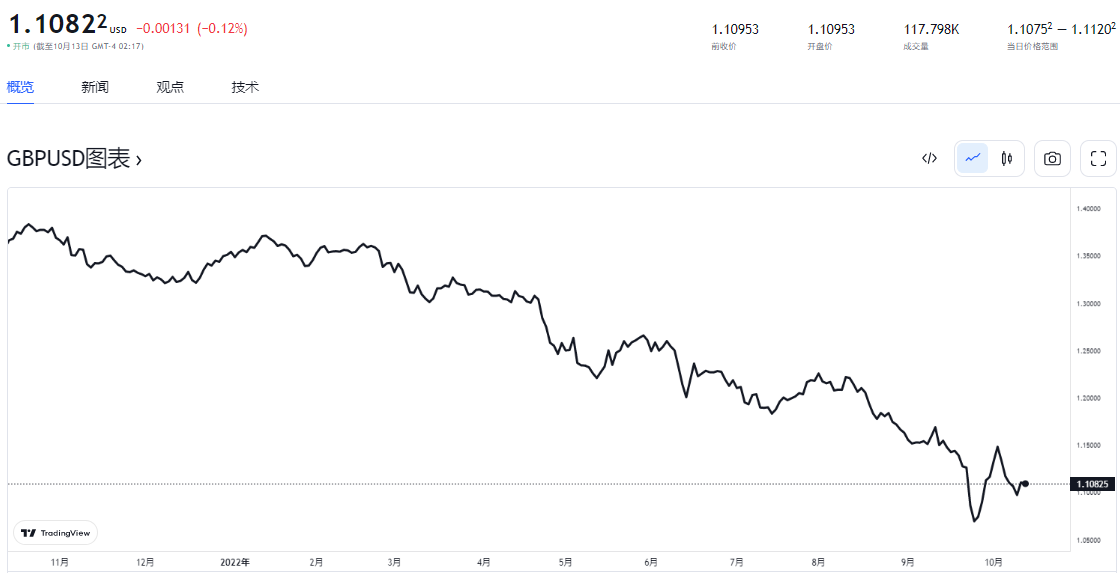

深受美元強勢上漲趨勢影響,英鎊近日連續承壓,英鎊兌美元本週一度曾跌穿1.1水平,低見1.0954。英國債市危機影響持續蔓延,加上美元上漲勢頭不減,以及英國通脹和經濟衰退等因素疊加的影響,英鎊早前一路下行陷入深跌,隨後英國央行向銀行暗示可能延長買債計劃,才令其價格回穩,但是隨著市場避險情緒回升,未來英鎊前景仍然令人憂慮。

英國央行“救市”計劃即將結束

今年9月,英國宣布50年來最大規模減稅計劃之後,英國養老基金發生流動性危機,英國長期國債遭到了大舉拋售,國債收益率急速上升,導致英國央行為了救市在市場中開始購買長期國債,這也讓英鎊在9月底和10月初出現短暫的回升。

但是此後席捲英國公債市場的動盪持續,其中在10月10日英國債券市場再度遭遇猛烈拋售,就在債市危機愈演愈烈之際,英國央行10月10日隨即再推出了新的措施穩定金融市場,包括加大購債力度等一系列舉措,把通脹掛鉤國債納入可購買範圍等“加碼”救市。

但是,為了防止進一步觸發債市崩盤的危機,在宣布增加擴大購債計劃的同時,英國央行行長貝利也確認其緊急債券購買計劃將於10月14日按計劃結束。這一決定讓英鎊再度下行,並且未來面臨經濟衰退、債市再度出現拋售、通脹高位持續等多方面的不利因素。

在當前的環境下,英國央行的救市計劃似乎並不能夠改變市場對於債市的悲觀情緒,此次債市危機的根源在於市場缺乏對於英國政府財政計劃和經濟前景的信心。如果英國的經濟數據持續惡化,債市危機的影響可能會繼續蔓延,英鎊的前景恐怕會不容樂觀。

美元持續上漲壓制英鎊走向

另一方面,英鎊很大程度上受美元波動的影響。過去一段時間,美元在加息憧憬中一路上升,加上英國債市風險觸發對於經濟危機的擔憂,美元由於其避險貨幣屬性有所受益,英鎊在近段時間一直承壓。但是,美元走向仍然要看官員們對11月加息幅度的立場,在美聯儲本周公布的9月貨幣政策會議紀要中,官員們表示校准進一步緊縮的步伐,以減輕美國經濟面臨的風險是重要的。不過,美聯儲仍然致力於提高利率,以降低通脹。市場認為這釋放出一些鴿派的信號,表明官員們開始考量加息幅度對於經濟的影響,但是有效遏制通脹仍然是會議主調。

最新出爐的美國9月CPI數據同比上漲8.2%,預期8.1%,前值8.3%,超出了預期,這反映出通脹繼續頑固地維持在高位,加息的預期仍然會處於升溫之中,這對於美元來說會形成提振,因此對於英鎊短期可能會再度形成壓力。不過,還需要觀察英國政府在停止購債計劃之後英國債市的反應,英鎊在市場持續恐慌以及更大的市場風險正在浮現的背景之下,近期可能很難有很好的表現,並且可能會繼續呈現波動。