Market Highlight 12/11/2025

The U.S. government made progress toward ending the longest shutdown in its history, with the Dow Jones Industrial Average closing at a record high on Tuesday. However, some artificial intelligence-related stocks fell as concerns resurfaced about overvaluation. The Dow rose 1.18%, the S&P 500 gained 0.21%, while the Nasdaq slipped 0.25%. ADP’s weekly estimate showed that U.S. hiring trends are shifting week by week, reflecting further weakness in the labour market. The U.S. Dollar Index fell 0.24% to 99.39, while the euro strengthened 0.29% to 1.159 against the dollar.

Gold prices climbed to a near three-week high, supported by optimism that the U.S. government’s progress in ending the shutdown and improving data could open the door for a Fed rate cut next month. Spot gold rose 0.3% to $4,126.44 per ounce, the highest since October 23. Oil prices rose by about $1 per barrel, buoyed by fresh U.S. sanctions on Russian oil and hopes of a government reopening, although ongoing concerns about supply limited gains.

Key Outlook 12/11/2025

Germany will release its final October CPI data, which is expected to remain around 2.3% year-on-year—above the European Central Bank’s target. This suggests that the ECB’s current stance of ending its rate-cut cycle will likely remain unchanged. Investors should monitor whether the actual figures align with expectations and assess their potential impact on the euro. In the oil market, attention will turn to OPEC’s monthly report for updates on demand and price forecasts.

Key Data and Events Today

- 15:00 EU GERMANY CPI YoY Final OCT **

- 20:00 OPEC Monthly Report **

Tomorrow:

- 05:30 API Crude Oil Stock Change ***

- 07:50 JP PPI YoY OCT **

- 08:30 AU Unemployment Rate OCT **

- 15:00 GB GDP Growth Rate QoQ Prel Q3 ***

- 15:00 GB Industrial Production MoM SEP **

- 17:00 IEA Oil Market Report **

- 18:00 EU Industrial Production YoY SEP **

Markets Analysis 12/11/2025

EURUSD

- Resistance: 1.1616/1.1639

- Support: 1.1544/1.1515

EUR/USD hovered around 1.1575 after briefly testing resistance near 1.1600, supported by a weaker dollar and expectations of resumed U.S. data releases following the government’s reopening. The pair remains capped by a descending trendline, but a break above 1.1616 could trigger momentum toward 1.1640.

GBPUSD

- Resistance: 1.3231/1.3274

- Support: 1.3092/1.3049

GBP/USD hovered around 1.3140, holding steady as the market digested soft UK employment data and a weaker U.S. dollar. The pair remains range-bound, with support near 1.3092 and

resistance around 1.3231. A rebound above 1.3150 could trigger renewed bullish momentum toward the upper range if risk sentiment improves.

USDJPY

- Resistance: 155.24/155.70

- Support: 153.28/152.70

USD/JPY traded near 154.30, slightly lower as the yen found modest strength from short-covering. Despite this, upside momentum remains intact, supported by solid U.S. yields and risk-on sentiment. Japan’s ¥65 billion stimulus plan and BoJ’s unclear policy outlook continue to limit volatility, with resistance seen near 155.24 and support around 153.28.

US Crude Oil Futures (DEC)

- Resistance: 61.89/62.92

- Support: 60.26/59.44

WTI crude hovered near $60.80 per barrel, extending gains after U.S. sanctions on Russia and optimism over a potential end to the government shutdown boosted sentiment. Still, persistent concerns about oversupply limited the upside. Technically, oil holds above the $60.26 support zone, with resistance seen near $61.89. A clear breakout above this level could open the door toward $63.00 in the coming sessions.

Spot Gold

- Resistance: 4218/4259

- Support: 4052/4020

Spot Silver

- Resistance: 51.85/52.31

- Support: 50.36/49.89

Gold extended gains to around $4,135 per ounce, reaching a two-week high as renewed Fed rate-cut expectations and easing U.S. shutdown concerns boosted safe-haven demand. The metal shows solid support near $4,052, with upside targets at $4,218 if momentum holds above the breakout level. A brief pullback could precede another leg higher toward the mid-$4,200s.

Dow Futures

- Resistance: 48224/48409

- Support: 47667/47428

The Dow futures surged 1.18% to a record close around 47,930, supported by optimism over the imminent end of the U.S. government shutdown. Strong performances in cyclical sectors such as industrials and financials reflected rising investor confidence. Technically, the index maintains its ascending structure, with immediate resistance at 48,224 and trendline support near 47,667 — a breakout could target the 48,500 region.

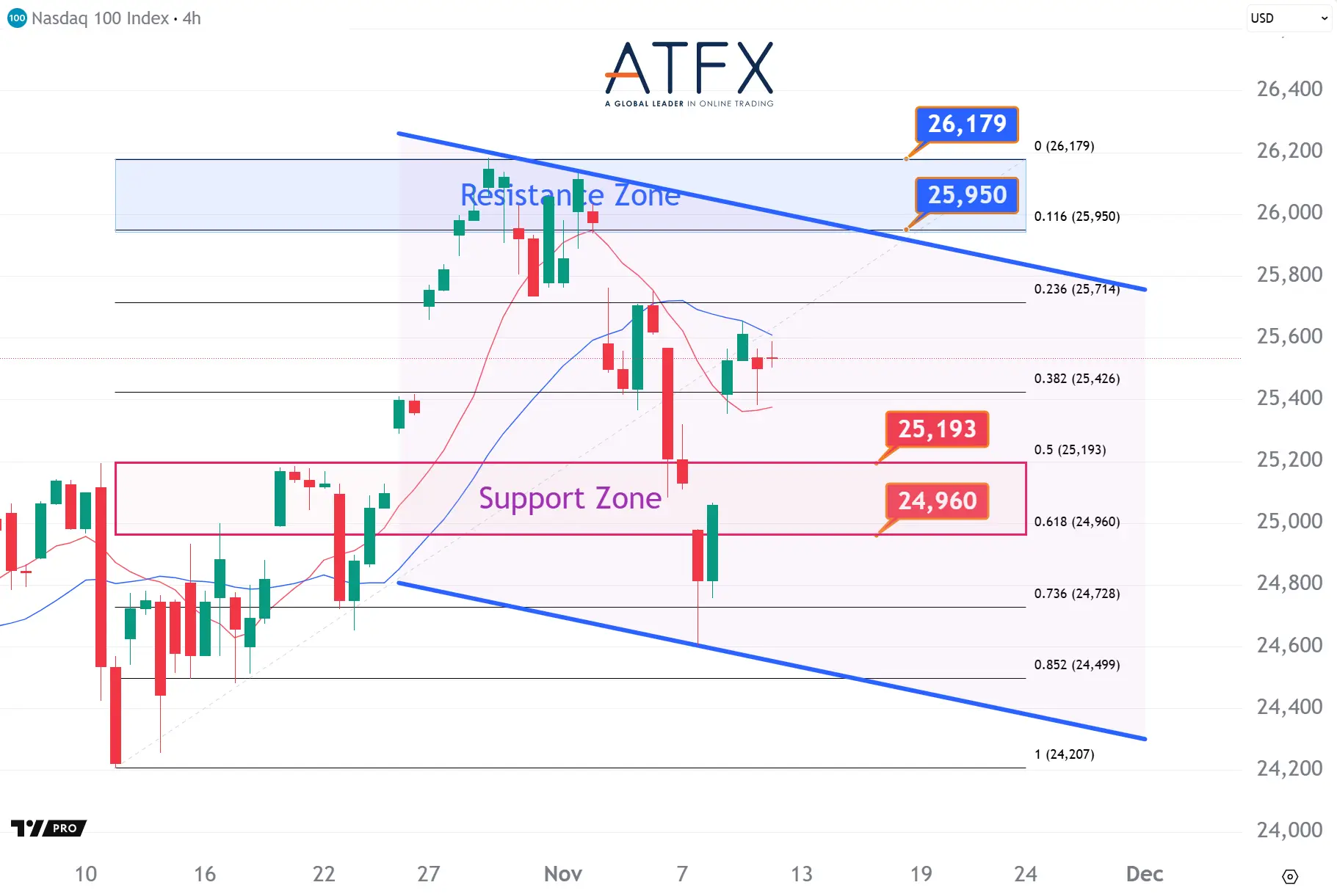

NAS100

- Resistance: 25950/26179

- Support: 25193/24960

The NAS100 dipped 0.25% as AI-linked stocks slid following SoftBank’s divestment of Nvidia shares. Despite mild profit-taking, the index held firm above the 25,000 support level, suggesting a potential for renewed buying if market sentiment stabilises. Technically, consolidation above 25,193 may open the door to the 25,950 resistance level.

BTC

- Resistance: 105437/106931

- Support: 100489/98557

Bitcoin retreated to around $104,200, erasing part of its earlier rebound despite progress toward ending the U.S. shutdown and continued accumulation by corporate holder Strategy Inc. The world’s largest cryptocurrency faced renewed selling as traders shifted capital toward tech

stocks and other risk assets. Key support lies near $100,489, while upside resistance remains around $105,437.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.