This week’s market prediction of the Fed’s meeting minutes came out in line with market expectations. Still, there was some new information that was uncovered. Therefore, we will analyse the latest Fed minutes and attempt to identify the Fed’s potential actions for the future.

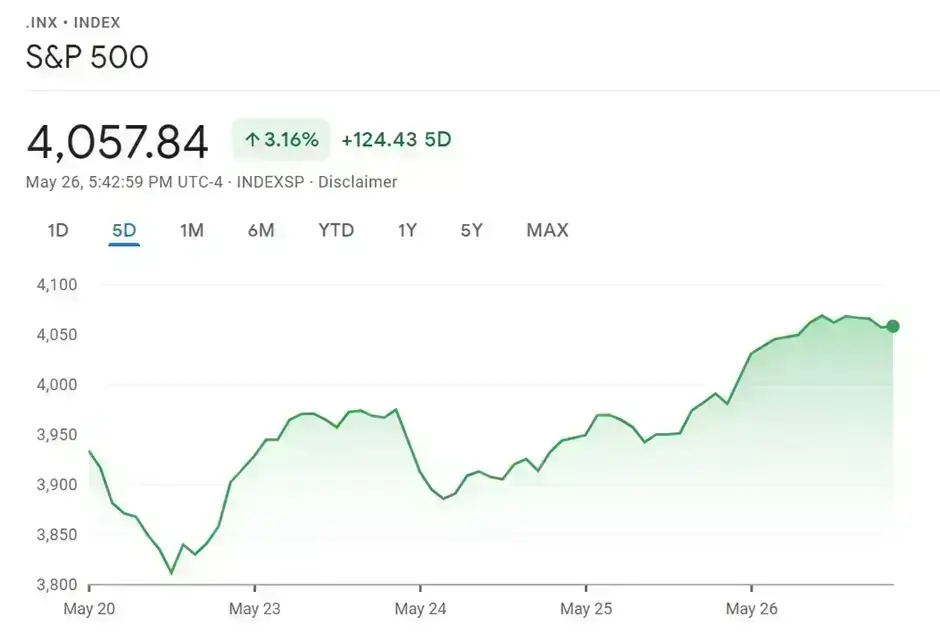

The minutes guide the number and magnitude of rate hikes, with most analysts believing that a 50 basis point hike may be appropriate during the next two meetings. Markets have also dispelled previous speculation about whether the Fed will aggressively raise interest rates by 75 basis points. Officials believe the US economy is robust and are working hard to curb record-high inflation using tighter monetary policies. With the release of the meeting minutes, the US stock market temporarily ended its decline and closed the day higher.

Fed researchers estimate that the personal consumption expenditure index will rise by 4.3% in 2022 but have downgraded their 2023 and 2024 forecasts to 2.5% and 2.1%, respectively. The move also increased speculation about the number of rate hikes, with suspicion of a slowdown or halt soon becoming reality as the US economy cools off.

The market has begun to discuss the timing of the end of the rate hike cycle, with the majority of people saying it’s either September or December. The stock market suffered a massive earthquake due to the sharp decline in the performance of retail companies, which made more US companies and investors worry about the country’s economic prospects. The ongoing interest rate hikes reduced the desire for corporate investment, which could quickly plunge the US economy into a recession.

Investors and analysts also need to know whether inflation can be reduced to the Fed’s expected range. Energy prices have fluctuated at very high levels, while wage growth fails to keep pace with rising inflation, putting more pressure on businesses. Moreover, rising costs may increase product prices, evolving into a vicious circle and exacerbating the upward inflation trend. Therefore, the United States still has many difficulties in stabilising inflation. In the short term, tight monetary policy still dominates despite dovish forecasts by the market.

The released minutes indicate that most Fed officials support its balance sheet reduction plan as they discuss the timetable for the reduction. Starting June 1, US Treasury holdings will be allowed to decrease by $30 billion per month. The reduction will be extended to $60 billion per month in September, while holdings of mortgage-backed securities will initially reduce by $17.5 billion per month and increase to $35 billion. This means that both short-term and long-term interest rates will have further upward pressure, and the cost of credit will rise further in the year’s second half of the year.

As for the trends in US stocks, investors need to pay attention to the possible shock risks that the US stock market may face. Market concerns about the economic downturn have not entirely disappeared as retail stocks come under significant cost pressures while facing the continuous impact of rising inflation. In addition, the aftermath of the conflict between Russia and Ukraine on supply chains and energy prices continues to disrupt the US stock markets, increasing the market’s bet on the recent downturn in US stocks.

On the other hand, the dollar’s direction is more apparent, supported by news that interest rates are expected to rise in the next two meetings. The dollar rally ended its last decline and is now headed higher. The direction of interest rate hikes and balance sheet reductions has not changed. Even if the interest rate hike is not as aggressive as previously expected, the news may trigger a short-term rally in the US dollar. Markets are concerned whether the ongoing interest rate hike policies could harm the US economy and the long-term stability of the US dollar.