【20251118 行情回顧】

美國股市週一大幅收低,投資者正在等待零售商和晶片巨頭英偉達的季度業績,以及週四的美國非農就業報告。道指收跌1.18%,標普500指數跌0.9%,納指跌0.84%。交易員在美國經濟數據回歸之前保持謹慎,週一美元兌部分主要貨幣上漲。

金價週一錄得下跌,受累於美元走強和對美國降息的預期下降,投資者等待本週將發佈的延遲經濟數據,為聯儲局政策路徑提供線索。現貨金收跌0.9%,報每盎司4044美元。國際油價下跌,俄羅斯黑海重要出口樞紐新羅西斯克港在遭受烏克蘭襲擊停止出口兩天後,已恢復裝貨。

【20251118 重點前瞻】

日內市場可能延續謹慎觀望的立場,今日數據方面,美國將公佈10月工業產出,市場預計該數據將錄得停滯,月率可能錄得0.0%。此外,美國11月NAHB房產市場指數預計持穩在37。

【重要財經日曆】

- 08:30 澳大利亞儲備銀行會議紀要 ***

- 22:15 美國9月工業生產 **

- 23:00 美國8月工廠訂單月率 **

11月19日

- 05:30 API原油庫存變化 ***

- 15:00 英國10月CPI **

- 18:00 歐元區10月CP終值 **

- 23:30 美國9月營建許可 **

- 23:30 EIA原油庫存變化 **

【20251118 行情分析】

歐元兌美元

- 1.1612/1.1635阻力

- 1.1539/1.1517支持

歐盟執委會預測,歐元區經濟在2025年的增長速度將快於此前的預期。不過歐元兌美元依然以連續第二天走低開啟本週行情,跌破1.1600關口後短線壓力可能繼續跟進,看是否跌破下方不遠處的日圖關鍵均線支撐,則繼續下探1.1539/1.1517低位。

英鎊兌美元

- 1.3194/1.3219阻力

- 1.3089/1.3064支持

英國央行官員指通脹風險持續上行,對英鎊構成輕微支撐,不過英國財政問題仍令市場擔憂,市場對英鎊的情緒謹慎,英鎊兌美元週一連跌兩日,不過暫時處於日圖10、20均線範圍內的交投,在明日英國CPI公佈前匯價可能繼續處於偏弱觀望。

美元兌日元

- 155.60/155.76阻力

- 154.83/154.67支持

日本首相高市早苗將於本週啟動稅制改革談判,週一美元兌日元維持在接近九個月最高位,也是10月底以來的最大漲幅,今早進一步走強,突破155.00關口,創2月初以來的最高,當前聚焦156關口作為下一更高區間的啟動目標,但在此之前先關注155.60/155.76阻力。

美國原油期貨(12月)

- 60.05/61.02阻力

- 59.27/58.49支持

隨著俄羅斯新羅西斯克港石油出口在暫停兩日後恢復,供應擔憂有所緩解,隔晚國際原油小幅回吐,尾盤未能站上60美元。技術上20天均線及自上週高位以來的趨勢線充當目前的阻力,如果未能突破則留意會否下望59美元下方。

現貨黃金

- 4109/4161阻力

- 3981/3939支持

現貨白銀

- 51.01/52.30阻力

- 48.92/47.87支持

聯儲局主要官員近期的表態顯示對進一步降息的熱情似乎不高,現貨黃金連續第三個交易日走低,目前缺乏明確的催化劑,待週四美國非農的關鍵指引。技術上金價進一步下探日圖主要均線下方,可能再度逼近4000美元關口,如果跌破意味著重返10月底至11月初的低位區間。

美國道瓊斯工業指數期貨US30

- 46946/47298阻力

- 46241/45894支持

聯儲局官員表態顯示進一步寬鬆暫時處於不確定,美股週一收跌,道指收跌逾1%,連續三日走低,盤中觸及近一個月最低位,暫時在前期低位範圍獲得支撐,看是否呈現低位整理等待週四非農數據公佈,但如果繼續跟隨市場情緒走低則可能威脅46000關口。

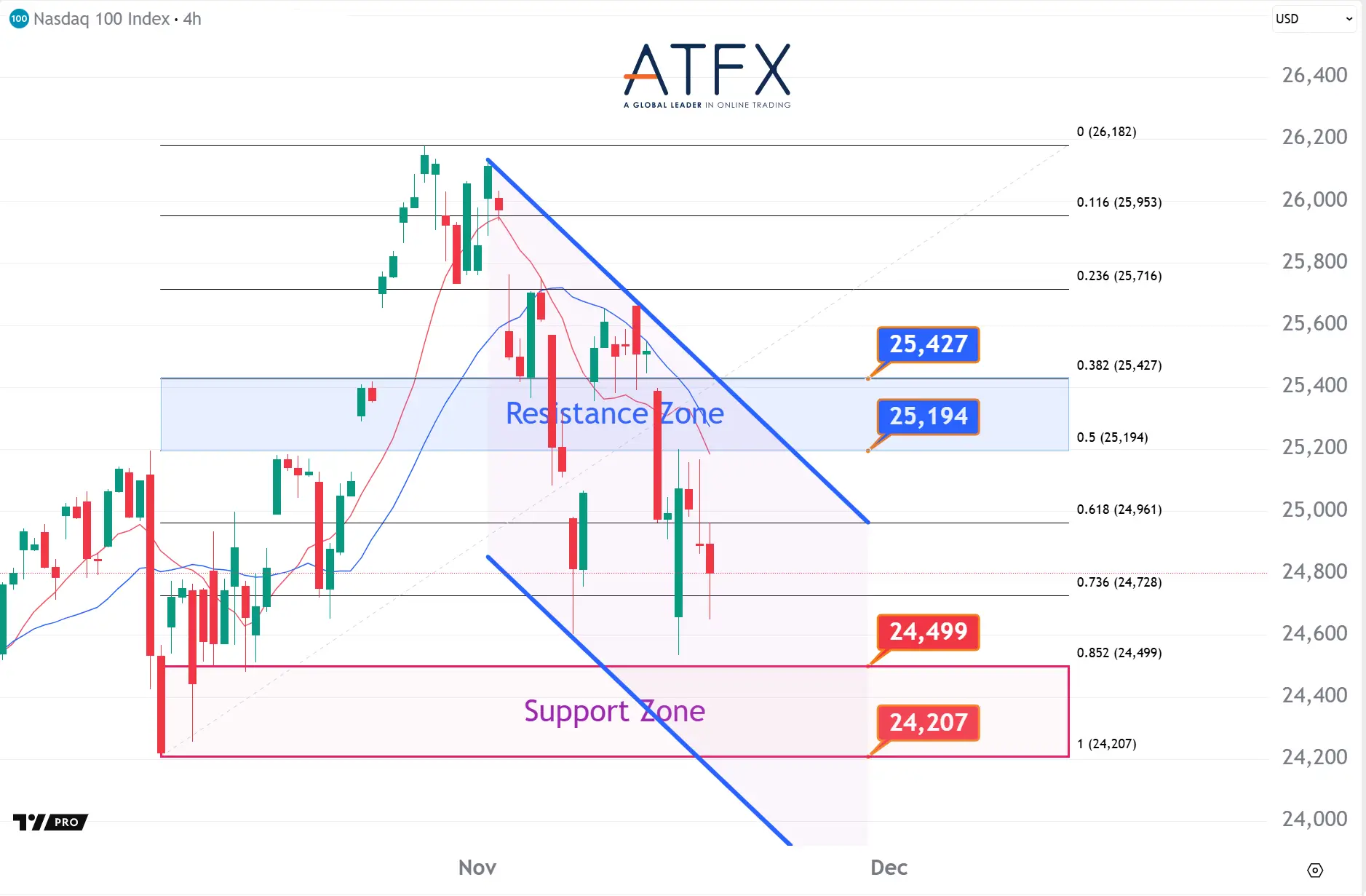

美國納斯達克指數NAS100

- 25194/25427阻力

- 24499/24207支持

市場對AI估值泡沫的擔憂猶存,週一科技股再度領跌,待英偉達週三公佈財報。NAS100指數隔晚大幅低開,盤中經過震盪後收低,連續測試25000關口上方但未能突破,顯示市場在關鍵指引發佈前的謹慎,所以日內可能繼續偏向弱勢整理,本月低位形成的下行趨勢線可暫時提供支撐。

香港恒生指數HK50

- 26326/26526阻力

- 25924/25726支持

昨日港股承接跌勢,低開低走後尾盤收跌0.71%,科技股呈現弱勢。HK50指數昨日連跌三日後,今早進一步刷新逾一週最低位,當前交投在26000關口處,是否守住該位是決定能否反彈的關鍵,若進一步失守可能指向25924/25726低位,不過自10月低位以來的上行趨勢線有望提供部分緩衝。

內容僅供參考:市場有風險,投資需謹慎。祝交易愉快!