EURUSD hit resistance and has declined ahead of the rate decision from the European Central Bank.

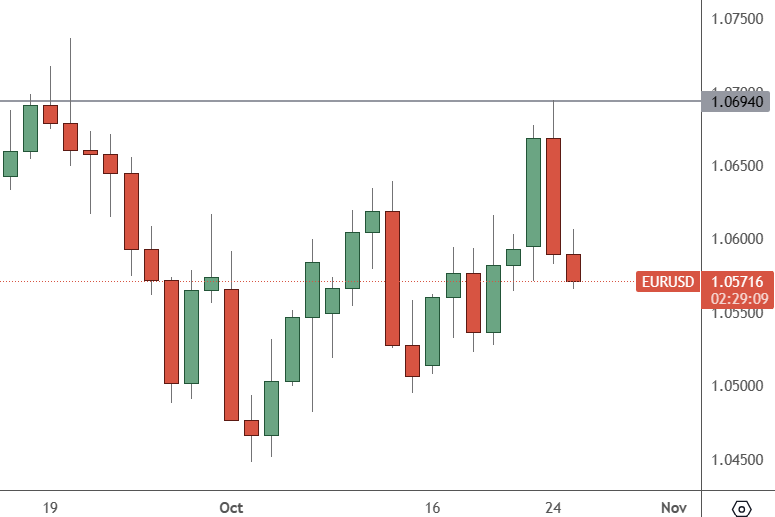

EURUSD: Daily Chart

EURUSD touched resistance at 1.0694 and slumped to 1.0571. A dovish central bank could see the pair test the 1.4050 level again in the coming days.

The euro rallied as traders began to believe that the Federal Reserve was finished with rate hikes. However, the economic outlook is still a concern for Europe.

The European Central Bank is “carefully monitoring” the crisis in the Middle East and the impact it may have on the euro zone economy, ECB chief Christine Lagarde said on Wednesday ahead of the meeting.

“We are particularly attentive,” she said in an interview.

“It is a region of the world where there is a lot of traffic on oil tankers, where there are oil-producing countries as well, and where there could be an impact either directly or indirectly or through the confidence channel, which also matters,” she added.

The ECB lifted its key interest rate by 25 basis points in September, taking the deposit rate to 4% and the refinancing rate to 4.50%. However, the bank signalled that its 10th increase in a 14-month-long streak was likely to be the last for now.

Inflation in the eurozone has continued to decline, despite the fact that September’s 4.3% reading was still double the ECB’s 2% target.

Lagarde also urged governments to assist the central bank by withdrawing support measures put in place at the height of the energy crisis.

“That would be the best way…to tame inflation and bring it back to 2% in the medium term,” she said, referring to Germany’s energy support measures.

Thursday is also a big day for US data with durable goods orders, followed by GDP for Q3. Markets are expecting a 4.3% growth rate for the quarter, and that will be sandwiched between the ECB decision and its press conference, which should make for a volatile day in EURUSD.