Market Highlight 18/11/2025

U.S. equities closed sharply lower on Monday, with the S&P 500 and Nasdaq falling below key technical levels for the first time since late April. Investors remained cautious ahead of quarterly results from major retailers and chip giant Nvidia, as well as Thursday’s U.S. nonfarm payrolls report. The Dow Jones slipped 1.18%, the S&P 500 lost 0.9%, and the Nasdaq declined 0.84%. The U.S. dollar edged higher against several major currencies as traders positioned defensively ahead of economic data releases.

Gold prices fell on Monday, pressured by a stronger dollar and fading expectations of imminent Fed rate cuts. Investors are awaiting delayed U.S. economic releases this week for clearer signals on the Federal Reserve’s policy path. Spot gold dropped 0.9% to $4,044 per ounce. Oil prices also retreated after Russia’s key Black Sea export hub, Novorossiysk, resumed operations following a two-day halt caused by a Ukrainian strike.

Key Outlook 18/11/2025

On Tuesday, the U.S. is expected to release October industrial production data, which is anticipated to show stagnation with a month-on-month reading likely around 0.0%. Meanwhile, the November NAHB housing market index is forecast to hold steady at 37.

Key Data and Events Today

- 08:30 RBA Meeting Minutes ***

- 22:15 US Industrial Production MoM SEP **

Tomorrow:

- 05:30 API Crude Oil Stock Change ***

- 15:00 GB CPI YoY OCT **

- 18:00 EU CPI YoY Final OCT **

- 23:30 US Building Permits SEP **

- 23:30 EIA Crude Oil Stocks Change **

Markets Analysis 18/11/2025

EURUSD

- Resistance: 1.1612/1.1635

- Support: 1.1539/1.1517

The EUR/USD is struggling to hold above 1.1612 resistance, with the price showing lower highs and pressure building toward the 1.1539 support zone. A continued failure to reclaim 1.1612 increases the risk of a downside extension, especially ahead of this week’s delayed U.S. data.

GBPUSD

- Resistance: 1.3194/1.3219

- Support: 1.3089/1.3064

GBP/USD hovered near 1.3150 as stronger dollar pressure and U.K. fiscal uncertainty persisted ahead of the Nov 26 budget. Technically, the pair continues to trade below the descending trendline and the 1.3194 resistance level, maintaining a bearish bias toward 1.3089 if the rebound fails.

USDJPY

- Resistance: 155.60/155.76

- Support: 154.83/154.67

USD/JPY climbed toward 155.20 as broad dollar strength kept the pair near a nine-month high. Technically, the pair is holding firmly above the rising trendline, with bulls eyeing 155.60 as the next resistance. Weak Japan GDP (-1.8%) offered little support to the yen, but intervention risks remain on watch.

US Crude Oil Futures (DEC)

- Resistance: 60.05/61.02

- Support: 59.27/58.49

WTI hovered near $59.9 as Russia’s Novorossiysk port reopened, easing short-term supply fears. Technically, prices are stuck between $59.27 support and $60.05 resistance, with a breakout likely to dictate the next move. Ongoing Ukrainian strikes on Russian energy sites keep geopolitical risks elevated.

Spot Gold

- Resistance: 4109/4161

- Support: 3981/3939

Spot Silver

- Resistance: 51.01/52.30

- Support: 48.92/47.87

Gold hovered around $4,050 as a stronger dollar and softer December rate-cut bets (~41%) kept buyers cautious. Technically, the break below $4,109 shifts momentum bearish, with price vulnerable toward $3,981 if $4,040 fails to hold. Markets await delayed U.S. data for a clearer direction.

Dow Futures

- Resistance: 46946/47298

- Support: 46241/45894

The Dow futures fell 1.18%, slipping below the 50-day MA for the first time since October as tech weakness and uncertainty ahead of U.S. retail earnings and NFP weighed on sentiment. Technically, the price broke below the 46,946 support level, with bears eyeing 46,241 if the index fails to reclaim the broken trendline.

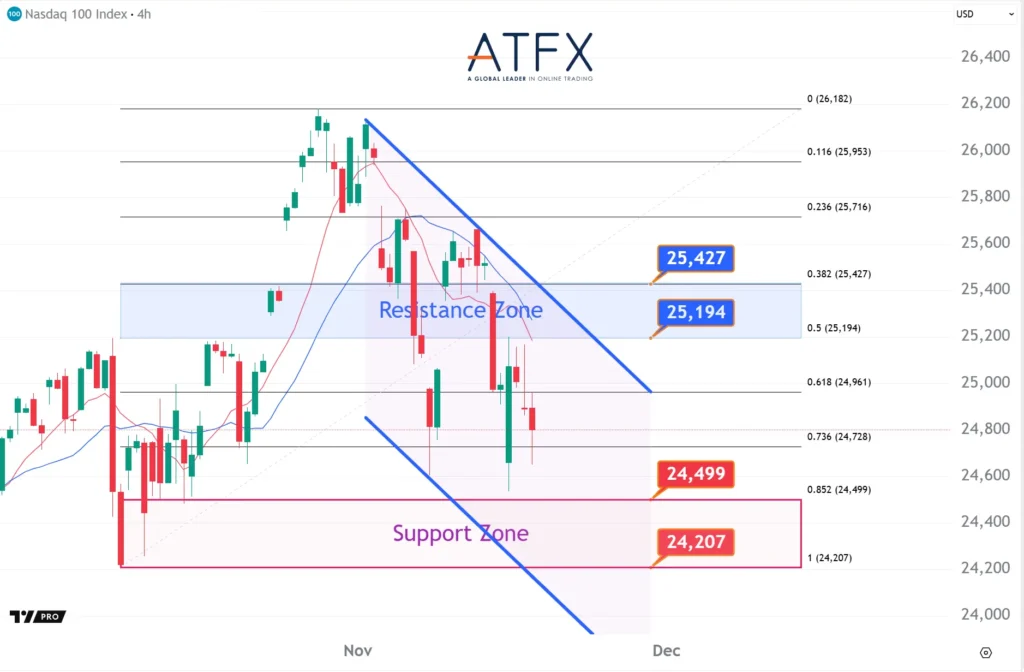

NAS100

- Resistance: 25194/25427

- Support: 24499/24207

NAS100 fell 0.84%, breaking below the 50-day MA as caution builds ahead of Nvidia’s earnings and shrinking Fed-cut expectations. Technically, the index is testing support near 24,499; a break lower may open the door toward 24,300, while a recovery above 25,194 would signal renewed upside momentum.

BTC

- Resistance: 94595/95576

- Support: 90277/89293

Bitcoin extended its decline toward $92,000, marking fresh six-month lows as fading Fed cut expectations fueled broad risk-off sentiment. Heavy ETF outflows and accelerated selling by long-term holders continued to cap any rebound attempts. With $94,595 acting as firm resistance, downside pressure remains intact, and a retest of the $90,277 support is increasingly likely.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.