Market Highlight 28/10/2025

U.S. equities extended gains on Monday, with all three major indexes closing at record highs for the second straight session. Optimism over a potential U.S.–China trade deal, combined with anticipation for this week’s Big Tech earnings and the Federal Reserve’s policy decision, fueled the rally. The Dow rose 0.7%, the S&P 500 gained 1.2%, and the Nasdaq climbed 1.86%. The U.S. dollar weakened against several major peers as risk appetite improved on trade optimism. The dollar index fell 0.11% to 98.84, while the EUR/USD rose 0.15% to 1.1643.

Gold prices broke below the $4,000/oz level as easing trade tensions reduced safe-haven demand, while markets await the Fed’s decision later this week. Spot gold traded at $3,980.52, down 3.2%. Oil prices edged lower as OPEC’s output-increase plan outweighed hopes for a U.S.–China trade framework deal and the impact of renewed U.S. sanctions on Russia.

Key Outlook 28/10/2025

Today, attention turns to whether the U.S. will release key data. The October Conference Board Consumer Confidence Index is in focus, with markets looking for a potential dip toward 90, which could reflect growing consumer concerns about the economic outlook. In addition, the October Richmond Fed Manufacturing Index will be closely monitored to see if it continues to weaken for a second month, potentially signaling mounting pressure on the U.S. manufacturing sector.

Key Data and Events Today

- 15:00 EU GERMANY GfK Consumer Confidence NOV **

- 22:00 US CB Consumer Confidence OCT **

- 22:00 US Richmond Fed Manufacturing Index OCT **

Tomorrow:

- 04:30 API Crude Oil Stock Change ***

- 08:30 AU CPI QoQ Q3 **

- 21:45 BoC Interest Rate Decision ***

- 22:00 US Pending Home Sales MoM SEP **

- 22:30 BoC Press Conference ***

- 22:30 EIA Crude Oil Stock Change **

Markets Analysis 28/10/2025

EURUSD

- Resistance: 1.1688/1.1706

- Support: 1.1611/1.1593

EUR/USD edged up to 1.1643 (+0.15%) on trade deal optimism, while traders await the ECB meeting. Technically, the pair holds above the rising trendline from last week, with 1.1611 as a pivot. A break above 1.1688 could open the door to 1.1706, while failure to sustain momentum risks a pullback toward 1.1593 before bulls re-engage.

GBPUSD

- Resistance: 1.3392/1.3426

- Support: 1.3281/1.3248

GBP/USD rebounded from 1.3300, snapping a six-day slide, with the pair holding just below the descending trendline near 1.3390. Momentum remains fragile ahead of the Fed’s expected 25 bps rate cut on Wednesday. A break above 1.3392 could trigger a rally toward 1.3426, while failure risks a retreat to 1.3281 support.

USDJPY

- Resistance: 153.27/153.73

- Support: 151.79/151.33

USD/JPY held near 152.40, easing from recent highs as traders awaited the Trump–Takaichi meeting. Price action is still supported by the ascending trendline, with buyers defending 151.079. A rebound toward 153.27 remains possible unless this key support breaks.

US Crude Oil Futures (DEC)

- Resistance: 62.92/63.73

- Support: 60.27/59.45

WTI crude settled near $61.28 (-0.3%), weighed by OPEC’s output hike despite renewed U.S. sanctions on Russia. From a technical view, short-term pullbacks look corrective as long as the market holds above $60.27, with buyers eyeing a potential breakout toward $62.92 if momentum revives.

Spot Gold

- Resistance: 4111/4163

- Support: 3944/3893

Spot Silver

- Resistance: 48.16/49.17

- Support: 45.90/44.91

Spot gold tumbled 2.7% to $4,002, briefly touching $3,970, the lowest since October 10, as easing U.S.–China trade tensions weakened safe-haven flows ahead of the Fed’s rate decision. Technically, the bounce looks fragile; if $4,110 fails to be reclaimed, the risk leans toward a deeper slide back to the $3,944–$3,893 support zone.

Dow Futures

- Resistance: 47666/47848

- Support: 47235/47050

The Dow Futures climbed 0.71% to 47,544, closing at a fresh record high as optimism over a U.S.–China trade deal and Fed rate cut expectations fueled risk appetite. Technically, the index consolidates above 47,235 support, with upside momentum pointing to 47,666 as the next resistance level. A sustained break higher could extend the rally toward 47,848.

NAS100

- Resistance: 25921/26036

- Support: 25576/25428

NAS100 surged 1.86%, boosted by AI optimism and strong earnings. Price remains elevated, and while momentum is intact, short-term pullbacks toward the 25,576 demand zone cannot be ruled out. As long as buyers defend this area, the path toward 25,921 and potentially higher remains favourable.

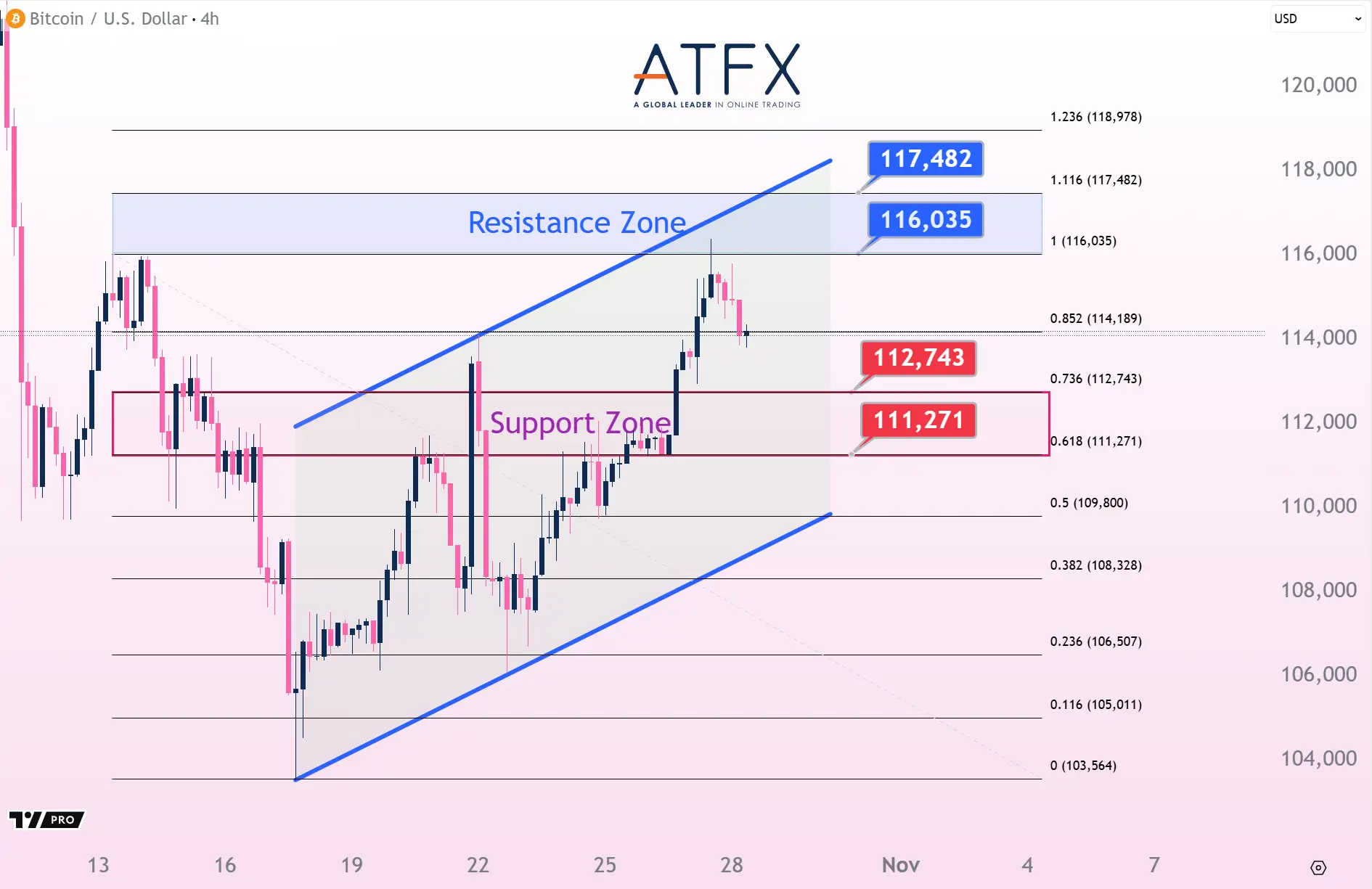

BTC

- Resistance: 116035/117482

- Support: 112743/111271

Bitcoin rose 1.2% to $114,880, breaking out of the $100k–$110k range on U.S.–China trade progress and Fed rate cut bets. Technically, holding above $112,743 keeps the bullish structure intact, with $116,035 as the next resistance target.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.