GBPJPY has surged ahead of recent resistance and will wait for central bank action.

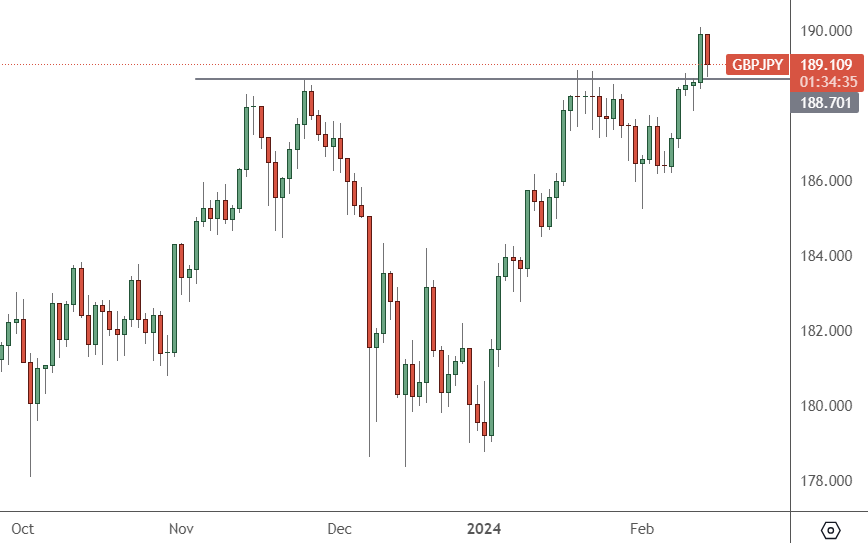

GBPJPY – Daily Chart

GBPJPY jumped across the 189 level to test 190 and will now look for a support level here. A further advance or correction is currently set up for the pound vs yen.

The key now will be central banks, with the Bank of England hinting at rate cuts soon, while the Bank of Japan may consider a currency intervention.

According to the IMF, the Bank of Japan has been urged to end its yield curve control and large asset purchases now and then gradually raise interest rates.

With Japan’s economy recovering, domestic demand is ahead of rising costs as the primary driver of inflation. The output gap is closing, and labour shortages are getting more significant, the International Monetary Fund said.

“The BOJ has been appropriately cautious, given Japan’s history of deflation and mixed signals from recent data. That said, upside risks to inflation have materialised in the past year,” the IMF said.

Increasing wages will keep core inflation, which excludes food and energy, above the BOJ’s 2% target until the second half of 2025, the group added.

“In the near term, the focus should shift to tighten fiscal policy and wind down unconventional monetary policy, while maintaining financial stability,” the IMF concluded.

“The BOJ should consider exiting YCC and ending QQE now while gradually raising short-term policy rates thereafter,” the IMF said.

The statement added that in letting go of its easy policy, the central bank should offer “clear and effective” communication that any rate hikes would be gradual and cautious.

The IMF suggested that the BOJ could also continue to reinvest maturing government bonds on its balance sheet to avoid market disruptions. The group also criticised the country’s energy subsidies and the plan to offer near-blanket income tax cuts as “not warranted” due to the country’s economic recovery and high debt-to-GDP ratio.

“Given its temporary nature and Japanese households’ low propensity to consume, the non targeted income tax cut is expected to have a limited impact on growth. In addition, energy subsidies can distort energy consumption and hamper decarbonisation initiatives and should be replaced with targeted transfers to vulnerable households.”

Changes will come for the GBP/JPY exchange rate as the BoE looks to cut rates. If the IMF is correct, the BOJ will go the opposite way. There is also the issue of intervention if the Japanese central bank thinks that speculation is devaluing the yen.