After a recent correction, global oil prices rose and hit a high of US$119.43 on May 27. This is because the imbalance between supply and demand has intensified, pushing oil prices higher. OPEC and non-OPEC oil-producing countries will hold the market-focused ministerial meeting on Wednesday, after which oil prices will likely fluctuate.

A source told media houses that OPEC+ would stick to its policy of increasing production by 432,000 barrels per day at its June 2 meeting. However, the pressure on crude oil supply continues due to the intensification of Western sanctions against Russia. Furthermore, it is difficult for some countries with lower oil output to keep up with current quotas. As a result, OPEC+ did not meet their output increase target during the past few months.

From the current point of view, many factors support the short-term upward trend of crude oil prices, as seen on the news. The first is that OPEC+, the leading supplier, is likely to maintain its current production increase quota. The United States and European countries hope the group will further increase their production to cool down record-high oil prices. Investors need to pay close attention to the information released at the upcoming OPEC+ meeting on Wednesday. If the current quota is maintained, it will not dispel the market’s concerns about insufficient supply supporting the upward movement of oil prices.

Western countries have increased their sanctions on Russian oil exports putting significant pressure on the global crude oil supply. According to some sources, the EU is considering using insurance companies as a tool for further sanctions against Russia’s oil trade. The blockade of Russian crude oil imports by sea will be implemented immediately. In contrast, the blockade of refined oil imports via pipeline will be implemented by the end of the year.

Second, in both the United States and China, the demand for crude oil is slowly rising, showing an upward trend. The peak driving season in the United States is coming, generally lasting from May to the end of Labour Day in September. During this period, Americans’ travel rates increase significantly, and the demand for crude oil will also rise to meet the higher travel rates. As a result, US crude oil and gasoline inventories fell last week, with total US crude stockpiles falling by nearly 7 million barrels, exacerbating fuel shortages ahead of the impending peak oil demand. In addition, Shanghai’s announcement of the complete and orderly resumption of work and production from June 1 increased China’s demand for crude oil. The Chinese economy is expected to recover gradually, supporting the upward trend in oil prices.

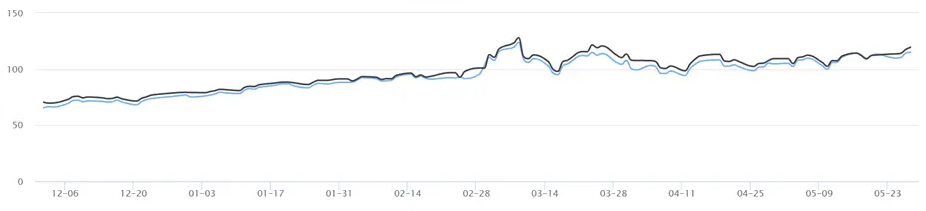

Overall, oil prices still have the opportunity to rise; hence, the prospects of global energy stocks are still promising. The valuation of defensive energy stocks was still low as we entered the interest rate hiking cycle. However, the fundamentals of the oil industry are strong, and energy companies still have good anti-inflation properties. Currently, inflation in the United States has not been suppressed, and the Fed’s process of raising interest rates is likely to continue. As a result, energy stocks have become a safe-haven asset favoured by most investors. The excellent performance of energy stocks has also driven the performance of energy-related ETF, which have become quite popular. In the first four months of this year, the US Natural Gas ETF (UNG) had the most significant increase of 100.16%.

However, some factors may restrain the uptrend in oil prices, such as the recent spread of the monkeypox virus in many European countries. If the number of infections increases and the countries implement new quarantine measures, it may lower the crude oil demand in European countries. Moreover, if oil prices rise too fast, consumers may significantly adjust their habits to reduce their oil consumption, thus limiting oil prices.

Since the start of the Russo-Ukrainian war, the prices of commodities such as aluminium, copper, and oil have risen, increasing investors’ interest in the low-carbon energy investment sector. The green and alternative energy industries have solid prospects and are suitable for medium to long-term investments. As clean energy attracts more attention from governments and industry players, investors will also choose to invest in more green energy stocks. Furthermore, demand for green energy investments will also lower the demand for traditional energy stocks.