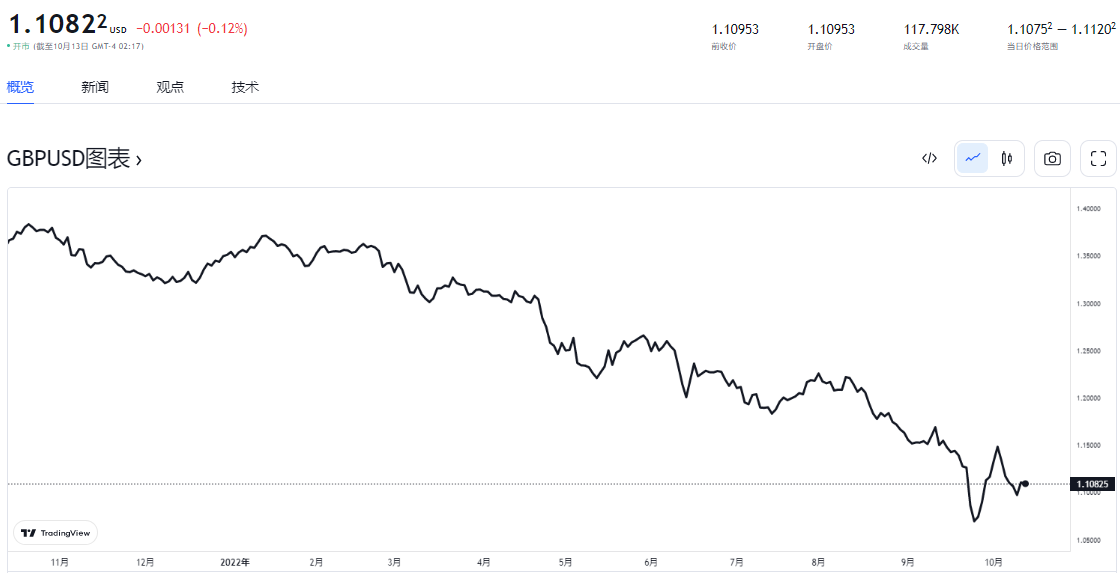

Affected by the strong upward trend of the US dollar, the pound has been under significant pressure in recent days, causing GBPUSD to fall below the 1.1 level against the US dollar earlier this week and even trade as low as 1.0954. The impact of the British bond market crisis continues to spread, coupled with the unabated upward momentum of the US dollar and the effect of factors such as inflation and a recession in the United Kingdom, and the pound fell into a deep decline. The dire situation prompted the Bank of England to hint at banks that it may extend the bond purchase plan to stabilise prices. Still, as the market risk sentiment recovers, the future outlook for the pound remains worrying.

The Bank of England’s Bailout Program Ends in September

After the UK announced the most extensive tax cuts plan in 50 years, a liquidity crisis in British pension funds, the sale of long-dated British government bonds, and the sharp rise in government bond yields forced the Bank of England to start buying long-term government bonds in the markets to stabilise the market. The decision also allowed the pound to recover briefly in late September and early October. However, the turmoil that swept the British public bond markets continues. The British bond market suffered a fierce sell-off on October 10, just as the bond market crisis intensified. Hence, the Bank of England immediately launched new measures to stabilise the financial markets on October 10, including measures such as increasing the purchase of bonds, including inflation-linked government bonds in its scope of investments. However, to prevent the crisis from further triggering the bond market’s collapse, Bank of England Governor Bailey confirmed that his emergency bond purchase program would end as planned on October 14, despite expanding its bond purchase plan. The decision caused the pound to fall again. The pound will face many adverse conditions in the future, such as a recession, another sell-off in the bond markets, and record-high inflation. In the current environment, the Bank of England’s bailout plan has been unable to change the market’s pessimism about the country’s bond markets, which is rooted in the market’s lack of confidence in the government’s fiscal plans and economic prospects. Suppose the UK’s economic data continues to deteriorate. In that case, the impact of the bond market crisis may continue to spread, and the outlook for the pound may not be as optimistic.

Continued Rise of US Dollar Weighs on Direction of Pound

The pound is primarily affected by fluctuations in the US dollar. In the recent past, the dollar has risen significantly, boosted by the expectations of interest rate hikes, coupled with the risks seen in the UK bond markets, which triggered fears of an economic crisis in the country. The US dollar has benefited from its safe-haven currency status and the Fed’s aggressive interest rate hikes, while the pound has been under pressure recently. However, the dollar’s future direction still depends on officials’ positions on the size of the November rate hike. In the minutes of the September monetary policy meeting released by the Federal Reserve this week, officials said it was essential to calibrate the pace of further tightening to mitigate the risks facing the US economy. Still, the Fed remains committed to raising interest rates to lower inflation. The market believes that the minutes are sending dovish signals that officials are starting to consider the impact of interest rate hikes on the US economy, but effectively curbing inflation remains the main priority of the rate-setting meeting. The latest US September CPI data surged 8.2% year-on-year, versus the expected 8.1% print; the previous value of 8.3% indicates that inflation stubbornly remains high. Expectations of further interest rate hikes will remain in place, boosting the US dollar, but it may come under pressure again from the pound in the short term. However, it is also crucial to observe the reaction of the UK government to the UK bond market activities after the suspension of the bond purchase program. The pound may not perform well soon after the program’s withdrawal in the context of the continued market panic. More significant market risks are emerging and may continue to fuel the pound’s volatility.