The euro maintained its footing above 1.1800 against the dollar on Tuesday, buoyed by growing expectations of monetary policy divergence between the Federal Reserve and European Central Bank.

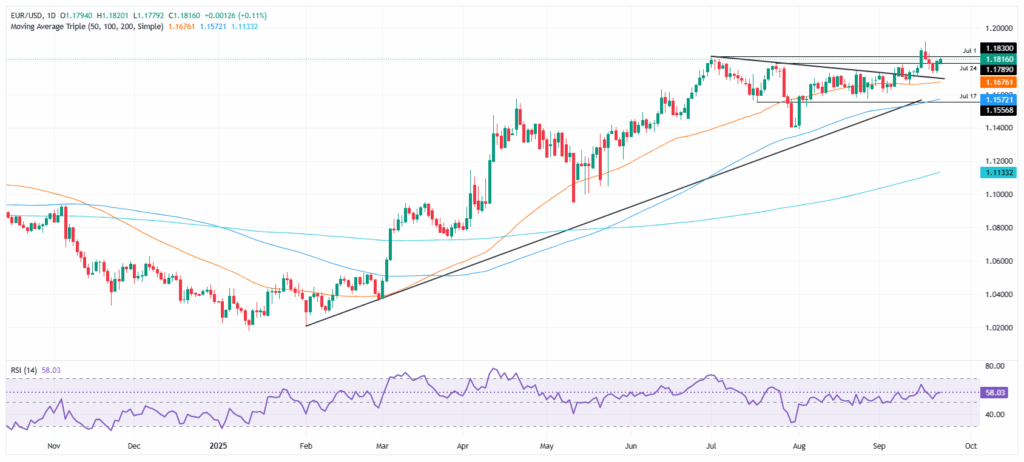

EURUSD – Chart

Chair Jerome Powell’s latest remarks reinforced the Fed’s dovish pivot, describing current policy as “modestly restrictive” while acknowledging elevated downside risks to employment. Markets are pricing a 91% probability of a 25-basis-point cut at the October meeting, according to Prime Market Terminal data.

Meanwhile, ECB President Christine Lagarde’s recent assertion that “the disinflation process is over” signals the central bank’s reluctance to ease further, creating a favourable backdrop for euro strength.

Economic Headwinds Mount

Flash PMI data revealed synchronized slowdown across both economies. U.S. manufacturing PMI slipped to 52.0 from 53.0, while services fell to 53.9 from 54.5. The eurozone showed similar weakness, with manufacturing contracting to 49.5 from 50.7, though services managed a modest uptick to 51.4.

The deteriorating activity data raises concerns ahead of this week’s U.S. GDP release and reinforces the case for Fed accommodation.

Technical Overview

EUR/USD’s bullish engulfing pattern pushed the pair back above 1.1800, though momentum remains subdued. Key resistance lies at 1.1850, with the yearly high of 1.1918 in focus. Support emerges at 1.1750, followed by 1.1700 and the critical 1.1560 -1.1574 zone.

The cross-current of slowing growth and policy divergence leaves EUR/USD poised for range-bound trading until clearer directional catalysts emerge.