Market Highlight 06/02/2026

A snowstorm pushed up initial U.S. jobless claims early last week, while job openings fell to their lowest level in more than five years. U.S. equities sold off sharply, with declines in Microsoft, Amazon, and other heavyweight technology stocks dragging the Nasdaq to its lowest level since November. The Dow Jones Industrial Average fell 1.2%, the S&P 500 declined 1.23%, and the Nasdaq Composite dropped 1.59%. The U.S. dollar index climbed to a two-week high, while the British pound plunged after the Bank of England narrowly voted to keep interest rates unchanged.

Ukraine and Russia concluded a second round of U.S.-mediated talks, easing safe-haven demand. Combined with a rebound in the U.S. dollar, gold prices turned lower overnight, while silver also fell sharply. Broad market sell-offs prompted investors to reduce precious metals positions. Spot gold closed down 3.7% at USD 4,769.89 per ounce. WTI crude oil fell 2% in volatile trading after the U.S. and Iran agreed to hold talks in Oman on Friday, easing concerns about Iranian oil supply.

Key Outlook 06/02/2026

Today’s data focus is on Germany’s December industrial production (MoM), expected to fall to -0.3% (previous: +0.8%), marking the first contraction in four months. Later in the session, Canada will release its employment report, with the unemployment rate forecast to hold at 6.8% and job gains expected to slow to 7,000 (previous: 10,100). Overall, the data are likely to reinforce expectations that the Bank of Canada will keep interest rates unchanged for now.

In the U.S., the nonfarm payrolls report has been postponed to next week. Tonight, attention will turn to the preliminary February University of Michigan Consumer Sentiment Index, expected to ease to 55 (previous: 56.4), marking the first pullback after two consecutive months of improvement.

Key Data and Events Today:

New Zealand Holiday

- 15:00 EU GERMANY Industrial Production MoM DEC**

- 21:30 CA Unemployment Rate JAN**

- 23:00 US Michigan Consumer Sentiment Prel FEB ***

Key Data and Events Coming Week:

- Monday: EU Sentix Investor Confidence FEB

- Tuesday: US NFIB Business Optimism Index JAN, US Retail Sales JAN

- Wednesday: Japan Holiday, API Crude Oil Stock Change, CN CPI & PPI JAN, OPEC Monthly Oil Market Report, US NFP, EIA Crude Oil Stocks Change

- Thursday: BOC Meeting Minutes, JP PPI JAN, GB GDP Prel Q4, GB Industrial & Manufacturing Production DEC, IEA Monthly Oil Market Report, US Initial Jobless Claims, US Existing Home Sales JAN

- Friday: EU Balance of Trade DEC, EU GDP 2nd Est Q4, EU Employment Change QoQ Prel Q4, US CPI

Markets Analysis 06/02/2026

- Resistance: 1.1830/1.1890

- Support: 1.1771/1.1711

EUR/USD slipped to 1.1788 as a firmer USD capped gain, while the ECB held. Technically, price broke the previous support zone and stalled below 1.1830–1.1890, leaving momentum fragile, with 1.1771–1.1711 as key support.

- Resistance: 1.3605/1.3667

- Support: 1.3421/1.3343

GBP/USD slid to 1.3550 after the BoE narrowly held rates, with political uncertainty weighing on Sterling. Technically, price broke below the trendline and failed at 1.3605–1.3667, leaving downside risk towards 1.3421–1.3343 support.

- Resistance: 157.35/158.17

- Support: 156.51/155.67

USD/JPY held firm as election-related fiscal expectations weakened the Yen and demand for USD persisted. Technically, price rebounded into the 157.35–158.17 resistance zone but remains capped by the descending channel, with 155.67–156.51 as key near-term support.

- Resistance: 64.63/65.57

- Support: 61.63/60.70

WTI eased towards $63 as US–Iran talks reduced near-term geopolitical premiums. Technically, upside momentum has faded after the pullback, with price drifting into a softer consolidation and buyers watching the $60.70-61.63 support area.

- Resistance: 4862/5003

- Support: 4688/4544

- Resistance: 80.92/86.48

- Support: 62.52/55.32

Gold slipped towards $4,760 as dollar strength and margin-driven selling weighed on prices. Technically, the break below $5,000 shifted focus to $4,688–4,544 support, while rebounds face resistance near $4,862–5,003.

- Resistance: 49298/49434

- Support: 48711/48570

Dow Futures slipped as tech-led risk aversion weighed on the market despite a defensive rotation. Technically, upside is capped near 49,298–49,434, while 48,570–48,711 marks key support, with a break risking further downside.

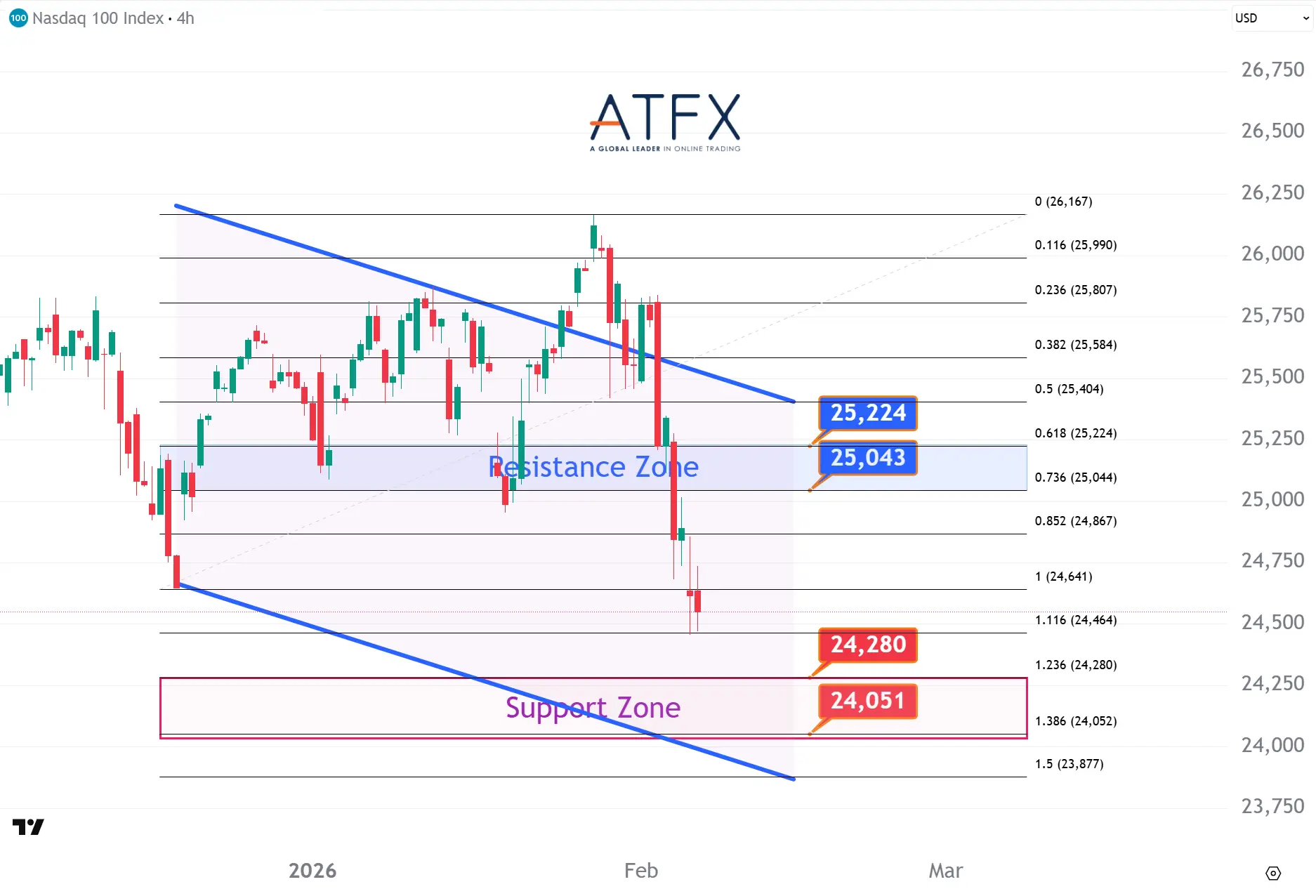

- Resistance: 25043/25224

- Support: 24280/24051

NAS100 slid as AI and software stocks came under heavy selling amid capex and monetization concerns. Technically, rejection below 25,043–25,224 keeps pressure on, with key support at 24,051–24,280.

- Resistance: 67711/69768

- Support: 61090/58999

Bitcoin slid further into a bear market amid tech-led risk aversion and forced liquidations. Technically, price is holding the $58,999–61,090 support zone, while rebounds face heavy resistance between $67,711 and $69,768.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.