Market Highlight 19/01/2026

U.S. equities closed mostly flat last Friday as markets traded cautiously ahead of a long weekend, though all three major indices posted weekly losses. The S&P 500 fell 0.38% for the week, the Nasdaq declined 0.66%, and the Dow Jones dropped 0.29%. The U.S. dollar strengthened after former President Donald Trump praised economic adviser Kevin Hassett and indicated he may want him to remain in his current role, fueling speculation that Hassett’s chances of being nominated as Federal Reserve Chair have diminished. The U.S. Dollar Index rose 0.06% to 99.41. Meanwhile, EUR/USD slipped 0.1% to 1.1594. However, market attention shifted on Saturday to Trump’s pledge to impose a new round of tariffs on European allies unless the United States is allowed to purchase Greenland. This escalation in tensions over Greenland has heightened geopolitical uncertainty, potentially boosting safe-haven demand at the start of the week.

Gold prices fell more than 1% last Friday as investors took profits following recent record highs, while signs of easing geopolitical tensions further reduced gold’s appeal as a safe haven. Spot gold settled at $4,594.79 per ounce, down 0.43% on the day. Weekly, gold gained about 1.9%, marking its second consecutive weekly advance. Oil prices closed higher on Friday, as some investors covered short positions ahead of the three-day U.S. Martin Luther King Jr. Day weekend, while markets remained concerned about the possibility of U.S. military action against Iran.

Key Outlook 19/01/2026

Global financial markets will face a busy week of key economic data releases, with inflation, employment, and GDP figures from major economies, including the U.S., Europe, and the UK, scheduled for release. These data points will play a critical role in shaping expectations for central bank policy paths, and markets will closely monitor whether policymakers may adjust their interest rate outlooks. With U.S. markets closed today due to a public holiday, attention will turn to the Eurozone’s final December CPI reading. The figure is expected to match the preliminary estimate, showing a year-on-year increase of 2%, which would return it to the European Central Bank’s target. This reinforces market expectations that the ECB will keep interest rates unchanged for an extended period.

Key Data and Events Today:

- US Holiday 10:00 CN Retail Sales & Industrial Production DEC ** 10:00 CN GDP YoY Q4 ** 12:30 JP Industrial Production MoM NOV ** 18:00 EU CPI Final DEC ** 21:30 CA CPI DEC **

Tomorrow:

- 09:15 CN Loan Prime Rate 1Y & 5Y JAN **

- 15:00 GB Unemployment Rate NOV **

- 15:00 EU GERMANY PPI DEC **

- 18:00 EU ZEW Economic Sentiment Index JAN **

Markets Analysis 19/01/2026

EURUSD

- Resistance: 1.1666/1.1689

- Support: 1.1570/1.1541

EUR/USD remains under pressure as safe-haven flows and rising trade tensions support a firmer USD. Technically, the pair stays within a descending channel, with rebounds capped at the 1.1666–1.1689 resistance zone. Failure to reclaim this area keeps downside risks toward 1.1570 / 1.1540 support.

GBPUSD

- Resistance: 1.3440/1.3470

- Support: 1.3312/1.3282

GBP/USD lacks upside momentum and consolidates around 1.3380, as a resilient USD continues to draw support from firm U.S. data. Technically, the pair remains capped below the descending trendline and the 200-day SMA, with 1.3440–1.3470 acting as a key inflexion zone. Unless this area is cleared, downside pressure toward 1.3312–1.3282 is likely to persist.

USDJPY

- Resistance: 158.27/158.88

- Support: 156.93/156.33

USD/JPY eases back toward 158 as renewed intervention warnings from Japan curb upside momentum. From a technical perspective, the pair is pulling back within an ascending structure, with rallies capped at the 158.27–158.88 resistance zone. Failure to reclaim this area could expose 156.93–156.33 on the downside.

US Crude Oil Futures (FEB)

- Resistance: 60.78/61.57

- Support: 58.27/57.49

WTI trades around $59, with geopolitical risk remaining the key short-term driver amid U.S.–Iran tensions. Technically, prices have pulled back from the ascending trendline, with rallies capped at the $60.78–$61.57 resistance zone. Any easing in geopolitics could refocus downside toward the $58.27–$57.49 support zone.

Spot Gold

- Resistance: 4719/4752

- Support: 4615/4582

Spot Silver

- Resistance: 95.69/97.73

- Support: 89.25/87.18

Spot gold consolidates after printing fresh record highs, with safe-haven flows sustained by trade and geopolitical risks. Technically, prices remain supported within an ascending channel, rebounding from the $4,615–$4,582 support zone. A break above the $4,719–$4,752 resistance could open room for further upside.

Dow Futures

- Resistance: 49772/50088

- Support: 49064/48742

The Dow Futures edges lower as healthcare weakness and policy concerns over credit card rate caps weigh on sentiment, while pre-holiday caution keeps volatility muted. Technically, the index remains within an ascending channel, but the 49,772–50,088 resistance zone caps upside. Failure to clear this area may lead to consolidation toward 49,064–48,742 support.

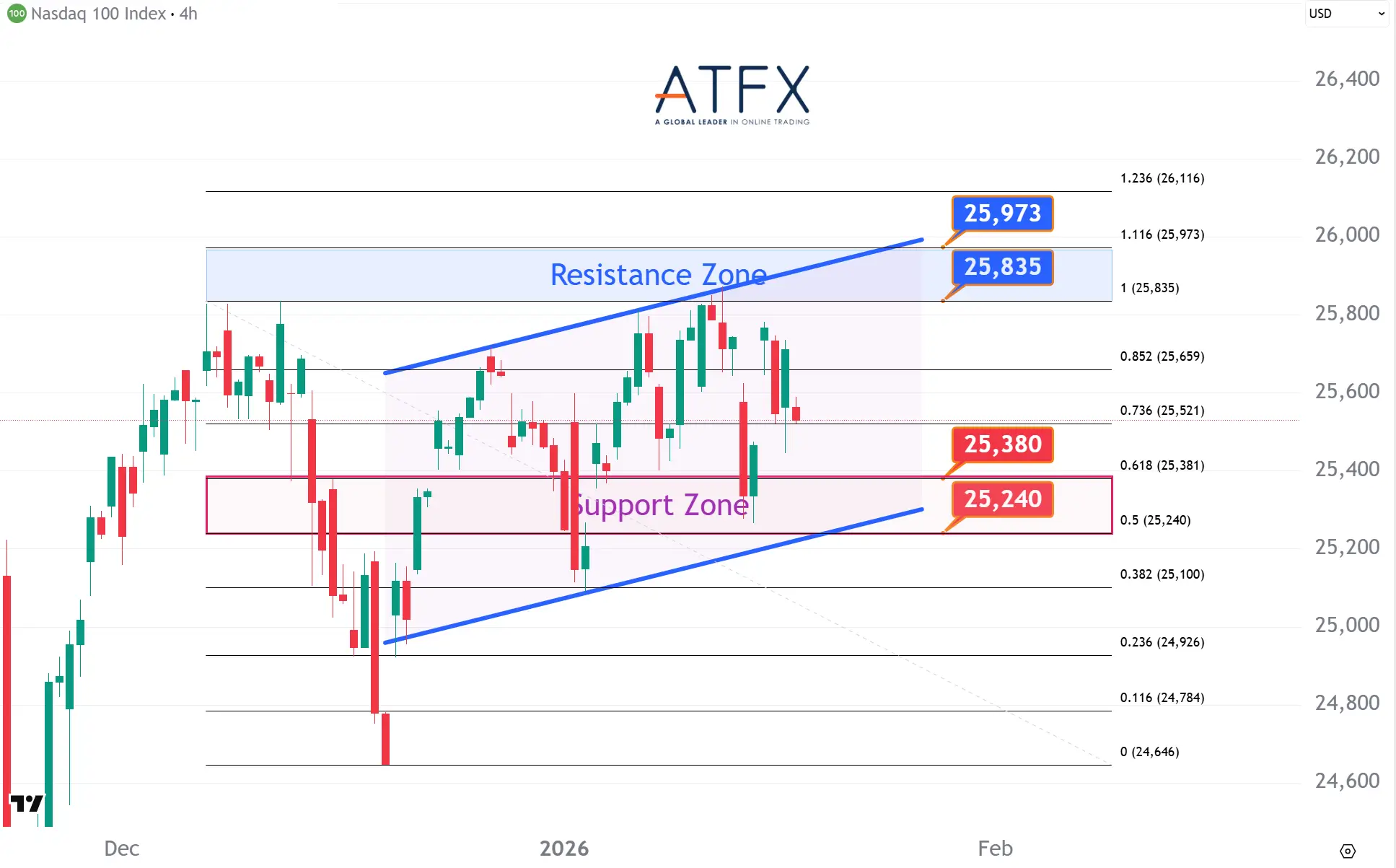

NAS100

- Resistance: 25835/25973

- Support: 25380/25240

The NAS100 ends flat as strength in chip stocks offsets broader market caution, with sector rotation still evident. Technically, the index is consolidating within an ascending structure, while upside remains capped by the 25,835–25,973 resistance zone. Failure to clear this area could see price action gravitate toward the 25,380–25,240 support range.

BTC

- Resistance: 94652/95837

- Support: 90747/89541

Bitcoin consolidates around $95,000 as regulatory optimism cools and market sentiment turns cautious. From a technical standpoint, upside is capped by the $94,652–$95,837 resistance zone, where selling pressure has emerged. Failure to reclaim this area could expose a pullback toward the $90,747–$89,541 support zone.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.