Market Highlight 29/10/2025

The three major U.S. stock indexes closed at fresh record highs on Tuesday as optimism grew ahead of earnings from big tech companies this week. Nvidia announced plans to build AI supercomputers for the U.S. Department of Energy. The Dow rose 0.34%, the S&P 500 gained 0.2%, and the Nasdaq climbed 0.8%. Meanwhile, U.S. October consumer confidence fell to a six-month low amid rising concerns over job opportunities. The U.S. Dollar Index slipped 0.08% to 98.69, while the euro rose 0.14% to 1.1659.

Gold prices dropped to a three-week low as hopes of progress in U.S.–China trade talks dampened safe-haven demand, with investors shifting their focus to this week’s Federal Reserve policy decision. Spot gold fell 0.7% to $3,951.56 per ounce, touching its lowest level since October 6. Oil prices extended their decline for a third consecutive session, as investors weighed the impact of U.S. sanctions on two major Russian oil companies against the prospect of OPEC+ increasing output in December.

Key Outlook 29/10/2025

The Bank of Canada will announce its policy decision later today. Despite earlier resilience in the labor market and an unexpected rise in inflation, markets still expect a 25-basis-point rate cut. Focus then turns to the U.S. Federal Reserve decision early Thursday morning. Markets anticipate another 25-bps cut, marking the second consecutive reduction of this easing cycle. With much U.S. economic data delayed by the federal government shutdown, investors will closely watch how policymakers balance inflation—still above the Fed’s target—against a labor market showing signs of weakness, particularly the tone of Chair Jerome Powell’s press conference following the decision.

Key Data and Events Today

- 21:45 BoC Interest Rate Decision ***

- 22:00 US Pending Home Sales SEP **

- 22:30 BoC Press Conference ***

- 22:30 EIA Crude Oil Stock Change **

Tomorrow:

- 02:00 Fed Interest Rate Decision ***

- 02:30 Fed Press Conference ***

- 11:00 BoJ Interest Rate Decision ***

- 14:30 BoJ Gov Ueda Press Conference ***

- 16:55 EU GERMANY Unemployment Rate OCT **

- 17:00 EU GERMANY GDP Flash Q3 ***

- 18:00 EU GDP Flash Q3 ***

- 18:00 EU Unemployment Rate SEP **

- 21:00 EU GERMANY CPI Prel OCT **

- 21:15 ECB Interest Rate Decision ***

- 21:45 ECB Press Conference ***

Markets Analysis 29/10/2025

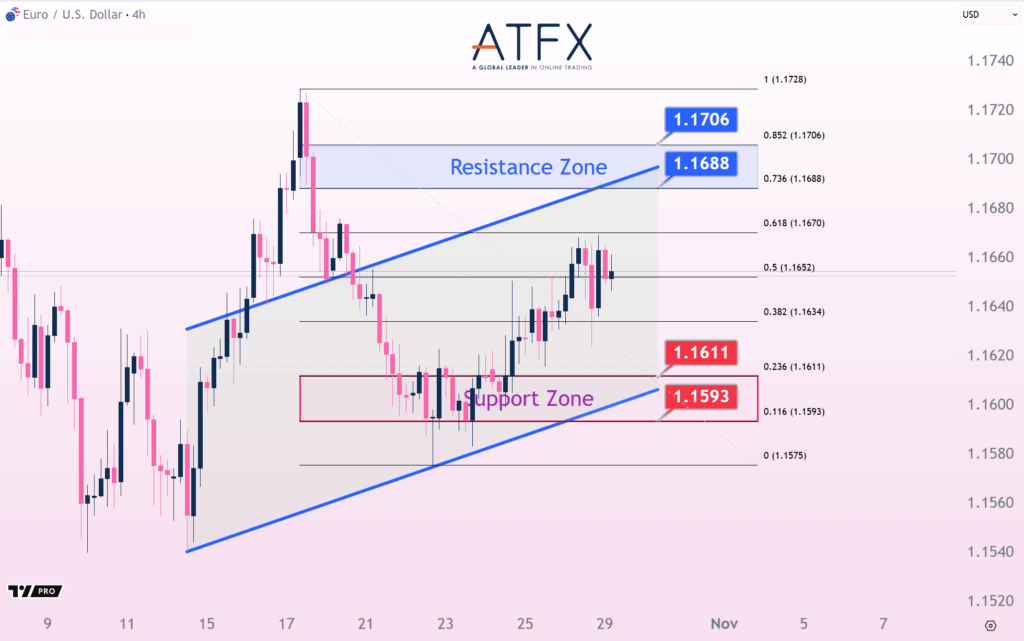

EURUSD

- Resistance: 1.1688/1.1706

- Support: 1.1611/1.1593

EUR/USD climbed to 1.1659 after softer U.S. consumer confidence data pressured the dollar. Markets widely expect the Fed to cut 25 bps, while the ECB is likely to hold steady this week. Technically, the pair is supported above 1.1611 ascending trendline, with potential upside toward 1.1688 if momentum holds.

GBPUSD

- Resistance: 1.3334/1.3360

- Support: 1.3196/1.3162

GBP/USD slid to 1.3280, its lowest since August, after the OBR flagged a £20B fiscal hit from weaker productivity. From a technical view, the pair remains capped by a descending trendline, with resistance near 1.3334 and downside risk toward 1.3196 if selling pressure extends. Policy divergence between the Fed and BoE may cushion losses.

USDJPY

- Resistance: 152.70/153.27

- Support: 150.87/150.30

USD/JPY eased to 151.81 after Japanese officials stressed fiscal discipline and U.S. Treasury backed conventional tools. BoJ is set to hold rates, with markets eyeing hints on future hikes. Technically, support at 150.87 may trigger a rebound toward 152.70.

US Crude Oil Futures (DEC)

- Resistance: 61.89/62.92

- Support: 58.63/57.62

WTI crude extended its decline to $60.15, marking a third straight loss as traders balance U.S. sanctions on Russian oil firms against OPEC+’s potential December hike. Momentum indicators suggest sellers remain in control, with bears eyeing a possible retest of the $58.63 zone if recovery attempts falter.

Spot Gold

- Resistance: 4059/4111

- Support: 3893/3840

Spot Silver

- Resistance: 48.16/49.17

- Support: 45.90/44.91

Spot gold fell to $3,964/oz, hitting a three-week low as easing U.S.–China trade tensions curbed safe-haven bids. Focus now shifts to the Fed’s policy decision. From a technical perspective, gold is attempting a modest rebound but remains capped within a broader downtrend; fail to clear the $4,059 area may see sellers regain control, while a drop below $3,840 could accelerate bearish momentum.

Dow Futures

- Resistance: 48036/48225

- Support: 47426/47235

The Dow Futures rose 0.34% to 47,706, hitting another record close on trade optimism and strong earnings. Nvidia jumped 5% on AI deals, while UPS surged 8% on robust quarterly results. Technically, the index is holding above 47,426 support, with upside momentum aiming at the 48,036 resistance zone.

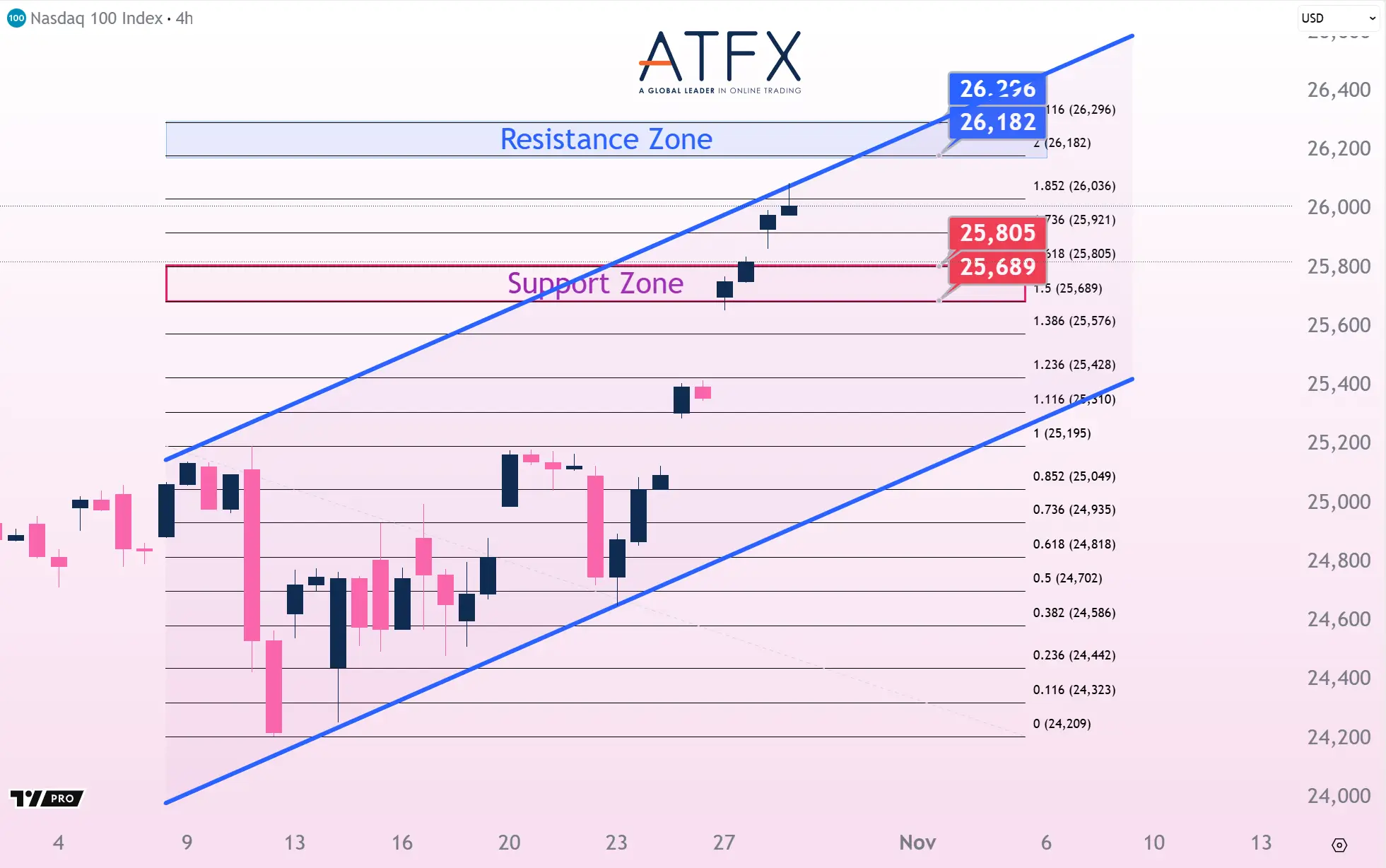

NAS100

- Resistance: 26182/26296

- Support: 25805/25689

The NAS100 rose 0.8% to 23,827, powered by tech strength. Microsoft gained 2% on a larger OpenAI stake, while Apple briefly crossed the $4T valuation mark. Technically, support lies at 25,805, with momentum favoring a push toward 26,182 resistance if buyers sustain control.

BTC

- Resistance: 114939/116423

- Support: 110027/108517

Bitcoin steadied near $115,700 after briefly topping $116k, with markets cautious ahead of the Fed’s rate decision and Trump–Xi talks. On charts, $110,027 serves as pivotal support; holding above could maintain bullish momentum, while a break lower risks deeper correction.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.