There is a concern in the market that if the July US ISM non-manufacturing PMI data performs poorly, the service industry’s rebound from the pandemic will reverse.

Final Markit Composite PMI

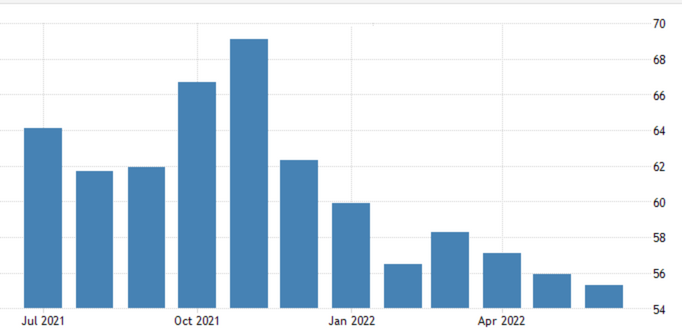

Due to the challenges in employment, continued capacity constraints and reduced orders, the US ISM non-manufacturing index in June was 55.3, better than market expectations of 54.3. Furthermore, the index remained above the 50 mark, which separates growth from decline. However, it has fallen for three consecutive months, hitting a new low last breached in May 2020. The market expects the PMI data to be 54 in July, representing a further decline indicating that the economic outlook is not optimistic.

The market is increasingly worried about a US economic recession, as the dollar index has been falling for several consecutive days. The DXY index is hovering around 105, and downward pressure still exists. As interest rates rise, the cost of living in the United States continues to rise, causing considerable challenges for the US economy. If multiple economic data points start declining, these may negatively impact the US dollar’s outlook.

The United States has announced that the July ISM manufacturing index was 52.8, a new low last seen in June 2020, but the outcome was higher than market expectations of 52. The final value of the US manufacturing PMI in July was 52.2, slightly lower than market expectations of 52.3 and the previous value of 52.3. Data showing that US manufacturing is slowing down is fueling concerns about a slowdown in the overall economy, further weighing down the US dollar.

The volume of new orders in the United States showed weak momentum in July, falling for the second consecutive month and putting significant pressure on the labour market. The new orders index in July was 48, lower than the expected 49 and the previous value of 49.2. In addition, the inventory index continued to rise from 56 in June to 57.3 in July, the highest level since 1984, reflecting a significant increase in manufacturers’ stockpiles. Inventory is being added to account for the supply shortages caused by regular supply chain disruptions.

In addition, US GDP has declined for two consecutive quarters, adding to the market’s speculation of a US economic recession. The sluggish financial data has also made investors focus on the labour market’s performance. Suppose the labour market is weaker than expected in July. In that case, the possibility of the Federal Reserve raising interest rates sharply in September will be significantly reduced. Pressure on the US dollar would soon follow, boosting gold prices.

Therefore, the US non-farm payroll report released this Friday is crucial for judging the current performance of the US economy, especially in the context of two consecutive 75 basis point US interest rate hikes. The data will also confirm whether the US economy is slowing down; hence, investors should pay close attention to this announcement. In addition, this week’s non-agricultural jobs data combined with a series of PMI data will provide the latest economic data guidance for the future dollar trends and the likelihood of the Fed raising interest rates in September.

The market’s expectations for a sharp US interest rate hike in September have cooled from the current situation. Some market participants are betting that the inflexion point in interest rate hikes is here. This is a bearish signal for the dollar but may bring some opportunities for bulls in the gold market during the year’s second half. However, we still have to wait for the release of multiple economic data points this week. After comprehensively judging the financial situation, the US dollar and gold price trends will become more apparent.