Market Highlight 10/11/2025

U.S. consumer sentiment fell in early November to its lowest level in nearly three and a half years, as households across political lines expressed growing concern over the economic impact of the longest-ever government shutdown. U.S. equities saw a choppy week, with the S&P 500 and Dow Jones eking out late-session gains, while all three major indices still ended the week lower. The Nasdaq posted its biggest weekly percentage drop since early April. The U.S. Dollar Index slipped 0.12% to 99.56, ending a two-week winning streak. On Friday, the greenback continued to weaken, pushing the euro higher by 0.15% to 1.1556.

Gold prices rose on Friday as a weaker dollar and heightened uncertainty over the U.S. government shutdown boosted safe-haven demand, while Wall Street’s indices suffered sharp weekly losses. Spot gold settled at $3,998.63 per ounce, up 0.5%. Oil prices rebounded on Friday after U.S. President Donald Trump met with Hungarian Prime Minister Viktor Orbán at the White House, with investors hoping Hungary could continue to use Russian crude. However, crude benchmarks still ended the week down about 2%.

Key Outlook 10/11/2025

This week, global markets will focus on several key economic data releases. While the U.S. CPI report may be delayed due to the ongoing federal government shutdown, GDP figures from the U.K. and Eurozone will take center stage. Other important indicators, including the Eurozone Sentix Investor Confidence Index, U.K. unemployment rate, and Germany’s CPI, are also expected to influence overall market sentiment.

Key Data and Events Today

- 17:30 EU European Sentix Investor Confidence NOV **

Key Data and Events Coming Week:

- 15:00 GB Unemployment Rate SEP **

- 18:00 EU ZEW Economic Sentiment Index NOV **

Markets Analysis 10/11/2025

EURUSD

- Resistance: 1.1592/1.1616

- Support: 1.1515/1.1490

The euro edged up to 1.1560 as the dollar weakened on prolonged U.S. shutdown uncertainty and weak sentiment data. Technically, EUR/USD remains supported above 1.1515, with room to test 1.1592 if buyers hold control. However, a short-term pullback remains possible before another push higher.

GBPUSD

- Resistance: 1.3188/1.3231

- Support: 1.3092/1.3049

GBP/USD held around 1.3150, up 0.10% after rebounding from session lows as traders weighed soft U.S. sentiment data and cautious Fed remarks. The pair maintains support near 1.3092, with resistance seen at 1.3188. Technically, a short consolidation phase could precede another leg higher if bullish momentum sustains.

USDJPY

- Resistance: 154.48/155.08

- Support: 153.28/152.53

USD/JPY advanced to around 153.70 as doubts over the BoJ’s next rate hike and Japan’s ¥65B stimulus plan pressured the yen. The pair continues to trade above the key 153.28 support zone, where repeated rebounds suggest strong buyer interest. A sustained move above 153.80 could open the door toward 154.48, but repeated failures to clear that area may trigger short-term pullbacks back into the 153.28 range before buyers regroup.

US Crude Oil Futures (DEC)

- Resistance: 61.03/61.82

- Support: 59.28/58.49

WTI crude steadied near $59.8 per barrel, rebounding modestly as geopolitical tensions re-emerged amid Trump–Orbán talks and renewed unrest in the Middle East. Technically, the $59.28–$58.49 zone remains a pivotal support area. A clear break above $60.50 could pave the way toward $61.03, but failure to hold above $59.28 risks dragging prices back into a broader consolidation phase.

Spot Gold

- Resistance: 4084/4115

- Support: 3989/3950

Spot Silver

- Resistance: 49.34/49.62

- Support: 48.39/48.10

Gold rallied to around $4,050 per ounce, buoyed by safe-haven inflows and a softer dollar amid prolonged U.S. shutdown concerns. Technically, prices have broken out of a descending triangle, indicating a potential shift in bullish momentum. Immediate resistance lies near $4,084, where sellers may emerge, while the $3,989–$3,950 zone acts as dynamic support. A pullback toward trendline support could precede another leg higher if risk aversion persists.

Dow Futures

- Resistance: 47433/47744

- Support: 46748/46442

The Dow futures inched up 0.16% to 46,987, recovering late in the session as hopes of resolving the U.S. government shutdown lifted sentiment. Technically, the index found support around 46,748 — aligning with its ascending trendline. Resistance at 47,433 remains a key ceiling; a clear breakout above it could reignite bullish momentum toward fresh highs, while failure may invite another short-term retest of the lower trendline.

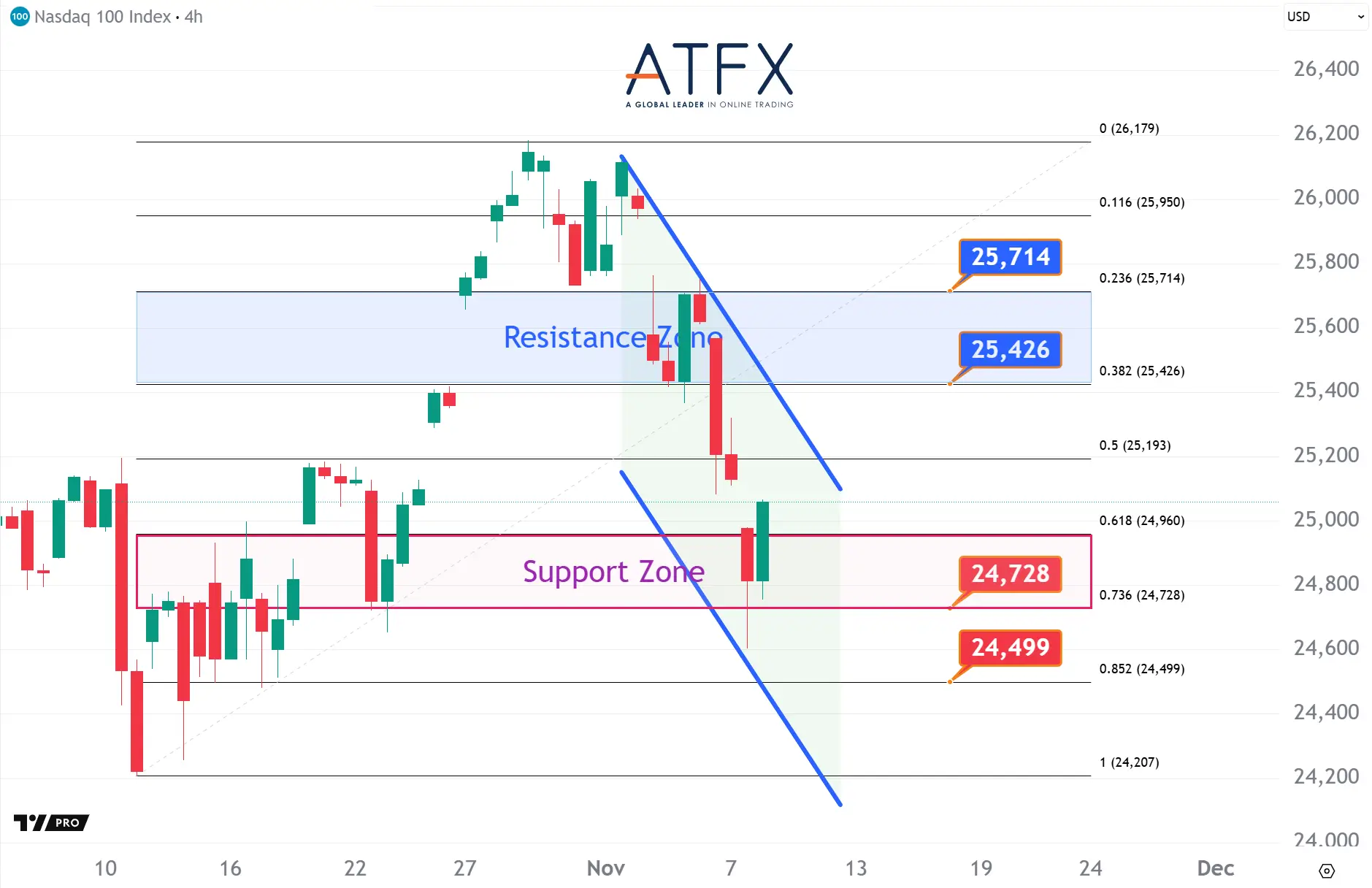

NAS100

- Resistance: 25426/25714

- Support: 24728/24499

The NAS100 slipped 0.21% as weakness in AI-related stocks continued to weigh on sentiment, offsetting optimism over a potential end to the U.S. shutdown. Technically, the index is consolidating above 25,000 support and testing its ascending trendline. A sustained rebound above this level could see momentum extending toward 25,425, though fading tech appetite still limits upside traction.

BTC

- Resistance: 108452/109972

- Support: 103530/102035

Bitcoin surged over 4% to around $105,000 after the Trump Administration announced a $2,000 stimulus payment funded by tariff revenues. The move revived optimism across crypto markets, though analysts caution that lasting momentum will depend on sustained follow-through. Key resistance sits at $108,452–$109,972, while $103,530 remains pivotal support.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.