Following the announcement of interest rate decisions by the Federal Reserve and the Bank of England, will the manufacturing PMI data from various countries trigger new volatility within the global financial markets? The latest interest rate hikes from various countries test the resilience of the economies of many countries. Changes in macroeconomic data are crucial indicators of the future trends of commodities and currency price changes. These will also guide the pace of interest rate hikes by the leading central banks. This week, the market will focus on the trends of PMI data from the United States, the United Kingdom and the eurozone.

The USA

The US Markit manufacturing, service sector, and composite PMIs continued to hit new lows last seen over two years ago in August, reflecting the apparent deterioration of the economy. Released on Friday, the initial value of the US Markit Composite PMI for September, which was recorded at 44.1 in August, was lower than the expected value of 49.8 and hit a 27-month low.

On Wednesday, the Federal Reserve announced it would raise interest rates by 75 basis points. At the same time, it announced that it would continue to expand the balance sheet runoff operation based on the set path. Judging from the latest dot plot released by the Fed, the Fed is likely to raise interest rates two more times this year. Hence, its interest rate will rise to 4.4% by the end of this year before peaking at 4.6% in 2023, after which a rate cut is very likely.

The market is concerned about whether the initial value of the Markit composite PMI in September will slow down further. If the data declines further, it may cause more adverse effects on the US stock market, and the US dollar may have a short-term correction. However, after the PMI announcements, the dollar index rose above its 20-year high of 111.

The UK

The UK’s September composite PMI and the September manufacturing and services PMIs were also announced today. The final value of the UK’s composite PMI in August was unexpectedly lowered to 49.6 from the initial value of 50.9. This is the UK’s lowest composite PMI since February 2021. It fell below 50 for the first time, marking a contraction in overall business activity. The British market is more worried about a recession than the United States. The rising cost of living and energy prices may put further pressure on its manufacturing and service industries.

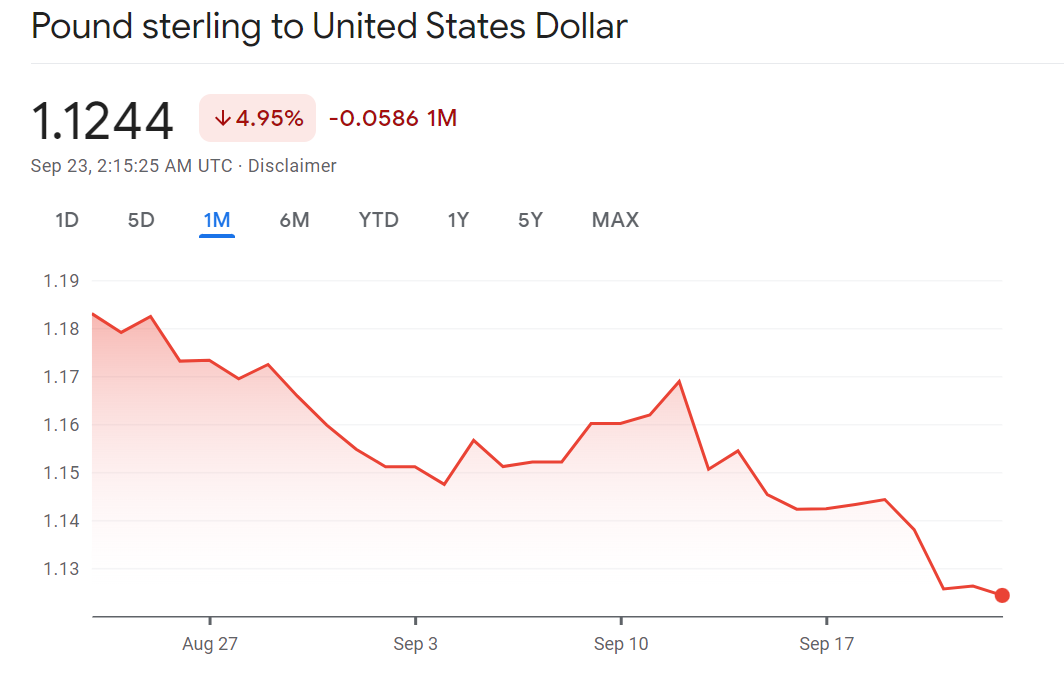

If the data continues to decline this month, the Bank of England’s subsequent interest rate hikes to curb inflation may be limited, which is not good news for the British pound, and may increase the downward pressure on the pound. At the same time, the market is full of people saying that the British economy will fall into recession. Furthermore, the Bank of England announced a 50 basis point interest rate hike this Wednesday, as expected by the market. As a result, the British pound continues to decline, and it is now approaching parity with the dollar.

The Euro

The eurozone’s composite PMI in August was also quite dismal, coming in at 49.2, higher than the expected 49 and lower than the previous value of 49.9, hitting an 18-month low. The European Central Bank announced earlier this month that it would continue raising interest rates by 75 basis points. Many expect the European Central Bank to raise interest rates significantly. Although the ECB is hawkish about raising interest rates, stopping the euro’s weakening trend is challenging.

Judging from the current market expectations, the PMI data in the euro area may slow down further, and the euro may continue declining in the future. The market expects the initial value of the eurozone manufacturing PMI in September will drop from 49.6 to 48.7. Likewise, the initial value of the service industry PMI is expected to drop from 49.8 to 49, and the initial value of the composite PMI in September is expected to drop to 48.2.

Clearly, the prosperity of the global business environment is being impacted by the central bank interest rate hiking policies, and signs of a global economic recession are constantly emerging. As a result, the euro’s value is at risk of falling further. In addition, the Russian-Ukrainian conflict continues as Putin recently announced a partial military mobilisation. The initial goal is to recruit 300,000 reservists to join the Ukraine war effort. The continued geopolitical tensions are providing an upward boost to the dollar. Therefore, we will likely have a situation where the US dollar will continue to rally as other non-US dollar currencies remain under pressure. The bearish trend in gold prices is also expected to continue.