Market Highlight 07/01/2026

U.S. equities closed higher on Tuesday, with chip stocks rallying strongly amid renewed optimism about artificial intelligence (AI). Moderna surged, and the Dow Jones Industrial Average closed at a fresh all-time high. The Dow gained 0.99%, the S&P 500 rose 0.6%, and the Nasdaq added 0.65%. The U.S. Dollar Index advanced 0.19% to 98.57, while EUR/USD fell 0.26% to 1.169.

Gold extended its rally, supported by safe-haven demand after the U.S. arrest of Venezuela’s president heightened global geopolitical tensions. Investors remained cautious ahead of key U.S. labor market data for clues on the Federal Reserve’s interest-rate outlook. Spot gold climbed 1.1% to $4,496.79 per ounce. Oil prices pulled back overnight as markets weighed expectations of ample global supply this year against uncertainty over Venezuelan crude output following the arrest of President Maduro.

Key Outlook 07/01/2026

Markets are focused on the U.S. December ADP employment report, expected to show job growth of 50,000 (previous: -32,000). While a return to positive territory is anticipated, signs of continued cooling in the U.S. labor market remain a key concern and will serve as an important reference ahead of Friday’s non-farm payrolls report. Investors will also watch the U.S. December ISM non-manufacturing PMI, forecast at 52.3 (previous: 52.6).

Key Data and Events Today:

- 15:00 EU GERMANY Retail Sales MoM NOV **

- 16:55 EU GERMANY Unemployment Rate DEC **

- 18:00 EU CPI YoY Flash DEC ** 21:15 US ADP Employment Change DEC ***

- 23:00 US Factory Orders OCT **

- 23:00 US ISM Services PMI DEC **

- 23:30 EIA Crude Oil Stocks Change **

Tomorrow:

- 15:00 EU GERMANY Factory Orders MoM NOV **

- 18:00 EU Unemployment Rate NOV **

- 18:00 EU PPI MoM NOV **

- 21:30 US Initial Jobless Claims ***

- 21:30 US Balance of Trade OCT **

Markets Analysis 07/01/2026

EURUSD

- Resistance: 1.1712/1.1734

- Support: 1.1666/1.1644

EUR/USD slipped towards 1.169, as softer eurozone inflation weighed on yields and supported the dollar. Technically, the pair fell back below the 1.1712–1.1734 resistance zone, weakening near-term momentum. As long as 1.1644–1.1666 support holds, the broader structure remains in consolidation.

GBPUSD

- Resistance: 1.3534/1.3549

- Support: 1.3468/1.3453

GBP/USD retreated after testing the 1.3550 area, as a steadier dollar found support in yields and mild risk aversion. From a technical perspective, upside follow-through faded near a heavy supply zone, pushing price back into congestion. As long as buying interest holds around 1.3453–1.3468, the move appears corrective rather than trend-changing.

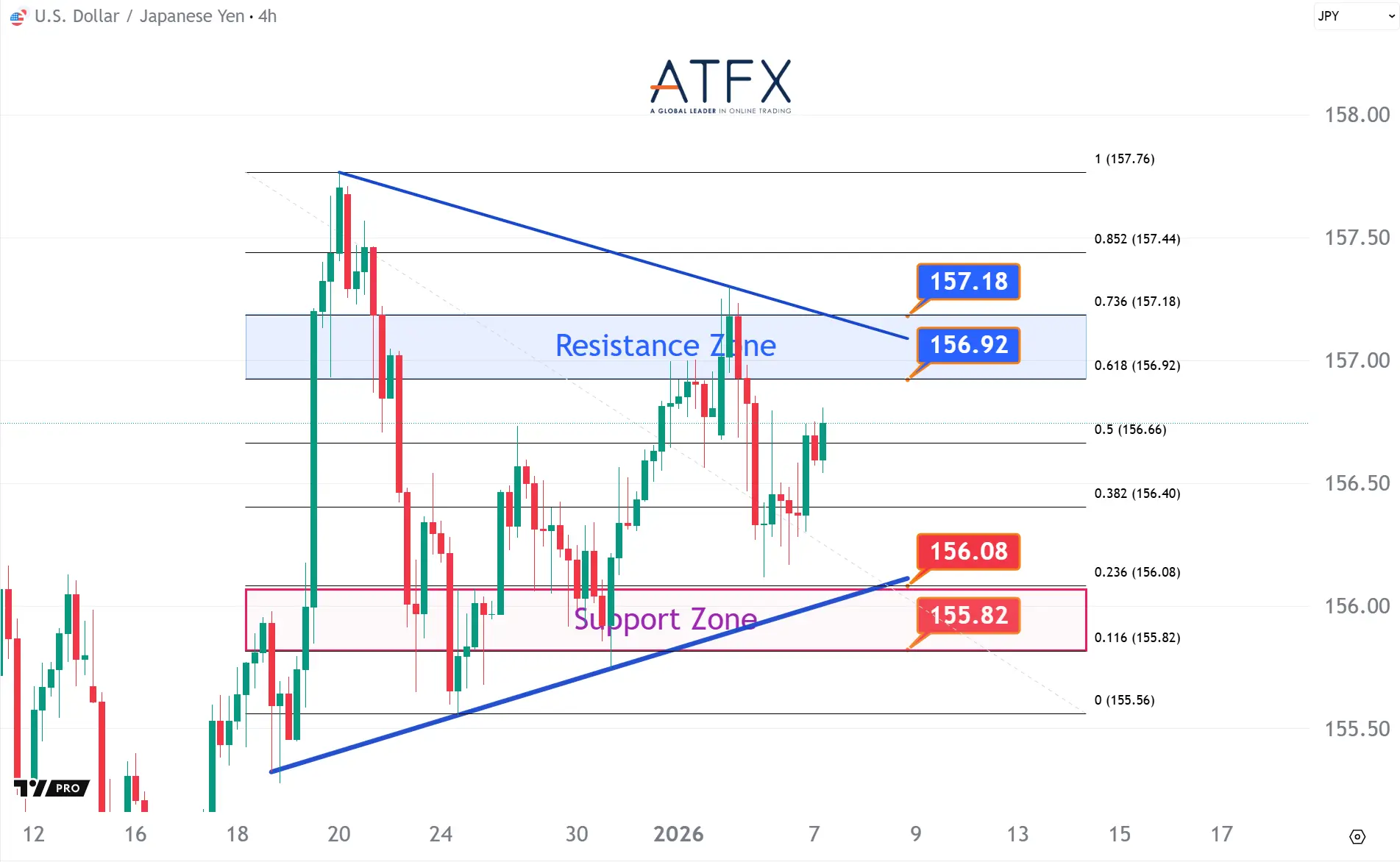

USDJPY

- Resistance: 156.92/157.18

- Support: 156.08/155.82

USD/JPY edged back towards 156.5–156.6, as firmer U.S. yields reduced safe-haven demand for the yen. Technically, dip-buying emerged around the 155.82–156.08 support zone, driving a short-term rebound. However, upside remains capped near 156.92–157.18, with intervention risks still in focus.

US Crude Oil Futures (FEB)

- Resistance: 56.92/57.38

- Support: 55.54/54.97

WTI slipped towards $57, with prices capped by the descending channel and resistance between $56.92 and $57.38. Key support lies at $55.54–$54.97, where a break could extend losses. Fundamentally, ample 2026 supply weighs on prices, while Venezuelan risks add volatility without altering the broader range-bound outlook.

Spot Gold

- Resistance: 4509/4550

- Support: 4444/4412

Spot Silver

- Resistance: 85.52/87.18

- Support: 78.64/77.01

Gold climbed towards the $4,500 level, facing resistance between $4,500 and $4,550 while holding its broader ascending channel. The $4,412–$4,444 zone remains key near-term support, preserving the bullish structure. Fundamentally, renewed geopolitical risks and rate-cut expectations continue to underpin safe-haven demand ahead of U.S. jobs data.

Dow Futures

- Resistance: 49772/50088

- Support: 49064/48742

Dow Futures printed fresh record highs, extending gains within a rising channel and approaching resistance between 49,772 and 50,088. Failure to break higher could trigger consolidation or a pullback towards support at 48,742–49,064. Fundamentally, strength in energy and financials offset geopolitical concerns, keeping investors’ focus on upcoming data and earnings.

NAS100

- Resistance: 25835/26179

- Support: 25290/25016

NAS100 edged higher but remains capped by resistance at 25,835–26,179, keeping the structure range-bound. AI and semiconductors led the gains, though internal divergence persists. Valuation concerns continue to limit upside, leaving moves sentiment-driven.

BTC

- Resistance: 94,652/95,844

- Support: 90,726/89,513

Bitcoin hovered near $94,000, capped by resistance between $94,652 and $95,844, keeping the price range-bound. Downside support lies between $90,726 and $89,513. Fundamentally, Strategy’s significant unrealised Q4 loss revived concerns about Bitcoin treasury firms, tempering bullish momentum.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.