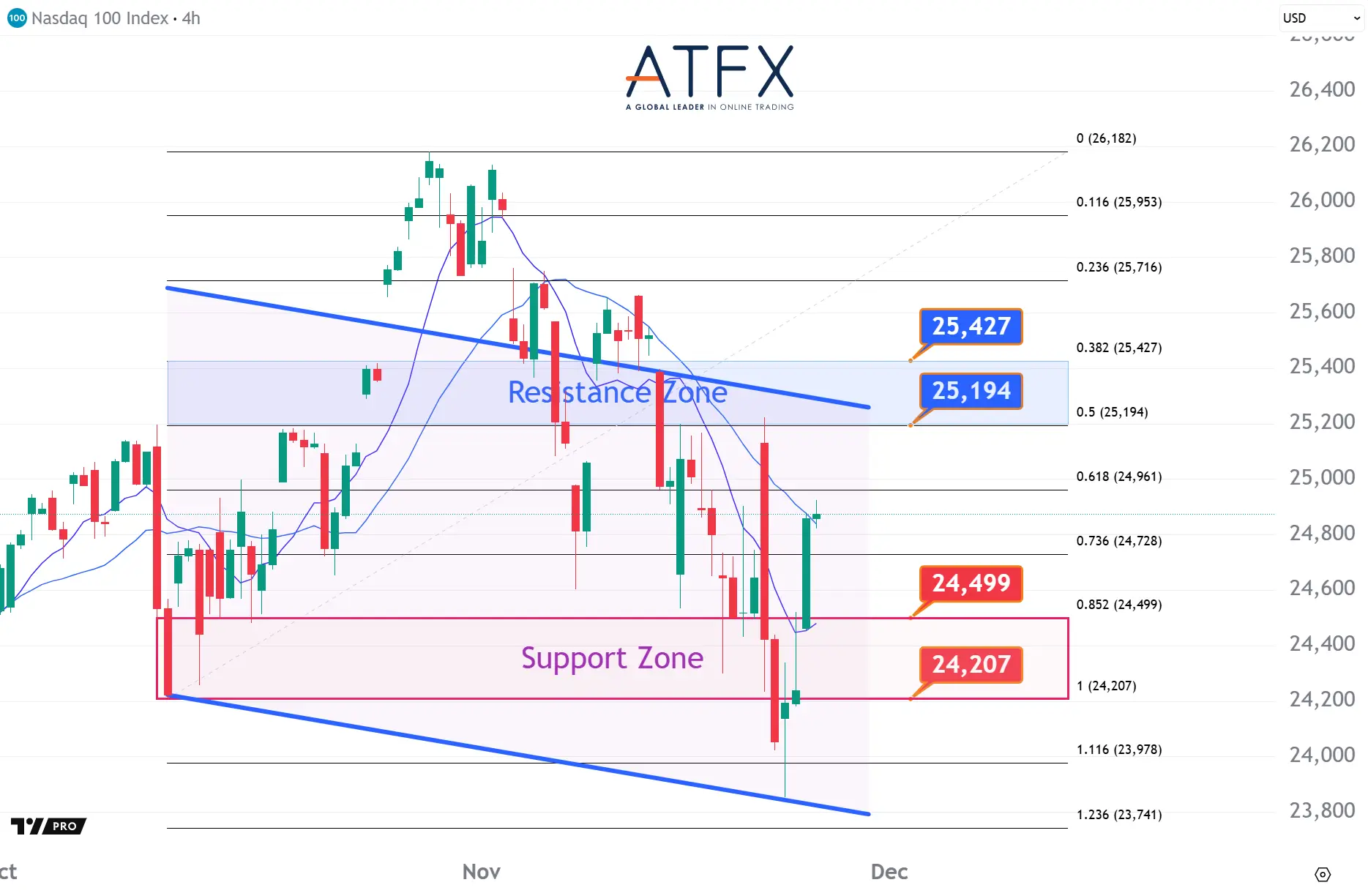

NAS100

- Resistance: 25194/25427

- Support: 24499/24207

The NAS100 jumped 2.69% as tech stocks rebounded sharply on renewed Fed rate-cut bets and strong earnings sentiment. However, upside remains constrained with price still capped below the 25,194 resistance zone. Unless the index breaks above this level, the structure points to a potential pullback toward the 24,499 – 24,207 region.

BTC

- Resistance: 90893/94057

- Support: 83759/80649

BTC slipped toward $85.8k as U.S. spot ETF outflows extended into a fourth week, signaling ongoing institutional risk-off sentiment. Fed uncertainty kept markets cautious despite a 70% chance of December easing. Technically, BTC remains capped below $90,893, and failure to break higher risks another drop toward $83,759–$8 0,649.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.