Tonight, the market is waiting for the announcement of the preliminary annualized quarterly real GDP of the United States for Q1 2022. Given that the Q4 2021 figure was 6.90%, the consensus analysts’ forecast of 1.00% is a big disappointment for the market.

According to a forecast survey conducted by Refinitiv, the US GDP’s quarterly growth rate may only reach 1% in the first quarter of this year. However, according to the Atlanta Fed’s GDPNow model, the US GDP is expected to increase by 1.3% in Q1 2022. What is the reason for such a sharp decline in the U.S. economy’s growth rate? And, what is the future for the U.S. economy?

High inflation continues to weigh on the U.S. economy

The market generally expects a sharp decline in the U.S. economy during Q1; the main reason being that U.S. companies in the fourth quarter of 2021 replenished depleted inventory to meet the strong demand for goods, driving rapid economic growth. However, the impact of a gradual decline in stockpiles during Q1 coupled with the rising COVID-19 infections in the United States at the beginning of this year hampered economic growth. To stop the pandemic’s spread, the United States reinstated some restrictions, which led to a slow down in some economic activities.

Although consumer spending in the United States rose more than expected in January, the ensuing war between Russia and Ukraine led to a sharp increase in global commodity and food prices, hurting supply chains. These combined factors led to rising inflation with a minimal increase in consumer spending in the U.S. in February. In addition, higher spending on services was offset by the lower consumption of other goods amid rising production costs.

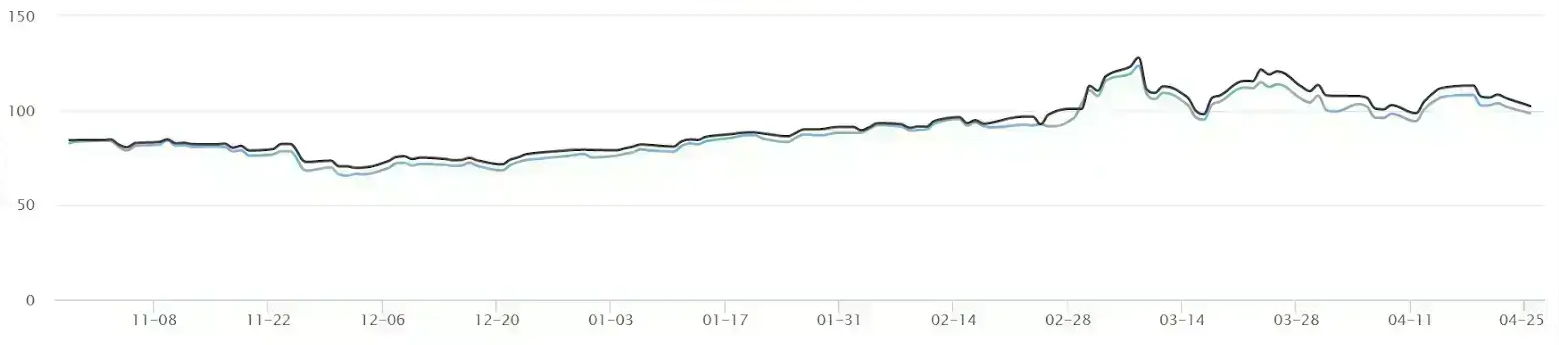

(Source: TRADINGECONOMICS)

In the first quarter of 2022, the U.S. consumer price index rose as the prices of different goods rose to varying degrees. From January to March, the CPI data rose from 7% to 8.5%, the highest inflation level seen in the United States in 40 years. Hence, the sharp decline in the Q1 GDP forecast also reflects the drag on growth from high inflation.

GDP growth in the coming months may remain low since it is possible that U.S. inflation has not yet peaked. According to the latest survey results from the American Business Economics Association, the proportion of U.S. companies that have raised wages in the first quarter reached a record 70%. As a result, companies will pass on the rising costs to consumers in the future, pushing prices much higher.

As for oil prices, the market saw a surge in the first quarter of 2022 due to market concerns about the shortage of oil supplies exacerbated by the Russian-Ukrainian war. Oil prices broke through $130, which dealt a significant blow to the U.S. economy. However, with the release of crude oil reserves by the United States government and the recent increase in oil production by the United States and OPEC, oil prices have experienced a sharp correction. Furthermore, with the Fed raising interest rates, the dollar exchange rate will strengthen in the future. The decline in demand for crude oil may cause a further correction in oil prices, and if oil prices continue to pull back, it will be fantastic news for the U.S. economy. However, it is necessary to pay close attention to the sanctions imposed by European countries on Russian crude oil. There is a real possibility that excluding Russian crude oil from international markets will lead to oil prices rising again.

What is the outlook for the U.S. economy?

Goldman Sachs has once again lowered its U.S. growth forecasts for 2022; hence, the market expects a sharp decline in the U.S. economy in the first quarter. In addition, economists led by Goldman Sachs chief economist Jan Hatzius lowered the U.S. real GDP growth forecast for 2022 from 2.0% to 1.75% while rating the chances of the U.S. economy falling into recession in the next two years at 35%. The bearish views are not only shared by Goldman Sachs, but many other banks and investors have warned that a sharp interest rate hike could trigger a recession. For example, U.S. home mortgage lender Fannie Mae expects a “mild recession” in the U.S. economy in the second half of 2023. In contrast, some opposing voices believe a recession will not occur, saying that U.S. economic demand remains strong and can adapt to tighter monetary policy.

However, the U.S. economy will inevitably encounter many difficulties in achieving a “soft landing” of the economy in the second half of 2022. The economy will face several tests, including interest rate hikes that increase pressure on various debt costs, inflation gradually eroding consumers’ disposable income, low consumer confidence, geopolitical tensions continuing to push up prices, etc. As a result, the Federal Reserve will have to resolve the above series of existing problems while reducing inflation, maintaining a stable employment rate, and keeping the economy away from the risk of recession.