今晚,市场关注的焦点美国第一季度实际GDP年化季率初值即将公布,其前值为6.90%,但是预计值仅为1.00%,令市场大失所望。

据路透社Refinitiv所做的预测调查显示,今年1季度,美国GDP季增年率可能只达1%。而根据亚特兰大联储银行的GDPNow模型预测,今年1季度,美国GDP经季调后的季增年率或只有1.3%。究竟是什么原因造成美国经济增速如此大幅的下降?未来美国经济前景又如何?

高通胀持续拖累美国经济

对于市场普遍预计美国Q1经济骤降,主要原因有以下几方面,美国公司在去年第四季补充耗尽的库存以满足对商品的强劲需求,带动经济快速增长,但是备货的影响在Q1的时候逐渐消失。加上奥密克戎疫情今年初在美国国内大流行,感染人数激增,为了阻止疫情扩散,美国重启了部分限制措施导致部分经济活动有所停滞。

虽然美国1月消费者支出增幅超过预期,但随后俄乌之间爆发战争,令全球大宗商品和粮食价格大幅增长,对供应链也造成负面影响。这也让本来就饱受通胀困扰的美国经济“雪上加霜”,可以看到美国2月消费者支出几乎没有增长,服务支出增加被其他商品消费的下降所抵消,商品生产成本不断上升。

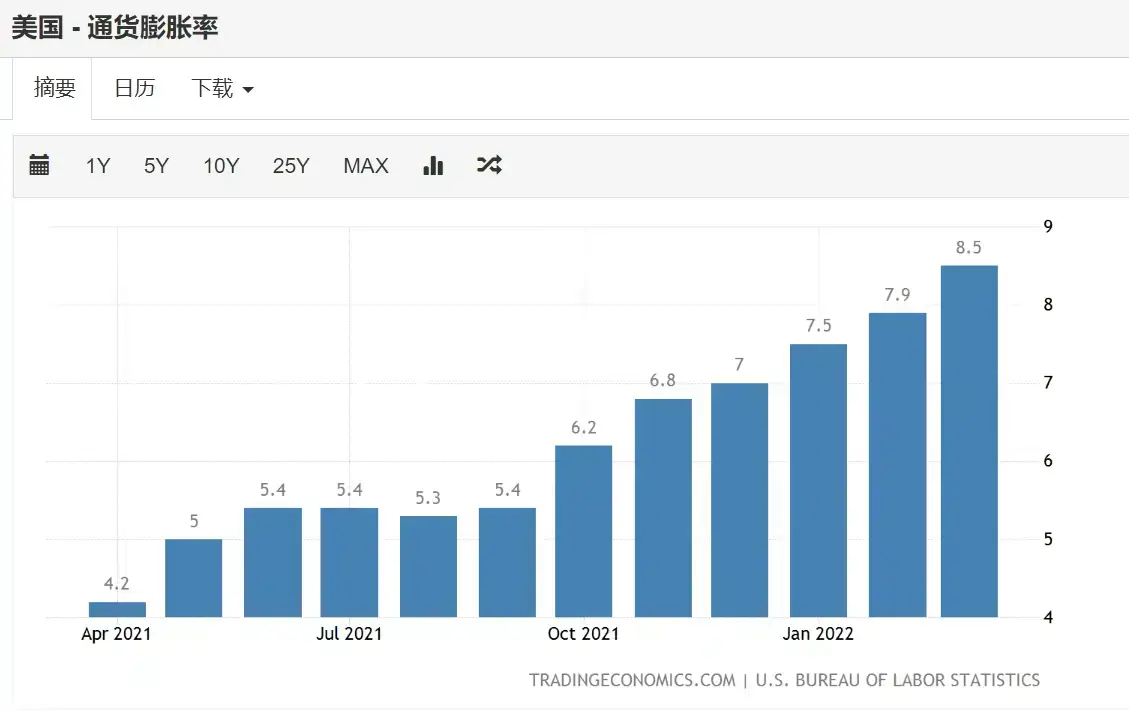

(来源:TRADINGECONOMICS)

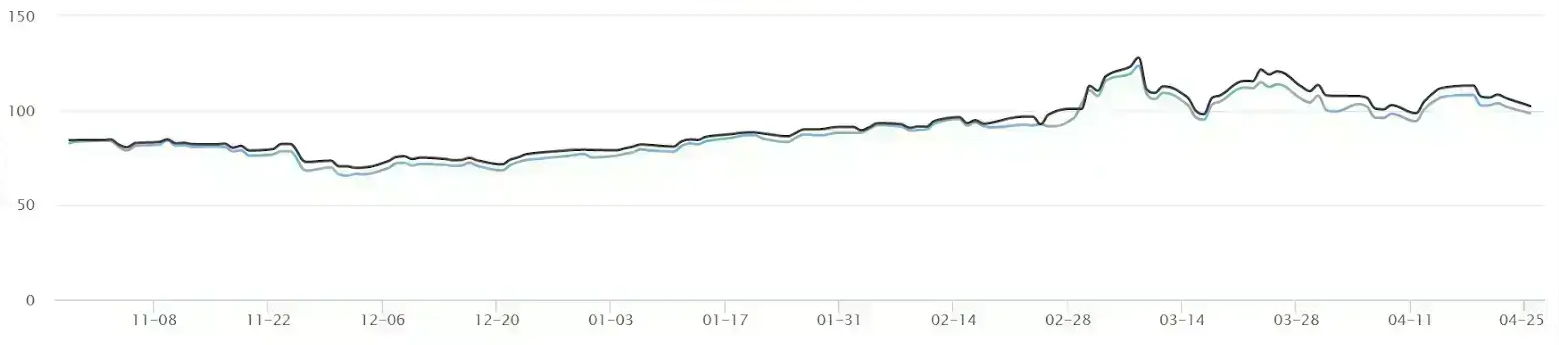

(来源:TRADINGECONOMICS)

在今年第一季度,美国居民消费价格指数一路攀升,不同类型的商品都出现了不同程度的价格上涨。从1月至3月,该项数据从7%上升至8.5%,创下40年来美国最高的通胀水平,因此Q1 GDP预测值的骤降也反映出居高不下的通胀对于经济增长形成拖累。

而未来数月的通胀水平仍不乐观,有可能通胀还没有见顶。根据美国商业经济学会的最新调查结果显示,第一季度已进行涨薪的美国企业比例达到创纪录的70%,未来企业会将成本的上升转嫁给消费者,推升物价继续保持高位。

在油价方面,由于市场担忧俄乌战争加剧石油供应不足,油价在今年第一季度处于飙升时期,一度突破130美元,对于美国经济造成一定打击。但是,随着美国释放原油储备油以及近期美国和OPEC提高产油量,油价出现较大幅度的回调。未来随着美联储加息,美元汇率走强,以及对原油需求预期的下降或会造成油价的进一步回调,若油价持续回调则对美国经济将是利好消息。但是,要密切关注欧洲国家对俄罗斯原油的制裁措施,不排除这会让油价出现再度走高的可能性。

美国经济前景如何?

在市场预计美国第一季度经济大幅下降之前,高盛已经再度下调了今年美国增长预测,以高盛首席经济学家Jan Hatzius为首的经济学家将美国2022年实际GDP增长预测从2.0%下调至1.75%,并且认为未来两年美国经济陷入衰退的可能性为35%。

不仅是高盛,不少银行和投资者警告称大幅加息可能引发经济衰退。美国住房抵押贷款机构房利美也预计,美国经济明年下半年将出现“温和衰退”。虽然也有相反的声音认为衰退不会出现,由于美国经济需求仍然非常强劲,能够适应更紧缩的货币政策。

不过,可以确定的是,今年下半年美国经济实现经济“软着陆”困难重重,其将面临着多项考验,包括加息导致各项债务成本压力增加、通胀逐渐侵蚀居民可支配收入、消费者信心持续低迷、地缘政治紧张继续推升物价等等,能够妥善解决好上述一系列存在的问题,才会真正实现在降低通胀的同时,保持稳定就业率,令经济远离衰退风险。